You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

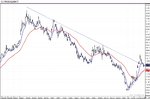

10 year note yield long term chart

inflationary FED, long term outlook has upside bias on yield, but gloommongerers would have you believe we are entering a depression, which implies 4% or lower on the 10 year. But with a proactive FED, the odds shift in favor of a inflationary yield explosion.

inflationary FED, long term outlook has upside bias on yield, but gloommongerers would have you believe we are entering a depression, which implies 4% or lower on the 10 year. But with a proactive FED, the odds shift in favor of a inflationary yield explosion.

Attachments

free4440273

Active member

- Messages

- 200

- Likes

- 2

so we're about to enter a period of massive inflation whilst the Fed continues to cut rates?

so we're about to enter a period of massive inflation whilst the Fed continues to cut rates?

with the debasement of the dollar, the FED has very few choices in the face of unprecedented deflationary pressures. So they have inflate us out of this mess. Which is being realized on the dollar index and in some ways the bond market.

fibonelli

Experienced member

- Messages

- 1,338

- Likes

- 288

An alternative explanation is a banking recapitalisation via a steep yield curve as was done between 1991-93 after the S&L crisis.

Obviously, this time there are major differences eg quantity and ownership of US debt and the strong price action of commodities and PM's. Inflate or die is the maxim.

Obviously, this time there are major differences eg quantity and ownership of US debt and the strong price action of commodities and PM's. Inflate or die is the maxim.

countries in the end only care about guns and missiles pointed at them, inflation and other aspects are really not the primary concerns. Thats why things can get out of hand, since inherently inflation wont be immediate enough to be a consequence to the present administration.

Even though CB's may talk tough, they will inflate us out of most anything. This is a yield fractal on the 10 year note. What I expect for long term rates. Noticeable inflation where long term rates are blatantly at historic highs wont be for a year or two. This will give room for the equity market to make new highs, before the rates start competing with allocation ratios between equity/credit in portfolios.

Even though CB's may talk tough, they will inflate us out of most anything. This is a yield fractal on the 10 year note. What I expect for long term rates. Noticeable inflation where long term rates are blatantly at historic highs wont be for a year or two. This will give room for the equity market to make new highs, before the rates start competing with allocation ratios between equity/credit in portfolios.

Attachments

news algos minor spike in futures up, expect price decay as day progresses.

decaying as expected.

Attachments

free4440273

Active member

- Messages

- 200

- Likes

- 2

inflationary FED, long term outlook has upside bias on yield, but gloommongerers would have you believe we are entering a depression, which implies 4% or lower on the 10 year. But with a proactive FED, the odds shift in favor of a inflationary yield explosion.

so we're about to enter a period of massive inflation whilst the Fed continues to cut rates?

with the debasement of the dollar, the FED has very few choices in the face of unprecedented deflationary pressures. So they have inflate us out of this mess. Which is being realized on the dollar index and in some ways the bond market.

thanks Xymox. are you saying that the fed no longer 'cares' about inflation, ditto the BofE - they are more worried about a risk of recession? also, is the bond market not worried at all about inflation? thanks

thanks Xymox. are you saying that the fed no longer 'cares' about inflation, ditto the BofE - they are more worried about a risk of recession? also, is the bond market not worried at all about inflation? thanks

the FED senses what can happen if they don't inflate, look at the Northern Rock fiasco, they need to escalate asset prices fast, mainly equities to preserve some good sentiment in the market place.

the FED oscillates between deflationary concerns and inflationary concerns, their main concern now is deflation as evidenced by the FED move this past week. FED will only be concerned with inflation once deflationary risks subside. The summation of all these dynamics are the yield oscillations that occur over multidecade spans. Thus risks are higher that yields move up in anticipation of inflation.

free4440273

Active member

- Messages

- 200

- Likes

- 2

the FED senses what can happen if they don't inflate, look at the Northern Rock fiasco, they need to escalate asset prices fast, mainly equities to preserve some good sentiment in the market place.

the FED oscillates between deflationary concerns and inflationary concerns, their main concern now is deflation as evidenced by the FED move this past week. FED will only be concerned with inflation once deflationary risks subside. The summation of all these dynamics are the yield oscillations that occur over multidecade spans. Thus risks are higher that yields move up in anticipation of inflation.

thanks. so all of this is bullish for stocks - hence the rally when the fed cut and why the dow is up +80 today. we could see 14K very soon then. what i find incrdible is that with all the bad news (low consumer confidence, subprime mess, inflation, high oil prices) stocks are reaching for an all-time high. and what about the dollar: fed no longer concerned about how weak it is...

Similar threads

- Replies

- 0

- Views

- 3K

- Replies

- 0

- Views

- 6K