What Is an In-the-Money Covered Call?

The ITM covered call can be used as a device to sell an appreciated stock at a price that is somewhat above the market price. It can also be used as a cash-flow generation strategy and tuned to be almost as conservative as treasury bills, or as aggressive as a biotech stock or anywhere in between.

How to Use an In-the-Money Covered Call

The mechanics are simple. You buy (or already own) 100 shares of a stock or exchange-traded fund. You then sell a call option, with a strike price that is quite far below the current stock price. You are selling someone the option to buy your stock from you at a price that is far below market. The amount of money you will be paid for selling the call is equal to the discount to market value you are offering, plus a little bit more. That little bit more is your profit.

Example of an In-the-Money Covered Call Trade

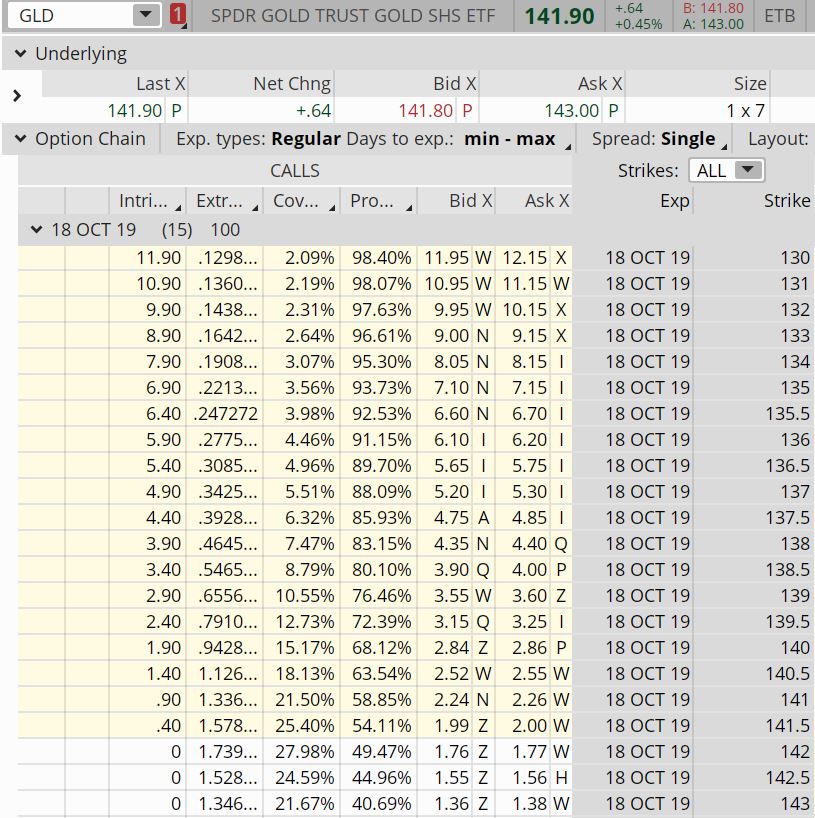

Below is a list of options on the exchange-traded fund called GLD, which follows the price of gold. The selected options were set to expire 15 days after the date of this screenshot, on October 18, 2019:

The price of the GLD shares at that time was $141.90.

The Strike column shows the various options that could be sold. For example, look at the row where the Strike is 137.

If you decided to use this call as an ITM covered call, you would take these steps:

- Buy 100 shares of GLD at $141.90, for a total of $14,190

- Sell 1 of the calls at the 137 strike, for $5.2425 per share (between the Bid of $5.20 and the Ask of $5.30) This would bring in cash of $524.25 for the option contract.

- Your net out-of-pocket cost is now $14,190 less $524.25, or $13,665.75. This is your investment.

- Wait 15 days for the options to expire. At that time, if GLD is still at any price above $137 per share, the option would be assigned.

This means that the GLD shares will be taken away from you and you will be paid $137 per share, a total of $13,700.

Your receipts at that time of $13,700, less your original investment of $13,665.75, would leave you with a $34.25 profit in 15 days. This could be multiplied by as many times as you have increments of $14,000 to invest.

The return may not sound like a lot, but as an annualized rate of return it is not bad.

The calculation of the return for an in-the-money covered call is Return / Amount Invested, in this case $34.25/$13,665.75 or about ¼ of 1% in 15 days. This works out to an annualized return of around 5.51% per year, and that is the amount shown in the table above, in the column labelled Cov… (Covered call profit %).

In this ITM covered call scenario, you are not looking to profit from any appreciation on the stock. You are committed to selling it at $137 no matter how high its price might go. The purpose of the ITM covered call is to harvest the cash flow.

If upon expiration you do not want to have the shares taken away (so that you can do another ITM or OTM covered call the next month), then instead of taking no action and allowing the shares to be called away at that time, you would buy to close the calls on expiration day. The price you would pay for the calls at that time would be such that your profit would be the same as if you did let the stock be called away. Any profit made on the stock would be lost on the calls, except for $34.25 which is yours to keep.

Finally, note that if GLD should be below $137 per share at expiration, you will retain the shares of GLD and you will also retain the entire $524.25 received for the calls. In that case your net cost per share would be the $141.90 originally paid, less the $5.2425 received for the call, for a net of $136.66. In other words, your cost basis in the GLD shares will be reduced by the premium received. If the stock is at your adjusted cost of $136.66 or above at expiration, you still have a profit. If below, you will have a loss.

Note the column labelled Pro… in the list above. This is Probability of being ITM at expiration. For the 137 call, this figure is 88.09%. That means that based on current option pricing it is estimated that there is about an 88% chance that you will in fact end up with your 5.51% profit. There is a small chance that you will not. If you don’t, it means that you will then be the proud owner of 100 shares of GLD, with which you can do whatever you please.

Notice the Cov… and Pro… columns for other strike prices. As you can see, if you were willing to take a bigger chance that the indicated profit would not be made on a particular call (smaller numbers of Pro…), then the profit when you do make it (Cov…) is higher. This is what I meant above when I said that the strategy can be tuned to be as aggressive or conservative as you like.

I hope this has stimulated your thinking about options. They are indeed a versatile and useful trading and investing medium.

Russ Allen can be contacted on this link: Russ Allen