darktone

Veteren member

- Messages

- 4,019

- Likes

- 1,086

Am interested to see what you guys can glean from these trades.

What i would like to know is:-

1) How you think the trader did in each example

2) What was the traders size

3) What was the method iyo

4) What was the objective

EDIT:-

5) what was the total risk the trader was at

And anything else you feel is relevant

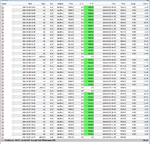

example 1

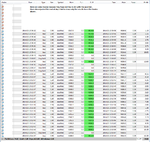

example 2

What i would like to know is:-

1) How you think the trader did in each example

2) What was the traders size

3) What was the method iyo

4) What was the objective

EDIT:-

5) what was the total risk the trader was at

And anything else you feel is relevant

example 1

example 2

Attachments

Last edited: