One Eyed Shark

Well-known member

- Messages

- 257

- Likes

- 13

Need some help to get my head round this one.

I currently trade most markets except the FTSE future, the main reason being I cant get a grip on order flow and price.

Many times I see the T&S data moving in the opposite direction to price, and this is unusual, it doesnt happen on other markets.

So if we are in a trend up I find that the T&S is showing red and vice versa, sometimes it is pretty much aligned but when we start to trend it goes in the opposite direction.

Any ideas ?????

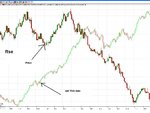

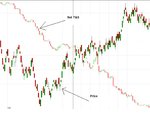

I have posted 2 charts, a FTSE and a DAX, the dark candles are price and the light candles are the net buying and selling from the T&S.

The DAX chart lines up so well, as do most charts for other contracts but not the FTSE

I currently trade most markets except the FTSE future, the main reason being I cant get a grip on order flow and price.

Many times I see the T&S data moving in the opposite direction to price, and this is unusual, it doesnt happen on other markets.

So if we are in a trend up I find that the T&S is showing red and vice versa, sometimes it is pretty much aligned but when we start to trend it goes in the opposite direction.

Any ideas ?????

I have posted 2 charts, a FTSE and a DAX, the dark candles are price and the light candles are the net buying and selling from the T&S.

The DAX chart lines up so well, as do most charts for other contracts but not the FTSE