situations with the systems

My life is dedicated to the systems right now. I am a dedicated person, with a dedicated server, with dedicated systems running on it.

http://dictionary.reference.com/browse/dedicated

1. wholly committed to something, as to an ideal, political cause, or personal goal: a dedicated artist.

That's right, I am wholly committed to my goal of making money.

So, all I can do today, as always, is talk about their state of health.

Here's their situations, and yes they're not one system but the sum of a bunch of different systems, so it does make sense to list them separately, and I will make more points about this issue.

HTML:

GC_ON 2,629.18

GBL_ID 2,068.55

CL_ON_2 1,947.54

YM_ON 868.00

ZN_ON_2 73.87

EUR_ID_5 -126.06

GBP_ID_3 -233.51

CL_ID_3 -612.34

YM_ID_2 -808.00

ES_ID_3 -983.00

ZN_ID -1,103.69

GBP_ID_5 -1,337.10

ZN_ID_2 -2,247.15

Next Monday we'll have been trading them for 6 months. And their overall profit is zero right now.

Pretty bad.

But things are better than they look from the overall profit.

You see: I was too optimistic in choosing them. Yeah, because I am hopeful and despite being a negative person regarding the present I am actually a dreamer regarding the future.

So I got screwed because, just like in discretionary trading, I was not realistic, and I picked the systems based on confidence/hope.

Mistakes:

1) I picked YM_ID_2 and ES_ID_3 because their back-tests were great, even though they show zero profit in forward-testing. The problem was that back-tests did not include an out-of-sample: the only out-of-sample was forward-testing and it showed no profit. It later turned out that these systems have done nothing but lose in their out-of-sample. So basically these guys cost us 2000 dollars. Without them, we would have hit 5000 of profit (at the peak of 3200, which would have been 5200). At a profit of 5000 we would have scaled up and included more and better systems, which we did not include because we didn't reach 5000 yet.

2) I picked ZN_ID which showed little profit (about 1000) in forward-testing and once again had not used an out-of-sample back-testing methodology (I have started using it only 6 months ago). So, once again, we have a situation where the forward-testing showed no profit, and yet, hopeful as I was, I implemented it. Also I used it because it made the past combined equity curve look really good and decreased its drawdown - or kept it the same while increasing profit. The problem is that in real trading it cost us 1100 dollars of losses.

The rest were not mistakes, but are just in a regular drawdown period. They did not fail yet at least by not exceeding their maximum historical drawdown.

Now you see how a bunch of systems that look non-profitable or break-even are actually the combination of some good systems and other bad systems.

Now we disabled those 3 systems, but they cost us 3000 dollars, and without that loss, we would have scaled up and now we would be trading more systems.

I finally remember and agree with the quote in someone's signature... it was wprins or maybe it was someone else, that said:

You need to trade solid methods that you absolutely will take a bullet for. Or you will regret it.

The author seems to be

Joel Rensink, in his pdf file entitled "

THE HOLY GRAIL!- Learning to Handle Variance in Returns":

http://infiniteyieldforex.blogspot.com/2008_05_01_archive.html

http://www.4shared.com/file/4845229...-_Learning_to_Handle_Variance_in_Returns.html

http://www.forexfactory.com/showpost.php?p=2828818&postcount=40

(on this last link there's pdf files by Rensink with valuable strategies).

Now I know what it really means. It means if a system has not done extremely well in the out-of-sample and in the forward-testing period, you must not include it in your trading.

I must add something important. Earlier I said that a system must not have exceeded its maximum historical drawdown:

...The rest were not mistakes, but are just in a regular drawdown period. They did not fail yet at least by not exceeding their maximum historical drawdown.

This is not entirely true and wise to say. We all agree that the systems perform in the future worse than they do in the past (partly because

we choose the best ones, so, among the other reasons, this is also a consequence of that choice). So what follows is that their past drawdown will be exceeded even if they are good.

And in fact, half of our systems, traded right now, have exceeded their maximum historical drawdown, but we're trading them because in the forward tested period they have produced a lot of profit. They can both be profitable and have exceeded their historical drawdown.

What I must not accept and let happen, especially given the dozens of systems I have, is to allow trading by systems that have both exceeded their historical drawdown and have not produced a lot of profit in the out-of-sample and forward-tested period.

And this is precisely what i did with ES_ID_3, YM_ID_2 and ZN_ID, which showed very little profit in the forward-tested period, had no out-of-sample testing and now have even exceeded their historical drawdown. Essentially my mistake is that I should not have picked the top 50% of my systems, but the top 25%, because systems don't follow my wishful thinking and do worse in the future. I should have been much more selective. Of all the systems I am forward-testing right now (I have built more but I have even stopped forward-testing them by how bad they were), only one third is really worth trading. I used to hope that all of them worked, and be positive that at least 50% of them were excellent. Now I am facing the facts.

All this time (six months) was useful in turning me from a dreamer to someone facing the facts. Not that I haven't worked hard for years, because I have. But if your hopes are always one step ahead of your actual work and performance, you will still lose money. The difference between profitable and unprofitable is not really in how good you are at predicting the markets, but in how good you are at appraising your prediction capabilities, which is called risk/money management. If you are only 60% good and you invest your money expecting to be 70% good, then you will lose money. Whereas the guy who is only 55% good and doesn't overestimate himself, because of wishful thinking, will make money.

I used to expect myself to make 100% a month. I did in some months, and in others I blew out my account.

Then I moved to trading systems, and transferred the same problem of wishful thinking to this field, in the selection of my systems.

Now I have learned at least which systems are good and which aren't and probably I have learned how to select them, too (only systems I'd take a bullet for).

Now the problem is how the investors are seeing this learning process, because I also have to remember that, from their point of view, they've wasted 6 months.

Well, for me it wasn't wasted time for sure. I have learned a lot of stuff, also thanks to their many lessons: using the out-of-sample is the most valuable one. They got me to do it. I had heard about it for years, but never resolved to use it.

Another lesson that they got me to understand is that the future is worse than the past. A fact to face. No more wishful thinking.

Another lesson is what it means to trade the systems without interfering and that I can be a disciplined automated trader, too. I have done no gambling on their account, ever. I have done no gambling on my account either for a while and now I am running systems on my account, thanks to a little trick of allowing the investors to have a share of my account - so that I feel i can't tamper at will.

Six months and no profit is a long long time, and so far they've waited. I would have been ok if they had quit after 3 months of this, but they are still trusting my systems.

Hopefully it's because they understand what I said above: that since it's not one system but many different ones, the whole unprofitability is just a consequence of having selected the wrong systems.

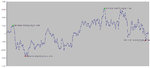

You see, this is the situation with the 3 mother ****ers:

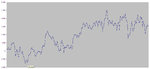

And here's the situation if I had never selected them:

Let alone the fact that we would have started trading many more systems (due to scaling up), and so we would be even higher.

Having said this, if they're still patient as they have been until here, profit will come sooner or later, because we got rid of the bad systems, and now we are only trading the good ones (regardless of whether they've lost or made money so far, because some are in a drawdown period from the start).

---------

Damn. I am dreaming of the past...

I remember in July 2008 I had about 24k due to my gambling with the systems: i was trading all the contracts I could, with any signal that came through. It was reckless but I didn't know it back then. There was no forward-testing back then, no out-of-sample, no keeping track of the trades. And yet I doubled my money for three months in a row, bringing 3500 to 24000.

Then, due to discretionary mistakes mostly, I blew out my account.

I wish I could go back to that 24k of July 2008 with what I know now.

Similary in December 2008 I brought 8000 from a bank loan to 26000 in one month, mixing discretionary trading with trades from the systems.

Then I blew it out.

Similarly in the summer of 2009, I had brought my 10k to 31k.

Then I blew it out, each time after repaying my debt though.

Then the game didn't work any more, because I had run out of luck.

I took out a third loan from the bank about a year ago, just 10k, but this time things didn't go as well and I could not pay it back in one month as I had before. Yeah, because instead of tripling my account, I immediately lost it all, live on this journal (I think it was documented half on "my journal" and half on "my journal 2").

Now I am doing everything properly and yet am seeing no profit. Hey, but at least I am not blowing out accounts any more.

Damn. I wish I could go back to one of those months, with my 30k, all my money. And invest them with what I know now. I could quit my job tomorrow I think.

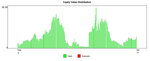

Yeah, here's my account equity line, from IB, march 2008 to april 2009:

And april 2009 to june 2010:

Oh, yeah. Those were the days, the days of wishful thinking and making things happen and disappear at will. Or rather, making things happen at will, and disappear against my will.

Yeah, that's right. I thought making money was easy, and I thought those days would never end.