barneydunn

Active member

- Messages

- 149

- Likes

- 39

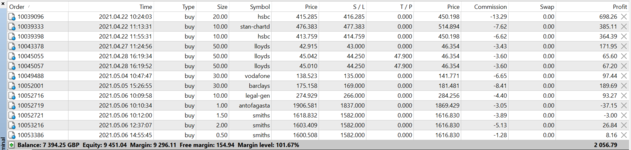

Hello, I'm spread betting UK shares using an mt4 broker, just because I'm so used to it, and I'd be interested in chatting with other people who are trying to do the same. I have attached my account as of the end of play today, Friday 7/5/21. If anyone wants to post their account here too and/or discuss trades, the reason for taking them and what's on the horizon for future trades then I'd be happy to hear from you.

I will post a bit about my approach, history, etc over the weekend.

I will post a bit about my approach, history, etc over the weekend.