There is an old saying in business: "Fail to plan and you plan to fail." It may sound glib, but those who are serious about being successful, including traders, should follow these eight words as if they were written in stone. Ask any trader who makes money on a consistent basis and they will tell you, "You have two choices: you can either methodically follow a written plan, or fail."

If you have a written trading or investment plan, congratulations! You are in the minority. While it is still no absolute guarantee of success, you have eliminated one major roadblock. If your plan uses flawed techniques or lacks preparation, your success won't come immediately, but at least you are in a position to chart and modify your course. By documenting the process, you learn what works and how to avoid repeating costly mistakes.

Whether or not you have a plan now, here are some ideas to help with the process.

Disaster Avoidance 101

Trading is a business, so you have to treat it as such if you want to succeed. Reading some books, buying a charting program, opening a brokerage account and starting to trade are not a business plan - it is a recipe for disaster.

Once a trader knows where the market has the potential to pause or reverse, they must then determine which one it will be and act accordingly. A plan should be written in stone while you are trading, but subject to re-evaluation once the market has closed. It changes with market conditions and adjusts as the trader's skill level improves. Each trader should write their own plan, taking into account personal trading styles and goals. Using someone else's plan does not reflect your trading characteristics.

Building the Perfect Master Plan

What are the components of a good trading plan? Here are 10 essentials that every plan should include:

1) Skill Assessment

Are you ready to trade? Have you tested your system by paper trading it and do you have confidence that it works? Can you follow your signals without hesitation? Trading in the markets is a battle of give and take. The real pros are prepared and they take their profits from the rest of the crowd who, lacking a plan, give their money away through costly mistakes.

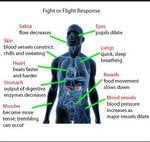

2) Mental Preparation

How do you feel? Did you get a good night's sleep? Do you feel up to the challenge ahead? If you are not emotionally and psychologically ready to do battle in the markets, it is better to take the day off - otherwise, you risk losing your shirt. This is guaranteed to happen if you are angry, preoccupied or otherwise distracted from the task at hand. Many traders have a market mantra they repeat before the day begins to get them ready. Create one that puts you in the trading zone.

3) Set Risk Level

How much of your portfolio should you risk on any one trade? It can range anywhere from around 1% to as much as 5% of your portfolio on a given trading day. That means if you lose that amount at any point in the day, you get out and stay out. This will depend on your trading style and risk tolerance. Better to keep powder dry to fight another day if things aren't going your way.

4) Set Goals

Before you enter a trade, set realistic profit targets and risk/reward ratios. What is the minimum risk/reward you will accept? Many traders will not take a trade unless the potential profit is at least three times greater than the risk. For example, if your stop loss is a dollar loss per share, your goal should be a $3 profit. Set weekly, monthly and annual profit goals in dollars or as a percentage of your portfolio, and re-assess them regularly.

5) Do Your Homework

Before the market opens, what is going on around the world? Are overseas markets up or down? Are index futures such as the S&P 500 or Nasdaq 100 exchange-traded funds up or down in pre-market? Index futures are a good way of gauging market mood before the market opens. What economic or earnings data is due out and when? Post a list on the wall in front of you and decide whether you want to trade ahead of an important economic report. For most traders, it is better to wait until the report is released than take unnecessary risk. Pros trade based on probabilities. They don't gamble.

6) Trade Preparation

Whatever trading system and program you use, label major and minor support and resistance levels, set alerts for entry and exit signals and make sure all signals can be easily seen or detected with a clear visual or auditory signal. Your trading area should not offer distractions. Remember, this is a business, and distractions can be costly.

7) Set Exit Rules

Most traders make the mistake of concentrating 90% or more of their efforts in looking for buy signals, but pay very little attention to when and where to exit. Many traders cannot sell if they are down because they don't want to take a loss. Get over it or you will not make it as a trader. If your stop gets hit, it means you were wrong. Don't take it personally. Professional traders lose more trades than they win, but by managing money and limiting losses, they still end up making profits.

Before you enter a trade, you should know where your exits are. There are at least two for every trade. First, what is your stop loss if the trade goes against you? It must be written down. Mental stops don't count. Second, each trade should have a profit target. Once you get there, sell a portion of your position and you can move your stop loss on the rest of your position to break even if you wish. As discussed above, never risk more than a set percentage of your portfolio on any trade.

8) Set Entry Rules

This comes after the tips for exit rules for a reason: exits are far more important than entries. A typical entry rule could be worded like this: "If signal A fires and there is a minimum target at least three times as great as my stop loss and we are at support, then buy X contracts or shares here." Your system should be complicated enough to be effective, but simple enough to facilitate snap decisions. If you have 20 conditions that must be met and many are subjective, you will find it difficult if not impossible to actually make trades. Computers often make better traders than people, which may explain why nearly 50% of all trades that now occur on the New York Stock Exchange are computer-program generated. Computers don't have to think or feel good to make a trade. If conditions are met, they enter. When the trade goes the wrong way or hits a profit target, they exit. They don't get angry at the market or feel invincible after making a few good trades. Each decision is based on probabilities.

9) Keep Excellent Records

All good traders are also good record keepers. If they win a trade, they want to know exactly why and how. More importantly, they want to know the same when they lose, so they don't repeat unnecessary mistakes. Write down details such as targets, the entry and exit of each trade, the time, support and resistance levels, daily opening range, market open and close for the day and record comments about why you made the trade and lessons learned. Also, you should save your trading records so that you can go back and analyze the profit or loss for a particular system, draw-downs (which are amounts lost per trade using a trading system), average time per trade (which is necessary to calculate trade efficiency) and other important factors, and also compare them to a buy-and-hold strategy. Remember, this is a business and you are the accountant.

10) Perform a Post-Mortem

After each trading day, adding up the profit or loss is secondary to knowing the why and how. Write down your conclusions in your trading journal so that you can reference them again later.

In Summary

Successful paper trading does not guarantee that you will have success when you begin trading real money and emotions come into play. But successful paper trading does give the trader confidence that the system they are going to use actually works. Deciding on a system is less important than gaining enough skill so that you are able to make trades without second guessing or doubting the decision.

There is no way to guarantee that a trade will make money. The trader's chances are based on their skill and system of winning and losing. There is no such thing as winning without losing. Professional traders know before they enter a trade that the odds are in their favor or they wouldn't be there. By letting their profits ride and cutting losses short, a trader may lose some battles, but they will win the war. Most traders and investors do the opposite, which is why they never make money.

Traders who win consistently treat trading as a business. While it's not a guarantee that you will make money, having a plan is crucial if you want to become consistently successful and survive in the trading game.

Matt Blackman can be contacted at Trading Education

If you have a written trading or investment plan, congratulations! You are in the minority. While it is still no absolute guarantee of success, you have eliminated one major roadblock. If your plan uses flawed techniques or lacks preparation, your success won't come immediately, but at least you are in a position to chart and modify your course. By documenting the process, you learn what works and how to avoid repeating costly mistakes.

Whether or not you have a plan now, here are some ideas to help with the process.

Disaster Avoidance 101

Trading is a business, so you have to treat it as such if you want to succeed. Reading some books, buying a charting program, opening a brokerage account and starting to trade are not a business plan - it is a recipe for disaster.

Once a trader knows where the market has the potential to pause or reverse, they must then determine which one it will be and act accordingly. A plan should be written in stone while you are trading, but subject to re-evaluation once the market has closed. It changes with market conditions and adjusts as the trader's skill level improves. Each trader should write their own plan, taking into account personal trading styles and goals. Using someone else's plan does not reflect your trading characteristics.

Building the Perfect Master Plan

What are the components of a good trading plan? Here are 10 essentials that every plan should include:

1) Skill Assessment

Are you ready to trade? Have you tested your system by paper trading it and do you have confidence that it works? Can you follow your signals without hesitation? Trading in the markets is a battle of give and take. The real pros are prepared and they take their profits from the rest of the crowd who, lacking a plan, give their money away through costly mistakes.

2) Mental Preparation

How do you feel? Did you get a good night's sleep? Do you feel up to the challenge ahead? If you are not emotionally and psychologically ready to do battle in the markets, it is better to take the day off - otherwise, you risk losing your shirt. This is guaranteed to happen if you are angry, preoccupied or otherwise distracted from the task at hand. Many traders have a market mantra they repeat before the day begins to get them ready. Create one that puts you in the trading zone.

3) Set Risk Level

How much of your portfolio should you risk on any one trade? It can range anywhere from around 1% to as much as 5% of your portfolio on a given trading day. That means if you lose that amount at any point in the day, you get out and stay out. This will depend on your trading style and risk tolerance. Better to keep powder dry to fight another day if things aren't going your way.

4) Set Goals

Before you enter a trade, set realistic profit targets and risk/reward ratios. What is the minimum risk/reward you will accept? Many traders will not take a trade unless the potential profit is at least three times greater than the risk. For example, if your stop loss is a dollar loss per share, your goal should be a $3 profit. Set weekly, monthly and annual profit goals in dollars or as a percentage of your portfolio, and re-assess them regularly.

5) Do Your Homework

Before the market opens, what is going on around the world? Are overseas markets up or down? Are index futures such as the S&P 500 or Nasdaq 100 exchange-traded funds up or down in pre-market? Index futures are a good way of gauging market mood before the market opens. What economic or earnings data is due out and when? Post a list on the wall in front of you and decide whether you want to trade ahead of an important economic report. For most traders, it is better to wait until the report is released than take unnecessary risk. Pros trade based on probabilities. They don't gamble.

6) Trade Preparation

Whatever trading system and program you use, label major and minor support and resistance levels, set alerts for entry and exit signals and make sure all signals can be easily seen or detected with a clear visual or auditory signal. Your trading area should not offer distractions. Remember, this is a business, and distractions can be costly.

7) Set Exit Rules

Most traders make the mistake of concentrating 90% or more of their efforts in looking for buy signals, but pay very little attention to when and where to exit. Many traders cannot sell if they are down because they don't want to take a loss. Get over it or you will not make it as a trader. If your stop gets hit, it means you were wrong. Don't take it personally. Professional traders lose more trades than they win, but by managing money and limiting losses, they still end up making profits.

Before you enter a trade, you should know where your exits are. There are at least two for every trade. First, what is your stop loss if the trade goes against you? It must be written down. Mental stops don't count. Second, each trade should have a profit target. Once you get there, sell a portion of your position and you can move your stop loss on the rest of your position to break even if you wish. As discussed above, never risk more than a set percentage of your portfolio on any trade.

8) Set Entry Rules

This comes after the tips for exit rules for a reason: exits are far more important than entries. A typical entry rule could be worded like this: "If signal A fires and there is a minimum target at least three times as great as my stop loss and we are at support, then buy X contracts or shares here." Your system should be complicated enough to be effective, but simple enough to facilitate snap decisions. If you have 20 conditions that must be met and many are subjective, you will find it difficult if not impossible to actually make trades. Computers often make better traders than people, which may explain why nearly 50% of all trades that now occur on the New York Stock Exchange are computer-program generated. Computers don't have to think or feel good to make a trade. If conditions are met, they enter. When the trade goes the wrong way or hits a profit target, they exit. They don't get angry at the market or feel invincible after making a few good trades. Each decision is based on probabilities.

9) Keep Excellent Records

All good traders are also good record keepers. If they win a trade, they want to know exactly why and how. More importantly, they want to know the same when they lose, so they don't repeat unnecessary mistakes. Write down details such as targets, the entry and exit of each trade, the time, support and resistance levels, daily opening range, market open and close for the day and record comments about why you made the trade and lessons learned. Also, you should save your trading records so that you can go back and analyze the profit or loss for a particular system, draw-downs (which are amounts lost per trade using a trading system), average time per trade (which is necessary to calculate trade efficiency) and other important factors, and also compare them to a buy-and-hold strategy. Remember, this is a business and you are the accountant.

10) Perform a Post-Mortem

After each trading day, adding up the profit or loss is secondary to knowing the why and how. Write down your conclusions in your trading journal so that you can reference them again later.

In Summary

Successful paper trading does not guarantee that you will have success when you begin trading real money and emotions come into play. But successful paper trading does give the trader confidence that the system they are going to use actually works. Deciding on a system is less important than gaining enough skill so that you are able to make trades without second guessing or doubting the decision.

There is no way to guarantee that a trade will make money. The trader's chances are based on their skill and system of winning and losing. There is no such thing as winning without losing. Professional traders know before they enter a trade that the odds are in their favor or they wouldn't be there. By letting their profits ride and cutting losses short, a trader may lose some battles, but they will win the war. Most traders and investors do the opposite, which is why they never make money.

Traders who win consistently treat trading as a business. While it's not a guarantee that you will make money, having a plan is crucial if you want to become consistently successful and survive in the trading game.

Matt Blackman can be contacted at Trading Education

Last edited by a moderator: