Frugi

Thank you for putting up the link it will be an interesting read. As to the 2nd time through it does help to understand the concept of the order situation, although I think it is quite commonly known that price will be pushed an pulled around these levels to lock in the business of these orders.

The one thing that I see from this set up is the fact that the entry is taken at a safe junction which is a good thing but at what seems a considerable distance from another method surrounding basic trends. If you are aware of these set-ups and that there is a likely outcome where you are waiting on the side of the previous trend and you know there is a chance of 2 moves down then why not sell / buy the existing trend when they turn. First you have a tight stop just above the top, 2nd you are expecting a bounce so you can close into the congestion should you wish to. Dependant upon how wide the swings are then you could risk buying the bounce, otherwise you wait to hit the sell again and maybe see this one through.

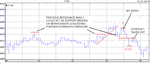

The reason I mention this is because in the example shown on JR's pdf it is a clear case of the price bars appearing to break the trendline of the bar tops but not take out the last main resistance to the up moves when in the downtrend. In your example that is not quite the case and it would be interesting to see this same dat on a 10 or 15 min chart to establish where the last main resistance was to pullbacks against the down trend. At a guess I would suggest they may show that the rise seen in the breakthrough of congestion did not take out the main resistance and so the previous trend continues not unexpectedly.

This is something I have studied when applying trends and normally tends to be a false move against the previous trend although I have not considered it for congestion before but as a minor correction but essentially it seem the same ingredients are involved in terms of how the trend remains intact overall. If you have access to the chart in a 10 or 15 min time frame I would be interested to see the comparison if you have time.

Thank you for putting up the link it will be an interesting read. As to the 2nd time through it does help to understand the concept of the order situation, although I think it is quite commonly known that price will be pushed an pulled around these levels to lock in the business of these orders.

The one thing that I see from this set up is the fact that the entry is taken at a safe junction which is a good thing but at what seems a considerable distance from another method surrounding basic trends. If you are aware of these set-ups and that there is a likely outcome where you are waiting on the side of the previous trend and you know there is a chance of 2 moves down then why not sell / buy the existing trend when they turn. First you have a tight stop just above the top, 2nd you are expecting a bounce so you can close into the congestion should you wish to. Dependant upon how wide the swings are then you could risk buying the bounce, otherwise you wait to hit the sell again and maybe see this one through.

The reason I mention this is because in the example shown on JR's pdf it is a clear case of the price bars appearing to break the trendline of the bar tops but not take out the last main resistance to the up moves when in the downtrend. In your example that is not quite the case and it would be interesting to see this same dat on a 10 or 15 min chart to establish where the last main resistance was to pullbacks against the down trend. At a guess I would suggest they may show that the rise seen in the breakthrough of congestion did not take out the main resistance and so the previous trend continues not unexpectedly.

This is something I have studied when applying trends and normally tends to be a false move against the previous trend although I have not considered it for congestion before but as a minor correction but essentially it seem the same ingredients are involved in terms of how the trend remains intact overall. If you have access to the chart in a 10 or 15 min time frame I would be interested to see the comparison if you have time.