Hi Guys

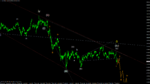

I would like to share a trading opportunity that is forming on the AUD/USD pair. On the daily chart the candles are forming an evening star right on the resistance level. The other very important fact is that this particular pattern is forming on top of the downtrend channel which is in play since September last year. I entered short on 0.7800 with my first target being 0.7717 nearest support level. I will close half a position at that level with therest of the position to capture any further downside. What do you think guys? It migh be a good opp. Let me know your thoughts.

I would like to share a trading opportunity that is forming on the AUD/USD pair. On the daily chart the candles are forming an evening star right on the resistance level. The other very important fact is that this particular pattern is forming on top of the downtrend channel which is in play since September last year. I entered short on 0.7800 with my first target being 0.7717 nearest support level. I will close half a position at that level with therest of the position to capture any further downside. What do you think guys? It migh be a good opp. Let me know your thoughts.