You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Articles

Filters

Show only:

Loading…

Are you a beginner? Before you start, have you got what it takes?

It is apparent that when starting out in the adventurous worlds of financial trading, that the complete novice and beginner can, within minutes of his first post on T2W, trot down the wrong road, due in no small part to the advice so readily given by enthusiastic members imparting their own beliefs and experiences. Just today a newcomer posed the question: I'm new, what trading platform should I have? Within minutes a reply was posted by a prolific poster, buy XYZ platform it's only ££s and you can get data feed at only ££ per month!

The thread continued, try this, and try that, and I imagined this person already starting to think that if they can get a great trading...

There has long been debate about price data and what kind of data are most appropriate for market analysis and reference. Much of that discussion revolves around traded price vs. indicative price. The former is the actual price at which a transaction is executed, while the latter uses the bid/offer as the basis for price series.

In the stock market, and most exchange-based markets, much of what is presented to the public is the last traded price. When one looks at the stock tables in the paper, or at the quotes presented on many screens, that is what they see. In many cases, this presents a fair representation of the market. The widely known and understood exception is thinly traded markets where the instrument in question (stock...

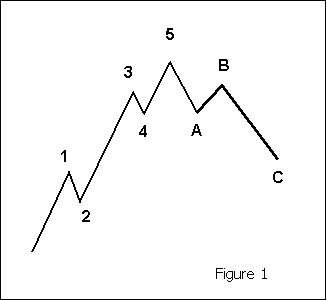

Elliot Wave theory was initiated in the 1930s by Ralph Nelson Elliot. His basic theory was that crowd behaviour, the basis for market activity, tends to operate in recognisable phases, and as such, price movements can be anticipated to some degree.

During his early studies, using Stock Market data for his analysis, Elliot isolated thirteen examples of patterns - or waves - that are repetitive in their form only, and that the time and amplitude of the waves need not necessarily be repetitive. To demonstrate what he learned, Elliot named, defined and illustrated each pattern, showing how several small patterns could be brought together to create one larger example of the same form, which would in turn merge into another, larger version...

The CFD market has expanded rapidly over the last few years and a number of innovative new products have resulted from the strong following that CFDs now have. One of those developments is CFD SIPPs. For those of you not familiar with SIPPs, they are Self Invested Personal Pension Plans which basically represent your pension fund, but instead of handing the management of those funds over to a pension fund company, you are able to manage it yourself. The range of investments available to you is very broad, including commercial property and of course stocks and shares. Recently the legislation has changed and you can now use CFDs as a means of trading equities within your SIPP. Now before I go any further, I hasten to add that I am not a...

Two of my favorite trading subjects are cycles and seasonality. In this feature, I'll discuss seasonality in agricultural markets.

I want to start out by emphasizing that seasonality or cycles, by themselves, do not make good trading systems. However, they are great "tools" to add to your "Trading Toolbox."

Seasonality in agricultural markets is a function of supply and demand factors that occur at about the same time every year. For agricultural markets, supply stimuli can be caused by harvest, planting, weather patterns and transportation logistics. Demand stimuli can result from feed demand, seasonal consumption and export patterns.

Livestock futures, too, have seasonal tendencies. Hog and cattle seasonals tend to be caused by...

As a new trader, or as one who has gained a new vigor, to be successful we must understand that the road ahead of us will not be easy, nor will it be a quick journey. The path is filled with daily challenges that will test our skills, both technical and mental.

In fact, most traders do not even progress past the start up phase. They fail to:

Learn to take a loss

Learn to be wrong

Learn that in fact, to succeed, this business is VERY Difficult!!

The one constant fact that all successful traders say is true, including Borselinno, Fisher, Jones and more, is that it will take time to become a successful trader. Borselinno says at least a year, Fisher says maybe 2 years, but they all say this business has nothing to do with instant...

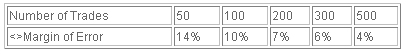

At Rockwell Trading we develop and test up to 25 trading systems a month. The 10 Power Principles for Successful Trading Systems is a set of rules we established and refined to help us effectively evaluate a trading system. Using these Power Principles you too can find solid trading systems - whether they be those you develop yourself or those you obtain from other sources. You can be assured of a high probability of success by applying these simple principles.

Principle #1: Few rules - easy to understand

It may surprise you that the best trading systems have less than 10 rules. The more rules you have, the more likely you "curve-fitted" your trading system to the past, and such an over-optimized system is very unlikely to produce...

In order to succeed as a professional trader, it is often said that the aspirant must treat trading "like a business". As with many of the clichéd phrases that litter the metaphorical trading floor, the importance of this statement is often overlooked, or the meaning misunderstood.

The following article by Tim Wilcox aims to address these problems by examining some of the ways in which a trader might go about achieving this vital goal.

It is divided into two sections: a general overview of what constitutes a trading plan and why it is prudent to have one, followed by a detailed analysis of the various aspects that should be considered during its creation, for example, the importance of self-awareness, discipline and risk management...

My last article, the Hardware Guide, covered the basic requirements for a capable, reliable hardware setup to trade the markets effectively. Some of you may also be aware of my Techies Corner Guide, which provides some basic information about PC security, and links to a variety of downloadable programs and tests to use for the security-conscious amongst us. Some of the information in both may be duplicated here, but this article brings everything together as a "one-stop shop", and provides a valuable reference point for future use.

There are many problems that we, as internet-intensive users can come across during our daily work. Most of us use ADSL connections, and whilst this type of connection is more often than not essential for...

Most "superstar" traders do not trade with mechanical systems; they trade with the most powerful force known to man: Vision.

Their experience has led them to an understanding, or "unlocking" of the Mystery of Market Behavior. They act proactively and intuitively. They use the most powerful computer with a unique operating system: Their brain and solid paradigms.

As a business consultant, it was often my responsibility to instill corporate paradigm shifts through Change Proficiency Maturity profiles and other means. A paradigm is like your "Mental operating system" much like Windows XP is to your Pentium 4.

A paradigm can be defined as:

One that serves as a pattern or model

A set of assumptions, concepts, values, and practices that...

Technical analysis can be defined as the study of past price behavior in an effort to determine patterns and trends that are believed to be predictable of the future. At the core of this school of thought is the assumption that human behavior is repetitive in nature. We all recognize that, although human behavior patterns may have recurrent tendencies, they do not normally express themselves in the same exact, mechanical manner each time. Even with this qualification in mind, technical analysis is capable of providing us with the ability to make price forecasts characterized with an improved probability of outcome. It can help us achieve the "edge" required in our pursuit of long-term consistent success.

A wide array of technical...

What is Market Profile?

Everyone has seen conventional volume displayed as a vertical bar underneath the price bar. But the most important information that this cumulative tally of total volume omits to tell you is at what individual prices the trades that make up this volume were traded at. Knowing what prices traded the biggest volume can give you a significant edge with regards to understanding what price levels traders see as significant now, and likely will again if market price trades back in the same area.

In its simplest form,

Market Profile is a graphical organisation of price, volume and time information. Market Profile displays price on the vertical axis and volume/time on the horizontal axis. In the conventional legacy...

Emotional Intelligence and the Trader

Why is it that 90 percent of traders who trade the markets fulltime fail to earn an adequate return even when using systems claiming 70 percent accuracy? Perhaps it is because traders do not recognize the importance of the Paramouncy Principle.

The Paramouncy Principle suggests that you are the most important variable in the trading equation. Not you, the dispassionate arbiter of

technical and fundamental analysis, but also you, the thinking, feeling, sentient being with all your human foibles, hopes and aspirations. Most traders lose money because they do not have an understanding of the markets or of themselves.

They trade without method, strategy or discipline. They fall prey to powerful...

Anyone who has studied point and figure charting will be aware of Kermit Zieg, who has published many articles and books on the subject. In this interview, George Hallmey met Kermit in his home near Washington and discussed with him his trading style.

In the interview, Kermit explains

Some of the history of point and figure charting.

The advantages of point and figure over other charting methods.

How he combines point and figure charting with an options strategy to swing trade US stocks.

How he selects stocks to trade.

The interview is provided in streaming video format below. If you have trouble viewing it, please download the interview instead.

George met Kermit as part of a series of 18 in depth inteviews with successful...

Mechanical systems do not work.

Let me rephrase that. Backtested over several years of data, mechanical systems do not show a sufficiently consistent profit and an acceptably low drawdown for the small trader to trade consistently, comfortably, effectively and economically.

To expand on that further, the results of a coded mechanical system might well show periods of excellent profits but, virtually without exception, they will also have draw-downs that most small traders would not be able to tolerate. In addition, most systems tested over several years invariably have considerable periods of losses, usually running over months if not years, plus long runs of losing trades.

If you start trading a mechanical system at the wrong time...

Volume patterns are much harder to interpret than price patterns. The difficulty stems from the clandestine strategies of big market players. These folks tend to move slowly and cover their tracks within the broad noise of daily movement.

While price bars tell many tales in a vacuum, volume has little or no meaning without underlying price movement. But don't abandon your volume study just yet. It still adds power to prediction when you apply it judiciously.

The importance of volume depends on its location within the overall pattern. For example, heavy volume through a broken trend line suggests the start of a new trend, while the same activity after a long rally or decline predicts a reversal. This counterintuitive logic confuses...

In life, we are each ultimately responsible for our own actions. The markets are no different. We are responsible for our own success and / or failure and the degree to which we are successful.

Winning at a career in trading is no different. To ensure a profitable future, one must be proactive. Preventing failure is an important part of that process. If you find yourself saying:

...or any number of negative mental messages, you are heading down the path that leads to failure.

Having been a successful business consultant and having traded for many many years, I have found several recurring characteristics and traits of people who thought they would hit a home run but who struck out in their attempt. Many of them stood with their bats...

The term Direct Market Access is used often in the industry and yet a lot of people do not know what it means or indeed how to use it. The term, in fact, relates to the use of the order book, a system used by market participants to trade directly with each other by inputting their sale and buy orders and waiting until they match. The system is more commonly referred to as

Level 2.

The first major benefit of using Level 2 is that it is the main mechanism used by the market to trade. It is used by all of the major traders such as institutional investors, hedge funds, and private individuals. Its benefits are significant as it enables market participants to buy at the bid and sell at the offer price. Consider the following example which...

In this streaming video, Phil provides the outline of a trading strategy he uses regularly for trading the forex market.

In this example, he demonstrates a simple break-out strategy on the Eur/JPY pair using 15 minute charts, but his interpretation of the charts, using price action and candlestick analysis, can be applied to many other price patterns across the currency pairs.

He details his precise method for identifying and trading this set-up, including:

when the set-up is most likely to appear

why you should avoid taking the trade on the first break-out

where to place a stop-loss and why you should resist the temptation to move this to break-even at the first opportunity

how candlestick analysis can be used to support the...

We get questions like this one quite often. We find that most aspiring traders don't have a clue as to what to expect from the market. Yet here they are, putting up their money. Most are going to learn the hard way. We have no idea in the world what you can expect to make in your first year of trading, or any other year, for that matter. What we can tell you is that without proper guidance and help, you are probably going to have some very bitter experiences. Why? Because your anticipations are almost completely wrong.

Futures traders, especially beginning traders, often open an account with unrealistic expectations of trading performance. These expectations could be formed by the sales literature for a trading program that emphasizes...

At some point, if they last long enough, all traders discover that successful trading is not the inevitable result of a good trading strategy or system. If all we needed was a good system or indicator we would all be successful traders. Yet clearly we are not, far from it, there are very few traders making their living consistently from the markets.

Technical analysis is a vast and well researched subject. Many minds have poured their heart and soul into searching for the holy grail of trading: the system, strategy or indicator that will yield to them unlimited wealth and glory. Yet with all this depth of knowledge readily available, trading profits remain as elusive as ever.

System Vendors and the Holy Grail

If we were to take a...

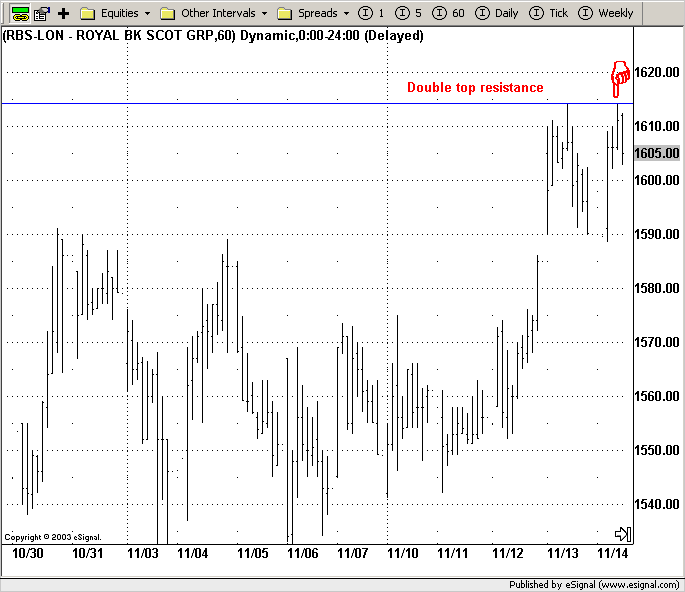

In the first and second parts of this series I looked at some of the various elements you will need to master if you are to have a chance of succeeding at trading. In this final article, I will run through a strategy I have used in the past to illustrate some of the concepts previously discussed.

Basic Strategy

The UK stock markets tend to be range-bound, especially on a short-term basis. This strategy looks to buy low and sell high, so it is swing based. It uses the basics of support, resistance and trendlines combined with money management as I've discussed earlier.

The Rules:

Look for a test of support or resistance or a trendline that fails to break.

If it tests support and bounces up, then go long and place the stop just...

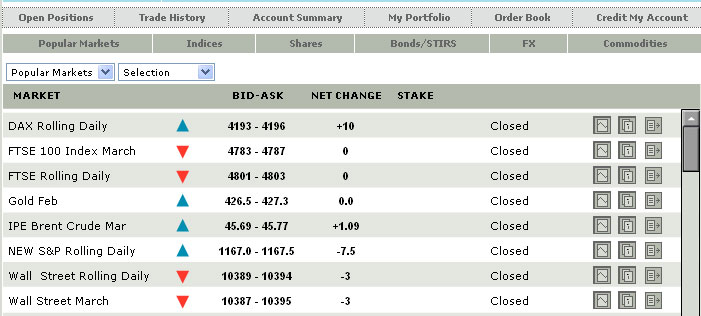

This article is aimed at those who fancy a go at spreadbetting, but haven't a clue what to do. The hope is that by the end you'll know enough to get started with a tiny bit of confidence. It goes on a bit, but compare it to books on the subject and you'll realise it's admirably brief.

Trading requires deep pockets, right?

Nope.

I'm pretty sure that out of the 20 odd thousand T2W members not every one of them has £500,000 - £1,000,000 to invest - in fact I'd take a long right now on the probability that thousands and thousands would consider £1000 quite a big lump to invest, especially as so many of us are struggling to learn how to survive, let alone win.

So let's assume you have a few hundred, or a couple of thousand, to invest...

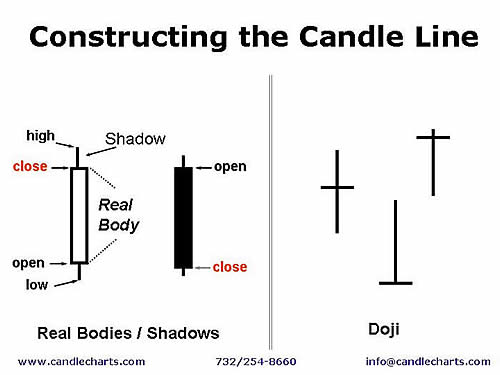

Steve Nison is a busy man. Ever since his first book "Japanese Candlestick Charting Techniques" was published in 1991 he has run his own advisory business, which gives trade recommendations to institutional investors and hedge funds. He is also one of the most respected teachers on trading the financial markets, and his seminars are always a sell-out wherever he goes. Since the publication of his first book he has written another two best sellers on

Candlestick analysis. His first book is affectionately known as the "modern-day bible" of trading.

Tom Hougaard caught up with Steve Nison during a quiet day in the market.

Tom Hougaard: How did it all start?

Steve Nison: 30 years ago I worked for a commodity broker and advisory service...

Without a doubt, more people follow the price of Gold than any other commodity in the world, and with good reason. Gold, that archaic, barbaric, precious metal men and women have coveted since the dawn of mankind, not only presents wonderful opportunities for making money, it also continues to have a major impact on currencies, interest rates and markets across the globe.

Four factors that influence Gold

While there are many factors that have some impact on this glittery metal the ones that I have found to have the most impact are:

The US Dollar Relationship

The Seasonal Pattern

The Commercials

Stockmarket Crashes/ Depressions

Let's start by looking at the relationship between gold and dollar index , specifically the United...

In part 1 of this article, I looked at some of the basic elements of trading, including chart reading and money management. In this second part, I will consider some other essential issues, such as the need for discipline in trading and the importance of practice and planning.

The Importance of Discipline

I have previously mentioned why it is important that you DON'T move a stop-loss to increase risk, and I wanted to go through the "what if" scenario of letting a stop run.

We'll take this example from Barclays from January 2003.

Here we have a nice double (or even triple) bottom on support, and a clean bounce up. You take this long entry with a tight manual stop at 360.

This is what happens over the days to come...

Brilliant...

Casinos bring in gaming revenue confident that over time they will collect more than they will pay out in winnings. They know that even though there are jackpots to be paid, the odds are in favor of the house. Similarly, insurance companies collect premium with the expectation of future payouts. By knowing the probability of a claim, they can calculate their expected return for assuming the risk of the policyholder. The insurer is confident that, over time, they will profit despite their obligation to pay claims.

Option traders can benefit from the same logic by selling credit spreads. This strategy gives them the ability to capitalize on probabilities, as opposed to entering a position hoping to profit on a "long shot", as well as...

Many traders will rather play a pullback than a breakout of the highs. In fact some research by Larry Connors in the US showed that on the

S&P in a ten year period from 1993 if you had bought 10-day-high breakouts and exited when prices crossed the 10 day moving average you would have lost over 312 points.

However, during the same time if you had bought every 10-day-low and exited when price crossed its 10 period moving average then you would have made over 830 points. Many trade the breakout of the highs but as Connors says "In reality it appears to be very wrong."

Although playing breakouts can be said by others to be a valid tool in a trader's tool kit, many often find that what they perceive as a breakout is actually a swing...

In the first part of this article, which can be read here, we looked at choosing an instrument and timeframe to trade, as well as establishing the set-up and entry rules. In the second and final part we will consider how to establish exit rules as well as various filters and money management rules to maximise the profitability of the system.

6. Stop Loss Rules.

Our strategy already has a natural stop loss in the stop order that does not get filled. The objective of the strategy is to capitalise on those days where the high or low for the day is in place early (9.30-11.45am). If we enter a trade on a breakout of either the high or the low and then the market subsequently hits the other stop we know that our trade is invalid. We know...