Shorting covered calls is a very popular option trading strategy that involves shorting a call option and taking a long position in underlying stock. On the upside, there is limited capped profit to the trader with limited and proportionate loss on the downside. Experienced traders apply this strategy with the right timing and careful selection of the expiry and moneyness of call options

The risks in selling covered calls

There's a common misconception that any option that is shorted, the potential for loss is unlimited. The same is thought of short covered calls, but this is not true. In fact, the maximum risk in a short covered call position is limited and can be managed efficiently - with the proper timing of the trade and selecting the covered calls on the right underlying.

First things first: What’s the risk in selling covered calls?

Let’s begin with an example. Assume we are creating a short covered call position on the NYSE-listed IBM stock with the underlying horizon of one year. Current market price (in mid-January 2015) for IBM stock is $155, one-year dated at the money (ATM) call with a strike price of $155 and expiry date of January 2016, trading at $13.

For the sake of simplicity, brokerage charges will be considered at the end for this trade which assumes ONE share purchase and ONE call contract shorting. In real-life trading, stock options are available in hundreds of contracts and shares should be bought proportionally.

Here’s what the covered call construction will look like:

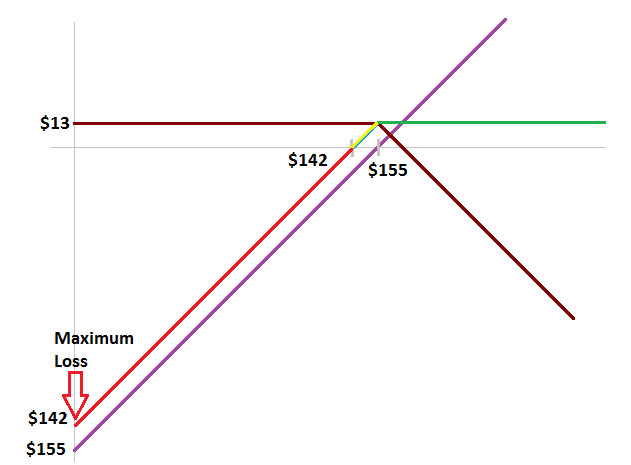

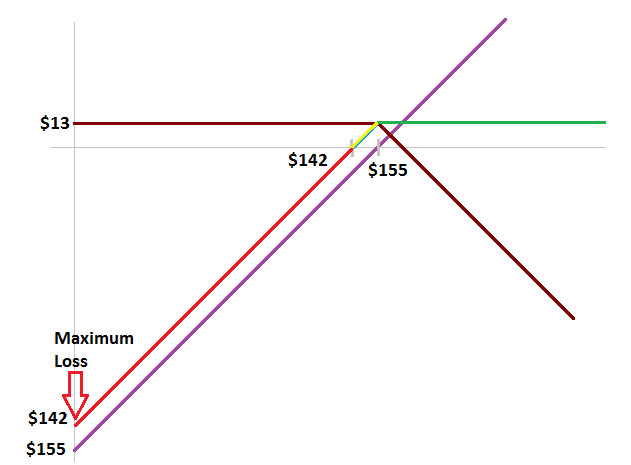

Fig 1

short-covered-call-payoff

Purple Graph - Long position in IBM Stock at $155 (payable).

Brown Graph – Short call position with strike price $155 and option premium $13 (receivable).

Blue Graph – Net payoff function for overall covered call (net sum of purple and brown graph).

Total Cost to create position = - $155 + $13 = - $142.

Analysis (Profit and Loss Scenarios for a Short Covered Call):

The blue graph is split as per the profit and loss regions for better understanding.

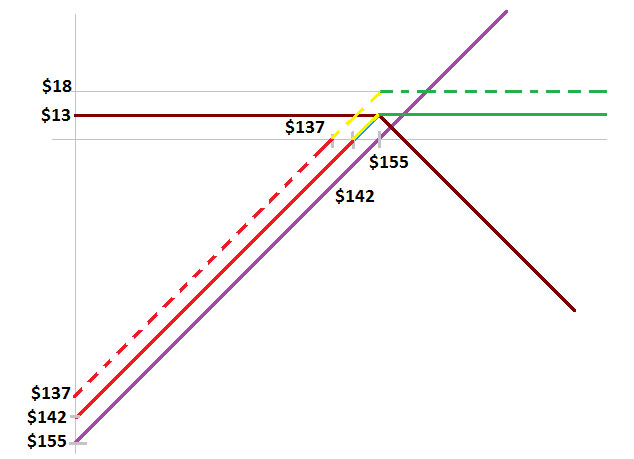

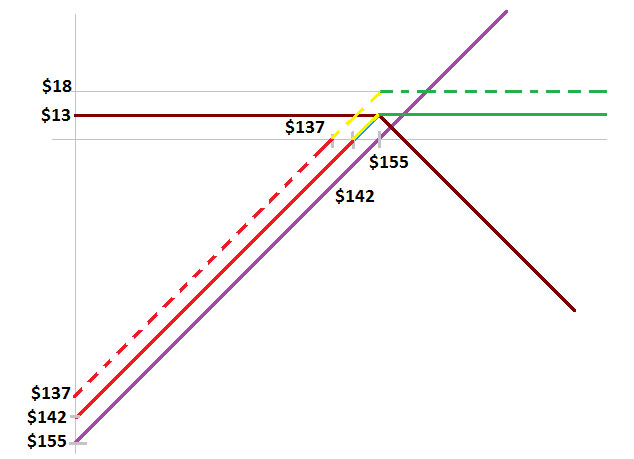

Fig 2

short-covered-call-payoff

If underlying IBM stock price remains above $155 at the time of expiry, the trader will get a maximum profit of $13 (minus the brokerage charges). This profit will remain capped at $13, irrespective of how high the stock price goes (indicated by horizontal region of the green graph above $155).

If underlying IBM stock price remains between $142 and $155, the trader’s profit will vary linearly – i.e. higher the underlying IBM stock price, the higher the profit (indicated by the slanting yellow graph between $142 and $155).

If underlying IBM stock price remains below $142, the trader will see a loss. The loss will vary linearly – the lower the IBM stock price goes, the higher the loss (indicated by the red graph below between $0 and $142).

The stock price can never go negative. The minimum stock price can be $0 (i.e. case of company going bankrupt), which would be the maximum loss. As indicated, this maximum loss is capped at $142 when this scenario of zero underlying price occurs. Theoretically, if the stock price goes to zero, the short call option will expire as worthless, allowing the trader to keep the $13 received as option premium. He will suffer a loss of $155 on the long stock purchase. Net loss = - $155 + $13 =-$142, which matches with the maximum loss value indicated in the graph.

How to minimize loss for short covered call option

Let’s explore ways in which the risks can be mitigated. (To learn more, see: Managing Risk With Options Strategies). Loss area is indicated by the red graph between the underlying stock price of $0 and $142. To minimize the risks (and loss), we should explore ways to push this net payoff function upwards (including the red graph). This can happen if there is a net receivable amount available to the trader in some form, such as a dividend receipt.

Risk management for short covered call using high dividend-paying stocks

IBM has a generous history of regularly paying quarterly dividends. For instance, it paid $0.95, $1.1, $1.1, $1.1 respectively in the four quarters of 2014. Assume that IBM will maintain its regular dividend payout trend and will pay a total $5 dividend in the following one year. Long position in underlying stock, an aspect of the short covered call, would enable the trader to receive the dividend amount i.e. $5. Since this is a net receivable, this adds to the net payoff and pushes the overall payoff function higher by $5 as follows:

Fig 3

short-covered-call-payoff

If the underlying IBM stock price remains above $155 at the time of expiry, the trader will now get a maximum profit of $18 (minus the brokerage charges). This profit will remain capped at $18, irrespective of how high the stock price goes (indicated by horizontal region of DOTTED green graph above $155)

If underlying IBM stock price remains between $137 and $155, the trader’s profit will vary linearly i.e. higher the underlying IBM stock price, the higher the profit (indicated by slanting DOTTED yellow graph between $137 and $155)

If underlying IBM stock price remains below $137, the trader will be in a loss. The loss will vary linearly i.e. the lower the IBM stock price goes, the higher the loss (indicated by red graph below between $0 and $137)

The hidden dividend payment has changed the profit and loss scenario significantly. First, it has shortened the loss region from the earlier ($0 to $142) to ($0 to $137) and second, it has added to the overall profit amount by $5 (maximum profit increased from $13 to $18)

Properly timing the trade to create short covered call allows benefits of dividend payment. Experienced option traders take such positions just before the dividend ex-date to qualify for dividend receipt.

Scenario analysis at expiry

If the underlying stock price goes down significantly (i.e. it ends in loss region, at $120 for example), the loss = (-155+120) from stock + ($13) from now worthless option premium + ($5) from dividend payment = -$17 net loss.

If underlying stock price ends in the yellow zone (e.g. $145), the profit = (-$155+$145) from stock + ($13) from now worthless option premium + ($5) dividend = $8 net profit.

If underlying stock price ends in green zone (e.g. $165), the profit = (-$155+$165) from stock + ($13) from option premium + (-$10) for option exercise as option is now ITM + ($5) dividend = $18 net profit

Risk management for short covered call using ITM calls:

Instead of shorting ATM calls, an option trader can also look to shorten the loss area (red graph) by taking in the money (ITM) calls at partial expense to the profit. Shorting ITM calls allows a higher option premium collection, which is another way to increase the net receivable amount.

Let’s create the same covered call option with an ITM call with strike price of $125 available at option premium of $35 (expiring January 2016, prices as available in January 2015).

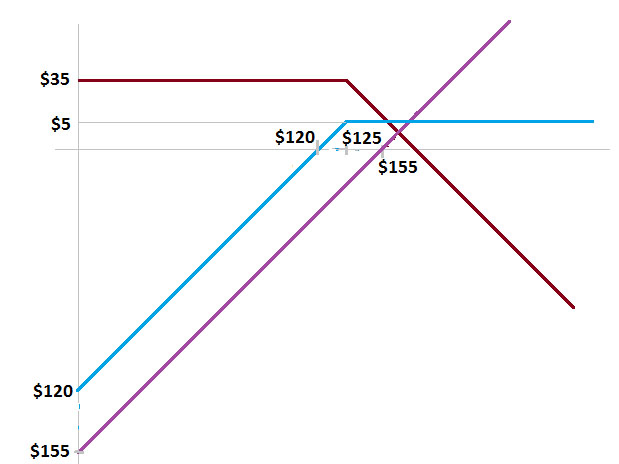

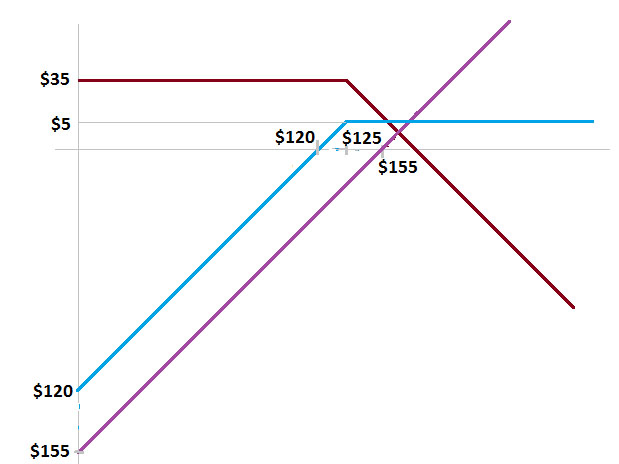

Fig 4

Short Covered Call

Purple Graph - Long position in IBM Stock at $155 (payable).

Brown Graph – Short call position strike price $125 with option premium $35 (receivable).

Blue Graph – net payoff function for overall covered call (net sum of purple and brown graph), offering maximum profit of $5 above $125, variable profit between $120 and $125 and variable loss below $120.

Total Cost to create position = -$155 + $35 = -$120 (comparatively lesser than that of ATM calls).

As observed, the ITM call inclusion has narrowed the loss region to $120 (against earlier $142) at the expense of profit which is now capped at $5 (against earlier $13)

Furthermore, if the same ITM short covered call is created on a high dividend-paying stock, the blue graph will shift upwards by $5 (dividend amount) improving profits and further limiting the losses:

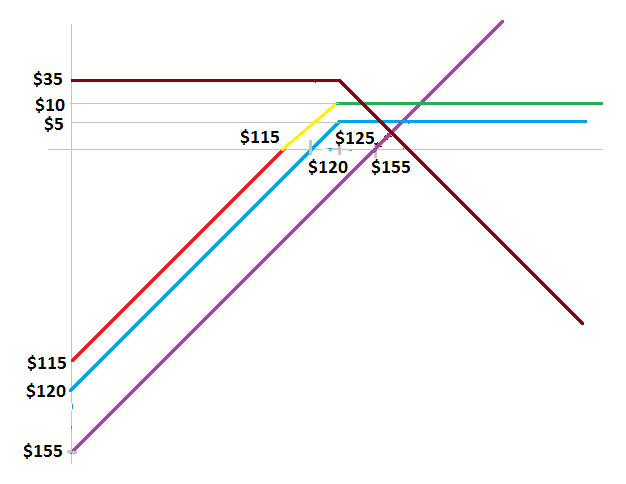

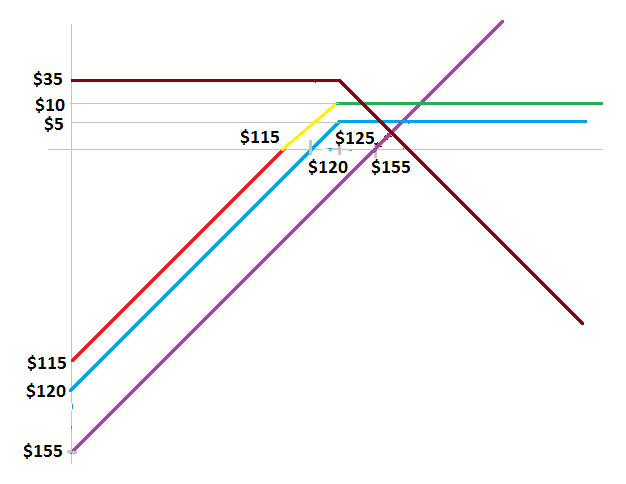

Fig 5

Short Covered Call with Dividend Payment

The dividend payment ($5) has further reduced the risk area to $115 (red graph), improved the profit offerings in both the yellow range ($115 to $125) and green range (above $125), with maximum profit improved to $10.

Compared to the earlier case of ATM call with same dividend payment, the risk region has reduced to between $0 to $115 as opposed to the former range of $0 to $137. But this came at the expense of the profit coming down from $18 to $10.

One important point that was not included above is the option brokerage charges, which are net payable and thus bring down the net payoff functions, reducing the profits and increasing the losses. Brokerage charges should be carefully considered and should not surpass the profit potential.

Keep in mind that options are usually traded in hundreds of contracts and sufficient capital should be allocated before commencing the options trading.

Other important points to mitigate the risk:

In Summary

The dynamics of options trading - involving combinations of multiple assets and positions, with significant impact within short interval price moves - can get tricky at times even for experienced traders. The complex structure of brokerage commission also impacts the profit and loss. Option traders should carefully consider the available profit potential against the risk appetite, and trade after a thorough analysis and carefully keeping pre-determined stop loss levels.

Shobhit Seth can be contacted at: FuturesOptionsEtc

The risks in selling covered calls

There's a common misconception that any option that is shorted, the potential for loss is unlimited. The same is thought of short covered calls, but this is not true. In fact, the maximum risk in a short covered call position is limited and can be managed efficiently - with the proper timing of the trade and selecting the covered calls on the right underlying.

First things first: What’s the risk in selling covered calls?

Let’s begin with an example. Assume we are creating a short covered call position on the NYSE-listed IBM stock with the underlying horizon of one year. Current market price (in mid-January 2015) for IBM stock is $155, one-year dated at the money (ATM) call with a strike price of $155 and expiry date of January 2016, trading at $13.

For the sake of simplicity, brokerage charges will be considered at the end for this trade which assumes ONE share purchase and ONE call contract shorting. In real-life trading, stock options are available in hundreds of contracts and shares should be bought proportionally.

Here’s what the covered call construction will look like:

Fig 1

short-covered-call-payoff

Purple Graph - Long position in IBM Stock at $155 (payable).

Brown Graph – Short call position with strike price $155 and option premium $13 (receivable).

Blue Graph – Net payoff function for overall covered call (net sum of purple and brown graph).

Total Cost to create position = - $155 + $13 = - $142.

Analysis (Profit and Loss Scenarios for a Short Covered Call):

The blue graph is split as per the profit and loss regions for better understanding.

Fig 2

short-covered-call-payoff

If underlying IBM stock price remains above $155 at the time of expiry, the trader will get a maximum profit of $13 (minus the brokerage charges). This profit will remain capped at $13, irrespective of how high the stock price goes (indicated by horizontal region of the green graph above $155).

If underlying IBM stock price remains between $142 and $155, the trader’s profit will vary linearly – i.e. higher the underlying IBM stock price, the higher the profit (indicated by the slanting yellow graph between $142 and $155).

If underlying IBM stock price remains below $142, the trader will see a loss. The loss will vary linearly – the lower the IBM stock price goes, the higher the loss (indicated by the red graph below between $0 and $142).

The stock price can never go negative. The minimum stock price can be $0 (i.e. case of company going bankrupt), which would be the maximum loss. As indicated, this maximum loss is capped at $142 when this scenario of zero underlying price occurs. Theoretically, if the stock price goes to zero, the short call option will expire as worthless, allowing the trader to keep the $13 received as option premium. He will suffer a loss of $155 on the long stock purchase. Net loss = - $155 + $13 =-$142, which matches with the maximum loss value indicated in the graph.

How to minimize loss for short covered call option

Let’s explore ways in which the risks can be mitigated. (To learn more, see: Managing Risk With Options Strategies). Loss area is indicated by the red graph between the underlying stock price of $0 and $142. To minimize the risks (and loss), we should explore ways to push this net payoff function upwards (including the red graph). This can happen if there is a net receivable amount available to the trader in some form, such as a dividend receipt.

Risk management for short covered call using high dividend-paying stocks

IBM has a generous history of regularly paying quarterly dividends. For instance, it paid $0.95, $1.1, $1.1, $1.1 respectively in the four quarters of 2014. Assume that IBM will maintain its regular dividend payout trend and will pay a total $5 dividend in the following one year. Long position in underlying stock, an aspect of the short covered call, would enable the trader to receive the dividend amount i.e. $5. Since this is a net receivable, this adds to the net payoff and pushes the overall payoff function higher by $5 as follows:

Fig 3

short-covered-call-payoff

If the underlying IBM stock price remains above $155 at the time of expiry, the trader will now get a maximum profit of $18 (minus the brokerage charges). This profit will remain capped at $18, irrespective of how high the stock price goes (indicated by horizontal region of DOTTED green graph above $155)

If underlying IBM stock price remains between $137 and $155, the trader’s profit will vary linearly i.e. higher the underlying IBM stock price, the higher the profit (indicated by slanting DOTTED yellow graph between $137 and $155)

If underlying IBM stock price remains below $137, the trader will be in a loss. The loss will vary linearly i.e. the lower the IBM stock price goes, the higher the loss (indicated by red graph below between $0 and $137)

The hidden dividend payment has changed the profit and loss scenario significantly. First, it has shortened the loss region from the earlier ($0 to $142) to ($0 to $137) and second, it has added to the overall profit amount by $5 (maximum profit increased from $13 to $18)

Properly timing the trade to create short covered call allows benefits of dividend payment. Experienced option traders take such positions just before the dividend ex-date to qualify for dividend receipt.

Scenario analysis at expiry

If the underlying stock price goes down significantly (i.e. it ends in loss region, at $120 for example), the loss = (-155+120) from stock + ($13) from now worthless option premium + ($5) from dividend payment = -$17 net loss.

If underlying stock price ends in the yellow zone (e.g. $145), the profit = (-$155+$145) from stock + ($13) from now worthless option premium + ($5) dividend = $8 net profit.

If underlying stock price ends in green zone (e.g. $165), the profit = (-$155+$165) from stock + ($13) from option premium + (-$10) for option exercise as option is now ITM + ($5) dividend = $18 net profit

Risk management for short covered call using ITM calls:

Instead of shorting ATM calls, an option trader can also look to shorten the loss area (red graph) by taking in the money (ITM) calls at partial expense to the profit. Shorting ITM calls allows a higher option premium collection, which is another way to increase the net receivable amount.

Let’s create the same covered call option with an ITM call with strike price of $125 available at option premium of $35 (expiring January 2016, prices as available in January 2015).

Fig 4

Short Covered Call

Purple Graph - Long position in IBM Stock at $155 (payable).

Brown Graph – Short call position strike price $125 with option premium $35 (receivable).

Blue Graph – net payoff function for overall covered call (net sum of purple and brown graph), offering maximum profit of $5 above $125, variable profit between $120 and $125 and variable loss below $120.

Total Cost to create position = -$155 + $35 = -$120 (comparatively lesser than that of ATM calls).

As observed, the ITM call inclusion has narrowed the loss region to $120 (against earlier $142) at the expense of profit which is now capped at $5 (against earlier $13)

Furthermore, if the same ITM short covered call is created on a high dividend-paying stock, the blue graph will shift upwards by $5 (dividend amount) improving profits and further limiting the losses:

Fig 5

Short Covered Call with Dividend Payment

The dividend payment ($5) has further reduced the risk area to $115 (red graph), improved the profit offerings in both the yellow range ($115 to $125) and green range (above $125), with maximum profit improved to $10.

Compared to the earlier case of ATM call with same dividend payment, the risk region has reduced to between $0 to $115 as opposed to the former range of $0 to $137. But this came at the expense of the profit coming down from $18 to $10.

One important point that was not included above is the option brokerage charges, which are net payable and thus bring down the net payoff functions, reducing the profits and increasing the losses. Brokerage charges should be carefully considered and should not surpass the profit potential.

Keep in mind that options are usually traded in hundreds of contracts and sufficient capital should be allocated before commencing the options trading.

Other important points to mitigate the risk:

- Option pricing mechanisms imply higher option premiums when volatility is high. Create short covered call positions when option volatility is high to gain higher option premiums as a seller. It increases the net receivable amount and improves the payoff by reducing the risk region.

- Few countries offer tax benefits on long term stock holding, which is an integral part of the short covered call. The covered call position should be created with sufficient long term view, which could enable benefits on taxes to add to profits and therefore further reduce loss.

- Dividend payment expectations usually provide support to underlying stock prices, which keeps the stock prices high even when the overall market is bearish. Other corporate actions like splits, acquisitions, etc. may not necessarily provide monetary payment like dividends, but will ensure higher valuations of the underlying stocks, making these eligible for short covered call for a selected period.

- It is advisable to stay prepared with pre-determined stop-loss levels to exit the position if there is a large downward move in underlying stock price.

- One should also prepare for steps at expiration. If the short call expires as worthless, nothing is needed on the trader’s part. One can maintain the long stock position and short a new call to make the next term covered call position. If short call gets into ITM, square off the long stock position to reap the profits and explore other underlying stocks for similar covered call strategy.

In Summary

The dynamics of options trading - involving combinations of multiple assets and positions, with significant impact within short interval price moves - can get tricky at times even for experienced traders. The complex structure of brokerage commission also impacts the profit and loss. Option traders should carefully consider the available profit potential against the risk appetite, and trade after a thorough analysis and carefully keeping pre-determined stop loss levels.

Shobhit Seth can be contacted at: FuturesOptionsEtc

Last edited by a moderator: