Recently the IMF said that the UK's property was overvalued and this could result in a spectacular slump. House prices in the US have slowed down considerably since 2005.

The UK avoided the Recession in 2001 when many countries went into deep recession. Post 9/11 the UK interest rates were at the lowest for many decades, this resulted in a boom in the UK housing market as the cost of mortgages was at its lowest. The low cost of borrowing also saw a boom in the buy to let market with many investors having a big portfolio of properties.

Not only was the UK government on a spending spree but also the UK consumer, due to the easy availability of credit. Currently the UK personal debt level has exceeded more than £1 trillion. It is expected that we could see a significant rise in insolvencies during 2008. The "time bomb" is ticking and could explode at any time; it could be triggered by any of the shocks to the economy. The Northern Rock fiasco was just the first such trigger, which resulted in savers withdrawing over £14 billion from the ailing Rock - no doubt the next 12 months we will witness more such triggers, which will dent overall consumer confidence. This could eventually lead to a big fall in the house prices.

Many "experts" feel that 2008 could see further rises in house prices, and some optimistic forecast has been put at over a 10% increase. Housing demand is influenced by the "feel good factor" resulting into the expectation that the house prices will continue to rise. Some of the reasons for a boom in house prices are;

The worrying part is when amateur investors join the party; it's likely that we may have seen the peak! One can see similarities with the technology stock boom of 2000. Many investors bought at the peak and after several years they have yet to recoup their losses.

The past year has seen many amateur investors venture into the buy to let market for the first time. This has meant that they have had to buy at the peak, with the mortgage rates almost doubling in the past 5 years.

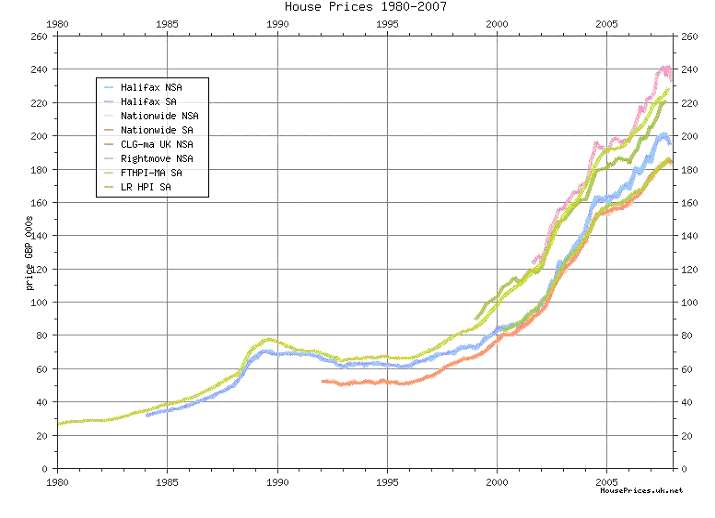

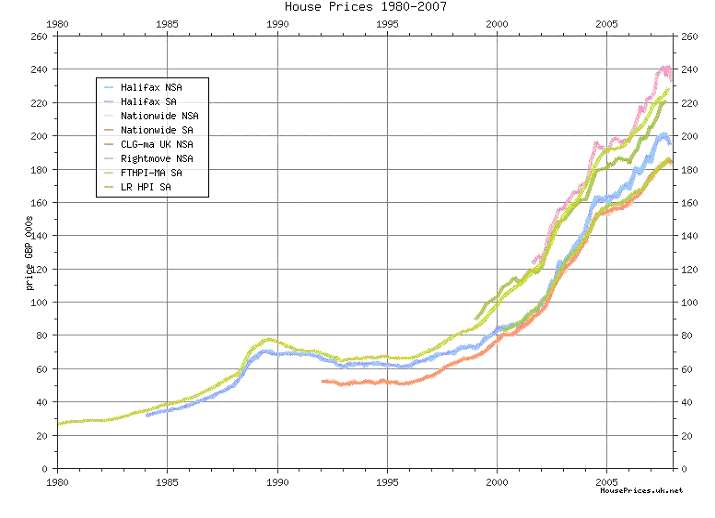

Currently prices are being supported by the expectations that they will continue to rise, and when this increase fails to materialise the bubble could burst. The house price inflation has been at its fastest this decade as can be seen from the following graph; and since 1995 we have not seen a dip in prices, it has just gone up in one straight line!

In addition, there are other serious issues with the economy which could trigger a sharp correction, not only in house prices but also the stock market. Some of the disturbing triggers will be;</span />

Buy-to-let bubble:

Is the party over? So far the landlords have had it easy, the cheap mortgage rates ensured that the rent covered the mortgage repayments and they benefited from the significant capital appreciation of their portfolio. It surely has been the best investment strategy for the past decade, as many investors have made fortunes and many have "retired" young.

Currently it is estimated that there are over a million buy to let mortgages, and landlords are now feeling the pinch. Past 2 years has seen significant rise in mortgage repayments and we are now seeing signs of price increase slowing down. The rents have not kept pace with outgoings, thus landlord profits have gone down. In some cases landlords are losing on their portfolio. Some areas in the UK have seen an oversupply of buy to let properties resulting into falling yields.

Although year on year prices rose by nearly 5% to December 2007, but the house prices fell for a second consecutive month in December according to Nationwide building society. New mortgages on a buy to let are also slowing, with many lenders now seeking up to 30% deposit and also a requirement that the rent on the property equates to 125% of monthly mortgage payment.

Unless the investor has a larger deposit the rental yield may be insufficient to cover the cost of the mortgage and with no expectations of a capital growth, you are likely to see significant drop in the buy-to-let mortgages. This could even result in many existing landlords starting to liquidate their portfolios. The only incentive to retain portfolios is the expectation of further capital gains. If this expectation evaporates and with falling yield, then there would be no point in buy to let investments.

Newer entrants to the buy to let market could soon face going into negative equity as soon as we start seeing declines in the prices. Furthermore, should the banks suffer to the extent of the housing bust, the fallout would be astronomical!

Changes to the Capital Gains could also contribute to the housing crash. The tax on property gains has been cut from 40% to 18% effective from 1st April 2008. So those investors who are sitting on fat profits would be tempted to lock in gains and also benefit from the lower tax.

Housing Repossessions

2007 has seen a significant rise in home repossessions, and it is expected that this figure will increase considerably in 2008. Rising property repossessions normally spell bad news for the property market creating a supply of houses, which are normally sold below market prices and this can dent confidence.

The Council of Mortgage Lenders (CML) has warned that the number of home repossessions is set to soar to levels not seen since the housing crash of the 1990s. It is also expected that there will be an increase in mortgage repayment arrears in the coming year.

Having said that, the current situation is very different from the 1990s. Firstly in the 90s interest rates were very high and peaked at 16%. We are probably unlikely to see huge scale cases of negative equity like we had in the 90s, due to the huge equity homeowners are sitting on at the moment.

What to do - Action Points?

Conclusion

Just as in year 2000, when we saw the NASDAQ stock market boom, we are now seeing some similarities - irrational exuberance in the housing market.

During the NASDAQ boom, we saw many amateur investors jump into the market at the peak, we are now experiencing a similar situation. Many amateur investors are jumping into the buy to let market.

As with all market activity, prices do not go up in one straight line and you will always have price retracement, the question is how big the retracement will be? There is no doubt that a significant house price correction is on the cards, the only question remains is when? It is a case of any one of the triggers to set in - as soon as the first domino falls, panic will set in resulting into significant declines in house prices.

The UK avoided the Recession in 2001 when many countries went into deep recession. Post 9/11 the UK interest rates were at the lowest for many decades, this resulted in a boom in the UK housing market as the cost of mortgages was at its lowest. The low cost of borrowing also saw a boom in the buy to let market with many investors having a big portfolio of properties.

Not only was the UK government on a spending spree but also the UK consumer, due to the easy availability of credit. Currently the UK personal debt level has exceeded more than £1 trillion. It is expected that we could see a significant rise in insolvencies during 2008. The "time bomb" is ticking and could explode at any time; it could be triggered by any of the shocks to the economy. The Northern Rock fiasco was just the first such trigger, which resulted in savers withdrawing over £14 billion from the ailing Rock - no doubt the next 12 months we will witness more such triggers, which will dent overall consumer confidence. This could eventually lead to a big fall in the house prices.

Many "experts" feel that 2008 could see further rises in house prices, and some optimistic forecast has been put at over a 10% increase. Housing demand is influenced by the "feel good factor" resulting into the expectation that the house prices will continue to rise. Some of the reasons for a boom in house prices are;

- Cheap mortgage rates post 9/11

- Availability of easy credit

- Speculation of ongoing price increases

- Buy to let investors having large portfolio of properties

- Amateur investors now joining the buy to let bandwagon

The worrying part is when amateur investors join the party; it's likely that we may have seen the peak! One can see similarities with the technology stock boom of 2000. Many investors bought at the peak and after several years they have yet to recoup their losses.

The past year has seen many amateur investors venture into the buy to let market for the first time. This has meant that they have had to buy at the peak, with the mortgage rates almost doubling in the past 5 years.

Currently prices are being supported by the expectations that they will continue to rise, and when this increase fails to materialise the bubble could burst. The house price inflation has been at its fastest this decade as can be seen from the following graph; and since 1995 we have not seen a dip in prices, it has just gone up in one straight line!

In addition, there are other serious issues with the economy which could trigger a sharp correction, not only in house prices but also the stock market. Some of the disturbing triggers will be;</span />

- Lenders offering loans of up to 5 times multiples to salary, thus borrowers are overstretching themselves.</span />

- Increases in mortgage rates have yet to have an impact and often this takes time to react. The mortgage rates have nearly doubled since 2002.</span />

- Nearly 1 million Britons now own a second home, often as a buy to let investment. When the downturn in economy comes, panic is likely to set in amongst the buy to let investors, which would result in the market being flooded with house for sale.

- The US sub-prime mortgage crisis also poses more risks for the UK's banking system. In the US the crisis has lead to plunging property prices, creating a loss of consumer confidence with billions of dollars in loss.

- UK Job prospects are worsening, with many economist predicting unemployment to rise to 1.8 million+. The banking & financial sector has been a big driver for employment growth. Many firms in the housing market; this could result into deteriorating earnings and leading to staff cutbacks.

- Consumer spending could see a slow down when faced with deteriorating economic and job conditions. Once again this would affect consumer spending, thus lower earnings.

- Inflationary pressures are driven by high commodity prices, as demand from emerging economies like India and China continue to increase. This not only has an impact on the monetary policies like the interest rates but will have significant impact on earnings, which could lead to a big fall in stock market.

Buy-to-let bubble:

Is the party over? So far the landlords have had it easy, the cheap mortgage rates ensured that the rent covered the mortgage repayments and they benefited from the significant capital appreciation of their portfolio. It surely has been the best investment strategy for the past decade, as many investors have made fortunes and many have "retired" young.

Currently it is estimated that there are over a million buy to let mortgages, and landlords are now feeling the pinch. Past 2 years has seen significant rise in mortgage repayments and we are now seeing signs of price increase slowing down. The rents have not kept pace with outgoings, thus landlord profits have gone down. In some cases landlords are losing on their portfolio. Some areas in the UK have seen an oversupply of buy to let properties resulting into falling yields.

Although year on year prices rose by nearly 5% to December 2007, but the house prices fell for a second consecutive month in December according to Nationwide building society. New mortgages on a buy to let are also slowing, with many lenders now seeking up to 30% deposit and also a requirement that the rent on the property equates to 125% of monthly mortgage payment.

Unless the investor has a larger deposit the rental yield may be insufficient to cover the cost of the mortgage and with no expectations of a capital growth, you are likely to see significant drop in the buy-to-let mortgages. This could even result in many existing landlords starting to liquidate their portfolios. The only incentive to retain portfolios is the expectation of further capital gains. If this expectation evaporates and with falling yield, then there would be no point in buy to let investments.

Newer entrants to the buy to let market could soon face going into negative equity as soon as we start seeing declines in the prices. Furthermore, should the banks suffer to the extent of the housing bust, the fallout would be astronomical!

Changes to the Capital Gains could also contribute to the housing crash. The tax on property gains has been cut from 40% to 18% effective from 1st April 2008. So those investors who are sitting on fat profits would be tempted to lock in gains and also benefit from the lower tax.

Housing Repossessions

2007 has seen a significant rise in home repossessions, and it is expected that this figure will increase considerably in 2008. Rising property repossessions normally spell bad news for the property market creating a supply of houses, which are normally sold below market prices and this can dent confidence.

The Council of Mortgage Lenders (CML) has warned that the number of home repossessions is set to soar to levels not seen since the housing crash of the 1990s. It is also expected that there will be an increase in mortgage repayment arrears in the coming year.

Having said that, the current situation is very different from the 1990s. Firstly in the 90s interest rates were very high and peaked at 16%. We are probably unlikely to see huge scale cases of negative equity like we had in the 90s, due to the huge equity homeowners are sitting on at the moment.

What to do - Action Points?

- If you are a homeowner and if you are contemplating selling your home, then the time to act is now,given that sharp falls may just be round the corner unless the government can delay the inevitable by aggressive reduction of interest rates.

- Cash is king - with so much uncertainty, undoubtedly cash is king. Fixed interest and government bonds are increasingly becoming popular.

- Stock market investment - Although we have seen healthy gains in the markets worldwide, longer term it offers good opportunity. Many analysts are calling for sharp falls in the markets and this should provide a good opportunity of bargain hunting. Emerging markets should also offer a good opportunity in the event of a market correction.

Conclusion

Just as in year 2000, when we saw the NASDAQ stock market boom, we are now seeing some similarities - irrational exuberance in the housing market.

During the NASDAQ boom, we saw many amateur investors jump into the market at the peak, we are now experiencing a similar situation. Many amateur investors are jumping into the buy to let market.

As with all market activity, prices do not go up in one straight line and you will always have price retracement, the question is how big the retracement will be? There is no doubt that a significant house price correction is on the cards, the only question remains is when? It is a case of any one of the triggers to set in - as soon as the first domino falls, panic will set in resulting into significant declines in house prices.

Last edited by a moderator: