new_trader

Legendary member

- Messages

- 6,770

- Likes

- 1,656

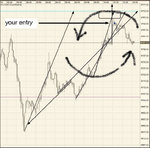

I have been trading for a while now but I still can't overcome my emotions. I made a trade today that went against me. I stopped out for a 2 point loss so nothing too disasterous. Following this I spotted what I believed to be another 2 good entries but was reluctant to enter a trade in case I got it wrong again. Both would have been profitable!! I am curious how many other traders go through this? Also, how many traders have gone through this stage and how did you overcome the fear? Is it a case of more practice and experience?

Last edited by a moderator: