You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Observations and conclusions

Having gone over the logs and the charts there is one thing that seems to be THE most urgent to change: If there is a really big move I should not look at the 1m chart but at the 5min chart

Out of 15 observations this came back 3 times.

Also it is clear my biggest losers would not have happened and some even be winners if this rule would have been in place.

Another thing mentioned is going in after a higher high or lower low : 2 times.

Also 3 mentions of not going in a trade in the direction close to an S&R level... but then another 1 mention of that resulting in a good trade.

These seem to be the most important things. I am definitely going to include the big move one. But not sure about the others. I don't want to alter the system too much at once. I will however add some small things but that's not really a change in the rules but a more clear definition of things I left open.

Having gone over the logs and the charts there is one thing that seems to be THE most urgent to change: If there is a really big move I should not look at the 1m chart but at the 5min chart

Out of 15 observations this came back 3 times.

Also it is clear my biggest losers would not have happened and some even be winners if this rule would have been in place.

Another thing mentioned is going in after a higher high or lower low : 2 times.

Also 3 mentions of not going in a trade in the direction close to an S&R level... but then another 1 mention of that resulting in a good trade.

These seem to be the most important things. I am definitely going to include the big move one. But not sure about the others. I don't want to alter the system too much at once. I will however add some small things but that's not really a change in the rules but a more clear definition of things I left open.

After careful analysis the new trading system as of 04-04-2017 is

Trading System as of 04-04-2017 (to be tested)

1) Define S&R levels up front monthly, weekly and daily (*)

2) Look for big moves 8 points or more (over the course of maximum 4 hours)

3) Watch where it reverses after a lower low (higher high) and wait for price to retrace.

4) If price reverses once again, take a position once the high (or low) previous to the retrace has been breached. (**)

5) put stop loss at 0.25 above or below highest high or lowest low

6) when nearing resistance (1p distance) or 3R profit put in a tight (tightest possible) trailing SL. (***)

7) avoid trading during US market open for now (15:30 - 16:00). Must a trade drag on long and would still be open during US market open, put tight trailing SL. Or close in case left over profit would be 0 or less.

(*) If after the upfront defining I spot another level I can draw it and treat is as a daily level.

If there are two previous daily levels in the past week which are the same, draw that on the chart too.

(**) For moves between 8 and 25 points look at the 1m chart to determine retracements. If the move > 25 look at the 5 min chart.

(***) The only exception is if you enter a trade close to an S&R level, don't put a tight trailing SL immediately (because we expect the trade to not stop at that level obviously)

Trading System as of 04-04-2017 (to be tested)

1) Define S&R levels up front monthly, weekly and daily (*)

2) Look for big moves 8 points or more (over the course of maximum 4 hours)

3) Watch where it reverses after a lower low (higher high) and wait for price to retrace.

4) If price reverses once again, take a position once the high (or low) previous to the retrace has been breached. (**)

5) put stop loss at 0.25 above or below highest high or lowest low

6) when nearing resistance (1p distance) or 3R profit put in a tight (tightest possible) trailing SL. (***)

7) avoid trading during US market open for now (15:30 - 16:00). Must a trade drag on long and would still be open during US market open, put tight trailing SL. Or close in case left over profit would be 0 or less.

(*) If after the upfront defining I spot another level I can draw it and treat is as a daily level.

If there are two previous daily levels in the past week which are the same, draw that on the chart too.

(**) For moves between 8 and 25 points look at the 1m chart to determine retracements. If the move > 25 look at the 5 min chart.

(***) The only exception is if you enter a trade close to an S&R level, don't put a tight trailing SL immediately (because we expect the trade to not stop at that level obviously)

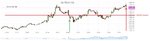

Short NASDAQ-100

Net P/L -16.45 points

Amount: 1 contract

Opening Rate 5420.4

Close Rate 5436.85

Open time 4/4/2017 4:03 PM

Close Time 4/4/2017 5:26 PM

Stop loss: fixed stop above highest high

Entry and exit on a 1m chart

Reason of closure: SL got hit

Comments

Error trade. I am trying to prevent big losses with the altered version of the system, typical that first trade I get is a big loss 😛

This trade was weird to begin with, there was no daily level so I could only draw a weekly. Setup got triggered, went in a bit late but according to the system that wouldn't have mattered, result would have been the same. The only thing I can think of to get rid of these losers as well is putting the SL at the high of the retracement instead of the highest high. I will see what that would have meant for the trades I logged for this system. If this proves more profitable I will quickly add that rule and start fresh next trade.

Oooorrr, my definition of a big trade should become smaller. On a 5m chart I would not have taken this trade... hmmmm

Actually, looking at the 5m chart the move was bigger than 25 points. Why did I only start counting near the open of the US market? That is not the system.

So I did not follow the system and I can call this an error trade.

I have not actually defined what constitutes a move or not, maybe I should.... I have to think about this.

Net P/L -16.45 points

Amount: 1 contract

Opening Rate 5420.4

Close Rate 5436.85

Open time 4/4/2017 4:03 PM

Close Time 4/4/2017 5:26 PM

Stop loss: fixed stop above highest high

Entry and exit on a 1m chart

Reason of closure: SL got hit

Comments

Error trade. I am trying to prevent big losses with the altered version of the system, typical that first trade I get is a big loss 😛

This trade was weird to begin with, there was no daily level so I could only draw a weekly. Setup got triggered, went in a bit late but according to the system that wouldn't have mattered, result would have been the same. The only thing I can think of to get rid of these losers as well is putting the SL at the high of the retracement instead of the highest high. I will see what that would have meant for the trades I logged for this system. If this proves more profitable I will quickly add that rule and start fresh next trade.

Oooorrr, my definition of a big trade should become smaller. On a 5m chart I would not have taken this trade... hmmmm

Actually, looking at the 5m chart the move was bigger than 25 points. Why did I only start counting near the open of the US market? That is not the system.

So I did not follow the system and I can call this an error trade.

I have not actually defined what constitutes a move or not, maybe I should.... I have to think about this.

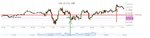

Short NASDAQ-100

Net P/L -16.20 points Officially -2.5

Amount: 1 contract

Opening Rate 5419.15

Close Rate 5435.35

Open time 4/6/2017 4:12 PM

Close Time 4/6/2017 5:22 PM

Stop loss: fixed stop above highest high

Entry and exit on a 1m chart

Reason of closure: SL got hit

Comments

Big move but > 25 so watched the 1 min chart. My setup got triggered and I was on time but when I clicked enter the broker said price changed and could not get me in (should use orders next time) so I got in less than perfect.

Then price seemed to establish a 5416.00 level and did not manage to break through. Then price spiked up again seemingly getting stopped by a 5428.00 level. All levels that were not visible and that I did not draw. A little before 16:45 price bounced off 5416.00 again. I knew I should get out there at break even BUT, not the system so I stayed in and got stopped out eventually.

What I could and should have done was draw a S&R line at 5416.00 while in the position. That is allowed according to the system and then set a trailing SL from that point which would have cost me -2.5 points instead of the staggering 16. Oficially I will make it -2.5 since I did not play it right. Still got to play it right of course 😛

A thing I possibly could incorporate for a next version of the system is to make it a trailing SL whenever price seems to not be breaking through a resistance (or support). Visible here from 16:15 till 16:30

Net P/L -16.20 points Officially -2.5

Amount: 1 contract

Opening Rate 5419.15

Close Rate 5435.35

Open time 4/6/2017 4:12 PM

Close Time 4/6/2017 5:22 PM

Stop loss: fixed stop above highest high

Entry and exit on a 1m chart

Reason of closure: SL got hit

Comments

Big move but > 25 so watched the 1 min chart. My setup got triggered and I was on time but when I clicked enter the broker said price changed and could not get me in (should use orders next time) so I got in less than perfect.

Then price seemed to establish a 5416.00 level and did not manage to break through. Then price spiked up again seemingly getting stopped by a 5428.00 level. All levels that were not visible and that I did not draw. A little before 16:45 price bounced off 5416.00 again. I knew I should get out there at break even BUT, not the system so I stayed in and got stopped out eventually.

What I could and should have done was draw a S&R line at 5416.00 while in the position. That is allowed according to the system and then set a trailing SL from that point which would have cost me -2.5 points instead of the staggering 16. Oficially I will make it -2.5 since I did not play it right. Still got to play it right of course 😛

A thing I possibly could incorporate for a next version of the system is to make it a trailing SL whenever price seems to not be breaking through a resistance (or support). Visible here from 16:15 till 16:30

Long NASDAQ-100

Net P/L 0.0 points

Amount: 1 contract

Opening Rate 5419.6

Close Rate 5419.6

Open time 4/7/2017 4:28 PM

Close Time 4/7/2017 22:14 PM

Stop loss: fixed stop below lowest low

Entry and exit on a 1m chart

Reason of closure: end of trading day.

Comments

Followed the system. Opened close to the 5420.00 level. Did not put a trailing SL right away as per the system. Since that was the highest defined level and price did not get to my SL the position did not get closed until the end of the day, at which point it was back to break even.

Realistically when monitoring the position one should probably close at around 19:30. Something I mentioned in my previous system, I should have another rule if there are no higher (or lower) levels defined I should be able to close sooner than having 3R profit. Especially in situations like these where the SL is pretty wide. One solution could be to put a tighter SL which I also mentioned before. That would have most likely stopped me out here though. Something to think of for a next version.

Net P/L 0.0 points

Amount: 1 contract

Opening Rate 5419.6

Close Rate 5419.6

Open time 4/7/2017 4:28 PM

Close Time 4/7/2017 22:14 PM

Stop loss: fixed stop below lowest low

Entry and exit on a 1m chart

Reason of closure: end of trading day.

Comments

Followed the system. Opened close to the 5420.00 level. Did not put a trailing SL right away as per the system. Since that was the highest defined level and price did not get to my SL the position did not get closed until the end of the day, at which point it was back to break even.

Realistically when monitoring the position one should probably close at around 19:30. Something I mentioned in my previous system, I should have another rule if there are no higher (or lower) levels defined I should be able to close sooner than having 3R profit. Especially in situations like these where the SL is pretty wide. One solution could be to put a tighter SL which I also mentioned before. That would have most likely stopped me out here though. Something to think of for a next version.

Short NASDAQ-100

Net P/L -8.7 points

Amount: 1 contract

Opening Rate 5431.9

Close Rate 5440.6

Open time 4/10/2017 4:03 PM

Close Time 4/10/2017 4:30 PM

Stop loss: fixed stop above highest high

Entry and exit on a 1m chart

Reason of closure: SL got hit

Comments

Trade according to the system. Opened close to the S&R level again. And that is exactly where price kept hovering, around the 5435.02 level. Mentioned many times already now, when that happens price usually will go up again (if it was going up) and so it did again now. Got stopped out of course.

Net P/L -8.7 points

Amount: 1 contract

Opening Rate 5431.9

Close Rate 5440.6

Open time 4/10/2017 4:03 PM

Close Time 4/10/2017 4:30 PM

Stop loss: fixed stop above highest high

Entry and exit on a 1m chart

Reason of closure: SL got hit

Comments

Trade according to the system. Opened close to the S&R level again. And that is exactly where price kept hovering, around the 5435.02 level. Mentioned many times already now, when that happens price usually will go up again (if it was going up) and so it did again now. Got stopped out of course.

Long NASDAQ-100

Net P/L -15.7 points

Amount: 1 contract

Opening Rate 5396.1

Close Rate 5380.4

Open time 4/11/2017 4:05 PM

Close Time 4/11/2017 4:21 PM

Stop loss: fixed stop below lowest low

Entry and exit on a 1m chart

Reason of closure: SL got hit

Comments

Trade according to the system. Big move, plunged through all the levels. Retraced a bit and then went down again to make a lower low. System does not mention anything like that but I have previously commented that taking trades that do this is probably not a good idea. Price retraced from that again and went above the first retracement up which is my trigger to enter long position.

However price started going down again afterwards and I got stopped out. It even went through the montly 54732.53 level (not visible on this chart). This is a clear downtrend (which the lower low was an indication of)

Net P/L -15.7 points

Amount: 1 contract

Opening Rate 5396.1

Close Rate 5380.4

Open time 4/11/2017 4:05 PM

Close Time 4/11/2017 4:21 PM

Stop loss: fixed stop below lowest low

Entry and exit on a 1m chart

Reason of closure: SL got hit

Comments

Trade according to the system. Big move, plunged through all the levels. Retraced a bit and then went down again to make a lower low. System does not mention anything like that but I have previously commented that taking trades that do this is probably not a good idea. Price retraced from that again and went above the first retracement up which is my trigger to enter long position.

However price started going down again afterwards and I got stopped out. It even went through the montly 54732.53 level (not visible on this chart). This is a clear downtrend (which the lower low was an indication of)

Similar threads

- Replies

- 817

- Views

- 85K

- Replies

- 152

- Views

- 52K

- Replies

- 0

- Views

- 2K