Of course the big question in everyone’s mind is where will this bull run end and is there anything I can do to protect my capital when it does? While no one can predict exactly where this price movement will reverse since there is no supply level above to signal this, there are some tools that traders can use to identify when the bullish pressure has subsided and therefore marked the time for profit taking in your portfolio.

Source: Sharekhan - TradeTiger

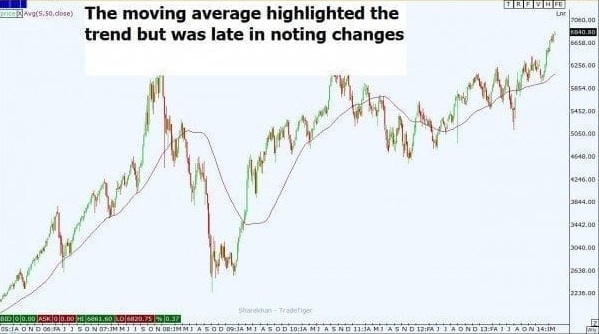

One of the most common methods is to use a moving average on your chart. The average summarizes the past trend and momentum and when prices start breaking down below it, you have likely seen the end of your trend. There are two problems with using moving averages. First, they are lagging and give very late signals. Secondly, since they are lagging, you are likely to have given back some profits you have made in the previous trend before you exit.

Source: Sharekhan - TradeTiger

To reduce the lag and hopefully exit with more profits, many traders will look to advanced technical analysis tools such as the Fibonacci Extension tool. This uses the Fibonacci numerical sequence to project probable price points in the future where price may turn. The problem is that the price may only use these areas as pausing points rather than reversal areas and you could be exiting prematurely.

Source: Sharekhan - TradeTiger

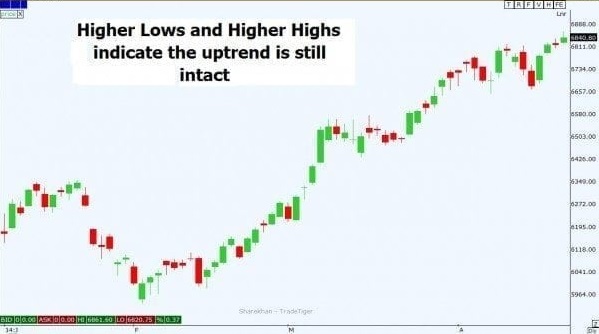

Price is usually the best indicator. Using the definition of a trend can help you identify when the trend is reversing and action is needed on longer term trades and positions.

Source: Sharekhan - TradeTiger

Again you can see that using this method will not necessarily get you out with the greatest profit but it will protect your money against a large drawdown. Perhaps a combination of the above methods would be a better plan for your trading and investing.

Brandon Wendell can be contacted on this link: Brandon Wendell