jezza888

Well-known member

- Messages

- 441

- Likes

- 24

Hi all,

I've been reading through this site and not found quite the answer I was looking for and would appreciate anyones thoughts on the following. (except for being told not to use indicators.)

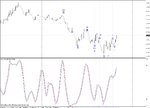

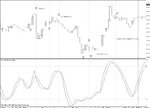

I've tweaked the S.O. in Metatrader4 and found a succesful way of trading cable of a 15 minute chart as shown in the attatchment.

The tests go back 12 months and I've been trading it with a capital spreads demo account for two weeks now and the results are great with high success, minimal losses and a few breakevens and I'm getting ready to go live.

My only concern is, many threads on this board say about how the markets change and what worked in the past won't work in the future etc... Now, is that for all POV (P/V or indicators) or what? On one hand theres loads about backtesting and ensuring the viability of your system (ie last Knowledge lab article) yet just as much about how its pointless.

I feel confident to go live and this is my only nagging fear that all my hard work and hours testing a system is going to leave me flat on my face and out of pocket in two weeks time when things change!

The system is using the stochastic Oscilator and surely that will allways correspend with the price in the same way as its a mathematical equation regardless of the the MM and traders style and attitude?

I've been reading through this site and not found quite the answer I was looking for and would appreciate anyones thoughts on the following. (except for being told not to use indicators.)

I've tweaked the S.O. in Metatrader4 and found a succesful way of trading cable of a 15 minute chart as shown in the attatchment.

The tests go back 12 months and I've been trading it with a capital spreads demo account for two weeks now and the results are great with high success, minimal losses and a few breakevens and I'm getting ready to go live.

My only concern is, many threads on this board say about how the markets change and what worked in the past won't work in the future etc... Now, is that for all POV (P/V or indicators) or what? On one hand theres loads about backtesting and ensuring the viability of your system (ie last Knowledge lab article) yet just as much about how its pointless.

I feel confident to go live and this is my only nagging fear that all my hard work and hours testing a system is going to leave me flat on my face and out of pocket in two weeks time when things change!

The system is using the stochastic Oscilator and surely that will allways correspend with the price in the same way as its a mathematical equation regardless of the the MM and traders style and attitude?