W D Gann had a number of approaches to predict market action. His techniques have been regarded as complex and difficult to implement & understand due to the lack of clean information he left. His 'Harmonic Rule of 1/8's is not to be confused with his more widely recognized 'Square of 9s' method.

Gann's Rule of 1/8's is based on specific arithmetic geometry, more specifically 'fractal arithmetic geometry'. When that 'geometry' is constructed properly, (Gann referred to them as 'Octaves, Squares or Boxes), we can apply a set of rules that has predictive capabilities in any market that can be plotted. Does the predictive outcome, using the rules, work all the time? NO. Losing is part of trading. As traders, we attempt to eliminate the losing trades and find the methods that leave us with the consistently highest probability setups. I have found Gann's Harmonic Rule of 1/8's to be very productive when certain rules are applied properly and when combined with other predictive tools.

As this is An Introduction to Gann's Rule of 1/8's, I'm not going to spend time on the specifics of the arithmetic structure of the individual Gann Frame Squares (or Gann Boxes) that contain what he calls the Octaves and fractal movements in time and price. Nor am I going to introduce Gann's 'Speed Lines' that many technicians overlay on a Gann Square which illustrate additional predictive 'angles' of support and resistance beyond the basic 'square-layout'. The focus of this paper is to illustrate the foundations of Gann's Rule of 1/8s. 'Speed-lines' will be addressed at a later date.

A FULL Gann Square (Box) Illustrated using an ES Chart

Before I move forward with an explanation of the 'Gann Square/Box', a word about Support and Resistance is in order here. It has been my observation over my 18 year trading career that the more advanced or accomplished a trader is, the more he adheres to the predictive principles of support/demand & resistance/supply. Many novice traders start out in their technical studies learning as much about 'technical indicators' as they can, searching for the one or two tools that will show them the key to consistent success in the markets. Unfortunately, they discount the importance of support and resistance. Their charting becomes very 'busy', becoming more complex as their initial studies progress. The more advanced trader matures to relying on tried and proven price patterns with predictive characteristics, supported by key levels of both conventional and non-conventional Support & Resistance and using 'indicators' only as a distant 'secondary-confirmation' for a trade action.

With that in mind, the use and plotting of a Gann Square in any market you are evaluating can be used as a 'non-conventional' Support & Resistance tool in itself, even without understanding or applying the predictive rules of the same.

A Short Review on Conventional/Non-Conventional Support & Resistance

The most obvious types of Support & Resistance areas are those identified by

'price activity'.

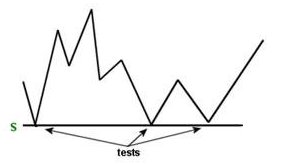

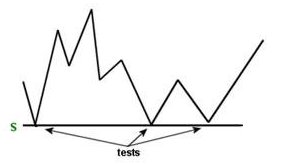

Above price activity 'stalled' at the S Level (support) when demand was too great to let the market drop at the 3-points illustrated. It is simple not only to see and denote, but to use as future technical reference.

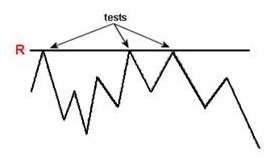

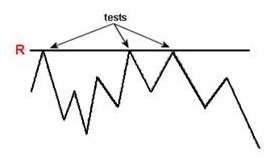

Below price activity 'stalled' at the R Level (resistance) when supply was too great to let the market rise at the 3-points illustrated. Again, simple to see, and use as a future technical reference.

The two previously illustrated examples are 'Conventional' types of Support & Resistance as their movements were restricted by 'price-activity' governed by 'supply and demand'.

Understand, there are different levels of Support & Resistance some stronger than others depending on the current underlying market internals, which astute traders constantly monitor. When a market 'stalls' or 'bounces' after seeing a strong area of Support or Resistance, analysts use classical predictive tools to help them evaluate the future 'or potential' price action, namely the 'retracement' off a 'stall' or 'bounce'. One of the more popular tools technicians use to evaluate potential price movement is Fibonacci Retracements, using the higher probability Fibonacci levels: 23.6%, 38.2%, 50%, 61.8% and 78.6% as retracement targets for trade action. Another is Elliott Wave analysis whose purpose is to target areas of retracement and subsequent movement by the predictive 'cycles' it attempts to justify. Also, Gann can be very powerful when a DeMark complex pattern terminates on one of their Key Levels (illustrated later).

The technical challenge to using any of these predictive technical tools is understanding when and where 'market change-ups' will occur with a higher degree of probability than not. Combining Ganns Rule of 1/8's with these or other predictive tools properly can get the astute trader closer to or higher on that scale of probability that will result in nosing up the stronger trade setups and will ultimately cut out more losing plays.

Here is a FULL Harmonic Gann Square illustrating the 13-Fractal Levels within this particular Octave. The Box shows the Overbought 5/8 to +2/8 Area, the Oversold 3/8 to -2/8 Area in addition to the Trading Range 3/8 to 5/8.

Gann saw prices move in 1/8's. These 1/8's act as areas of Support & Resistance as price changes over time.

Rule of 1/8s Guidelines

My experience has shown the Even Levels within a Gann Box have a much higher degree of technical validity than the Odd Levels. Understand, illiquid markets won't show technical reliability/validity with any technical tool. Liquid markets will illustrate technical reliability/ validity. Therefore, the more liquid a market the more validity/reliability the tool will have.

This is how I plot and use the following configuration of a Gann Box illustrating only the Even Levels:

Gann assumes ALL markets are the same, in that they are traded by what he calls mobs and therefore are driven by the same emotional mob behavior that moves every market.

Mark Likos can be contacted at Trading Views

Gann's Rule of 1/8's is based on specific arithmetic geometry, more specifically 'fractal arithmetic geometry'. When that 'geometry' is constructed properly, (Gann referred to them as 'Octaves, Squares or Boxes), we can apply a set of rules that has predictive capabilities in any market that can be plotted. Does the predictive outcome, using the rules, work all the time? NO. Losing is part of trading. As traders, we attempt to eliminate the losing trades and find the methods that leave us with the consistently highest probability setups. I have found Gann's Harmonic Rule of 1/8's to be very productive when certain rules are applied properly and when combined with other predictive tools.

As this is An Introduction to Gann's Rule of 1/8's, I'm not going to spend time on the specifics of the arithmetic structure of the individual Gann Frame Squares (or Gann Boxes) that contain what he calls the Octaves and fractal movements in time and price. Nor am I going to introduce Gann's 'Speed Lines' that many technicians overlay on a Gann Square which illustrate additional predictive 'angles' of support and resistance beyond the basic 'square-layout'. The focus of this paper is to illustrate the foundations of Gann's Rule of 1/8s. 'Speed-lines' will be addressed at a later date.

A FULL Gann Square (Box) Illustrated using an ES Chart

Before I move forward with an explanation of the 'Gann Square/Box', a word about Support and Resistance is in order here. It has been my observation over my 18 year trading career that the more advanced or accomplished a trader is, the more he adheres to the predictive principles of support/demand & resistance/supply. Many novice traders start out in their technical studies learning as much about 'technical indicators' as they can, searching for the one or two tools that will show them the key to consistent success in the markets. Unfortunately, they discount the importance of support and resistance. Their charting becomes very 'busy', becoming more complex as their initial studies progress. The more advanced trader matures to relying on tried and proven price patterns with predictive characteristics, supported by key levels of both conventional and non-conventional Support & Resistance and using 'indicators' only as a distant 'secondary-confirmation' for a trade action.

With that in mind, the use and plotting of a Gann Square in any market you are evaluating can be used as a 'non-conventional' Support & Resistance tool in itself, even without understanding or applying the predictive rules of the same.

A Short Review on Conventional/Non-Conventional Support & Resistance

The most obvious types of Support & Resistance areas are those identified by

'price activity'.

Above price activity 'stalled' at the S Level (support) when demand was too great to let the market drop at the 3-points illustrated. It is simple not only to see and denote, but to use as future technical reference.

Below price activity 'stalled' at the R Level (resistance) when supply was too great to let the market rise at the 3-points illustrated. Again, simple to see, and use as a future technical reference.

The two previously illustrated examples are 'Conventional' types of Support & Resistance as their movements were restricted by 'price-activity' governed by 'supply and demand'.

Understand, there are different levels of Support & Resistance some stronger than others depending on the current underlying market internals, which astute traders constantly monitor. When a market 'stalls' or 'bounces' after seeing a strong area of Support or Resistance, analysts use classical predictive tools to help them evaluate the future 'or potential' price action, namely the 'retracement' off a 'stall' or 'bounce'. One of the more popular tools technicians use to evaluate potential price movement is Fibonacci Retracements, using the higher probability Fibonacci levels: 23.6%, 38.2%, 50%, 61.8% and 78.6% as retracement targets for trade action. Another is Elliott Wave analysis whose purpose is to target areas of retracement and subsequent movement by the predictive 'cycles' it attempts to justify. Also, Gann can be very powerful when a DeMark complex pattern terminates on one of their Key Levels (illustrated later).

The technical challenge to using any of these predictive technical tools is understanding when and where 'market change-ups' will occur with a higher degree of probability than not. Combining Ganns Rule of 1/8's with these or other predictive tools properly can get the astute trader closer to or higher on that scale of probability that will result in nosing up the stronger trade setups and will ultimately cut out more losing plays.

Here is a FULL Harmonic Gann Square illustrating the 13-Fractal Levels within this particular Octave. The Box shows the Overbought 5/8 to +2/8 Area, the Oversold 3/8 to -2/8 Area in addition to the Trading Range 3/8 to 5/8.

Gann saw prices move in 1/8's. These 1/8's act as areas of Support & Resistance as price changes over time.

Rule of 1/8s Guidelines

- Markets will stay within Gann's Trading Range 40% of the time. Price movements within the trading range will characteristically be sluggish with a high degree of 'range-bound' action, where any 3/8's move will have a high-probability of a 1/8 retracement. Consider scalping 1/8 moves within the Gann Trading Range depending on the particular market you're watching & Market Internals.

- Any 5/8's move (or better) that stalls out at a Key Gann Level has a high probability for pullback. Therefore, if I'm Long or Short after any 5/8's move, I'm frequently taking some profit and/or moving my Stop tighter. IF the move is against the overall trend, I'll be looking for a reversal opportunity.

- The Strongest Support & Resistance Levels on any time frame in a Gann Frame are the 0/8 & 8/8 levels with travel beyond those levels averaging no more than 1/8 on the first move attempt.

My experience has shown the Even Levels within a Gann Box have a much higher degree of technical validity than the Odd Levels. Understand, illiquid markets won't show technical reliability/validity with any technical tool. Liquid markets will illustrate technical reliability/ validity. Therefore, the more liquid a market the more validity/reliability the tool will have.

This is how I plot and use the following configuration of a Gann Box illustrating only the Even Levels:

Gann assumes ALL markets are the same, in that they are traded by what he calls mobs and therefore are driven by the same emotional mob behavior that moves every market.

Mark Likos can be contacted at Trading Views

Last edited by a moderator: