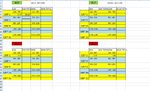

closed +20

102 tick profit this week +20 = 122

Next Week I will see if I can apply the blinkered Big John candle to this system😆😆😆😆

5 th consecutive week of profits average over 100 ticks per week.

have a nice weekend everybody!

I made +324. Luck? Probably. I can't believe, either. It was done by taking notice of you, fl. I did not change my system-but you got me off FT. I'll try it again, next week.