TD, I was wondering how many pin setups you usually take per week, from the hourly alone? I think you said you watch around 80 markets, it would also be interesting to hear how many you pass on.

I'm doing some backtesting and have a question about the placement of the pin nose. Let's say there is an obvious res at 100 for a market, do you prefer the pin bottom to hit that level *exactly* or would you rather see a break of it and close above? Fakeouts vs strong res basicly. I assume both are ok as you've previously mentioned to look at levels as areas.

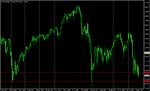

I've attached the example that got me thinking although it's not a great example of the above. Personally I think it looked really interesting and would be interesting to hear any comments, or another way I could've played it.

2 bar fakeout to the upside, then pin going down below the most recent range showing the true break direction. Thick line is from a weekly pivot line, thin blue lines are my target1 and target2. In my testing I would've gotten stopped out at t1 after price retraced back down. Eventually price went far above my t2.

This chart also raises another question - my entry is right at the weekly pivot line, which has also been getting some hammering. Price has hovered around this level for a while. Woud you say its value as res has gotten less as it has already been tested for a long time? I'm thinking a bit like daily pivots, the longer/more often it gets tested the lesser chance of price bouncing off it. At least that's what I've found to be true on other markets. And by daily pivots I mean the precalculated version, not what TD is teaching with pivot lines. I guess this question is related to the fakout vs strong res question, as it might look like on a higher timeframe. hmm..

Thanks for taking time to read my ramblings, and for keeping this thread going. I hope I'm making sense.

[edit] My pin bar here might be touching on what's allowed to be called a pin. Am I right in thinking a higher close would've been prefered or is it not a problem?