Booted out.

Too bad that today i decided to trade on standard instead of cent.

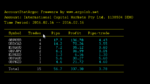

Pl -18

drawdown -18

win rate 33%

No of trades: 6

Bad pair GU.

From today i started maintaining a journal of each of my trades.

Tomorrow No trade, I will be out for invitation.

Hi Sun

Sorry to have to totally disagree with you - ie regards the GU

It was the pair of the AM session - and why - simply because of red news on Pound at 9 30am this morning

I informed you of the Gu being the one to trade pre 6 35 am and as you know it was a nice sell and then the buy after 7 00 am - and that made over 100+ pip

I deliberately did not mention about the news at 9 30 am UK time - to see if you or anybody else was aware.

Checking the calendar every day is so important - it gives you clues etc

The clue today was tha pre 9 30 am the GU - ( and other pound crosses ) would be busy - simply because of the news coming later and ideal time to fry bulls and bears

You need to go 3 steps backwards to go forwards next

We now know your weaknesses and your strengths - but you seem to love carrying on with your weaknesses - impulse scalps - anxiety \& stress with live accounts - not having patience to know when the main moves are are when its a BTTZ set up etc etc

Your main strenghts are - you can do it - as shown on demos - and you are willing to keep learning and normally your disciplines are very good - but certainly not this morning

I dont want to knock you back further - but I need you to focus more on the scalp basics - disciplines - and patience - you missed a 100 pip move up and I confirmed it in my comments pre 7 30 am with a clear buy GU after 7 00am and the levels over the down trendline etc

Unfortunately - you were out the game to early - mainly due to what both darktone and Nick have said - - and I have mentioned many time already - think - slow down on number of scalps - and only take scalps at ideally lows and highs along with bias and then time rules

Taking 3 impulse revenge scalps both ways in under 5 mins - is not you Sun - its you panicing and showing your emotions taking control of your mindset

I will say last week you had a few positive days on a real account - please dont let that go - get back in control and pace yourself -

Never to be out the game before the London Open hour

I am sure you know - we all want you to succeed - but we have to be open and tell you when you do it wrong - so that you carry on learning from mistakes

You will have mistakes - I do most days - but I am in control and accept I cannot get 100% accuracy - even 80% is brilliant - so on 100 scalps - 20 will be wrong - whether I lose 1 pip or 6 pips

We wlll get you there - just take on board all the comments etc etc - even NVP said to counterscalp trends is difficult until you are experienced - atm you have still to make over 1000+ scalps ( I think ) - think how good you will be when you get to 22000+ like me - but stay in the game meanwhile

Regards

Peter