Most investors by nature will "go long" when they buy stocks. Few investors naturally will short stocks (or bet on their decline) because they really don't know what to look for. Some investors see the shorting process as somewhat counter-intuitive to the traditional investing process, since many stocks do appreciate over time. That said, there is a lot of money to be made by shorting and, in this article, we'll give you a list of signs that show when a stock might be ripe for a fall.

Technical Trends

Look at a chart of the stock you are thinking about shorting. What is the general trend? Is the stock under accumulation or distribution?

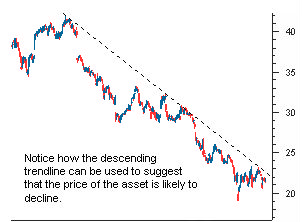

It is not uncommon to see a stock that has been in a downtrend continue to trade in that same pattern for an extended time period. Many traders will use various technical indicators to confirm the move lower, but drawing a simple trendline may be all that is needed to give a trader a better idea of where the investment is headed.

As you can see from the chart below, the declining trend will make it difficult for an investor to gain on a move higher, because the position will need to fight against the major underlying trend, which in this case is downward.

Fig 1 Short Sell – Source:- Metastock.com

Other technical indicators, such as a moving average, can also be used to predict a downtrend. Many traders will watch for an asset's price to break below a major moving average to suggest a likely decline, because stocks that fall below a major moving average, such as the 200-day moving average, typically continue their descent.

Estimates Ratcheted Down

When a company misses its quarterly earnings estimates, management will usually try to explain to investors what happened in a conference call or a press release. Following this, Wall Street analysts work to compose a report and distribute it to their brokers. This process can often take a great deal of time – sometimes hours or days – which feels like an eternity in Wall Street chronology.

Astute traders will often aim to short a stock somewhere between the actual release and the time it takes the analyst to generate the report. Keep in mind that when the brokers receive these reports, they are likely to be moving their clients out of the stock, or at the very least reducing their positions.

Tax Loss Selling On the Horizon

In the fourth quarter, you will note that companies trading in the lower end of their 52-week trading range will trade even lower. Why is this? It is because individuals and mutual funds want to book some of their losses before year-end to reap the tax benefits. Therefore, these types of stocks may make good candidates for traders seeking to profit from a move lower.

Insider Selling

There are plenty of reasons why an insider might sell his or her stock. This may include buying a home, or simply a desire to book some profits. However, if a number of insiders are selling the stock in large quantities, it may be a wise move to view this as a harbinger of things to come. Keep in mind that execs have extraordinary insight into their companies. Use this information to your advantage and time your short sales accordingly.

Fundamentals Deteriorating

You don't need to find a company that is on the verge of bankruptcy to successfully short its stock. On the contrary, you need to see only a mild deterioration in a company's overall fundamentals for big holders of the stock, such as mutual funds, to get fed up and dump the shares.

Look for companies that have declining gross margins, have recently lowered future earnings guidance, have lost major customers, are getting an inordinate amount of bad press, have seen their cash balances dwindle or have had accounting problems. Put another way, investors need to be aware at all times of the "cockroach theory." That is, where there is one (problem), there is probably a whole bunch more.

Swelling Inventories & Accounts Receivables

This fits in under the topic of deteriorating fundamentals, but it stands to be emphasized because these are two of the most obvious (increasing inventories and accounts receivable) signs that a company is going downhill.

What do these figures tell you?

Increasing inventory figures might not be a bad thing if a company has recently launched a new product and is building up a backlog of that product in anticipation of selling it. However, if a company shows a sizable inventory jump for no reason, it is a sign that it has goods on its books that are stale and might not be saleable. These, in turn, will need to be written off and will have an adverse impact on earnings down the line.

Increasing receivables is a bad sign because it indicates that a company isn't being paid by its customers on a timely basis. This will also throw off earnings going forward. If some of these debts ultimately prove to be uncollectible, they will also have to be written off at some point.

Declining Sector Trends

While a company will occasionally buck a larger trend, most companies within a given sector or industry trade in relative parity. That means that supply and demand issues facing one company are likely to impact others at some point down the road. Use this information to your advantage. Make phone calls to a company's suppliers and/or customers. They can confirm whether the company is witnessing the same problems (or opportunities) as other players in the same industry or sector.

In Summary

Investors need to be aware not only that short selling presents an opportunity to generate tangible gains, but also that signals can alert an investor when a stock is about to take a fall. This knowledge will make you an immeasurably better investor.

Glenn Curtis is a freelance financial writer and analyst contributing to the likes of Investor's Business Daily, The Washington Times, Forbes and CNN

Technical Trends

Look at a chart of the stock you are thinking about shorting. What is the general trend? Is the stock under accumulation or distribution?

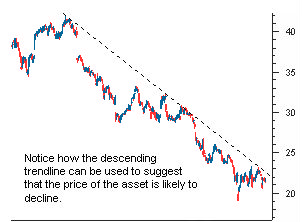

It is not uncommon to see a stock that has been in a downtrend continue to trade in that same pattern for an extended time period. Many traders will use various technical indicators to confirm the move lower, but drawing a simple trendline may be all that is needed to give a trader a better idea of where the investment is headed.

As you can see from the chart below, the declining trend will make it difficult for an investor to gain on a move higher, because the position will need to fight against the major underlying trend, which in this case is downward.

Fig 1 Short Sell – Source:- Metastock.com

Other technical indicators, such as a moving average, can also be used to predict a downtrend. Many traders will watch for an asset's price to break below a major moving average to suggest a likely decline, because stocks that fall below a major moving average, such as the 200-day moving average, typically continue their descent.

Estimates Ratcheted Down

When a company misses its quarterly earnings estimates, management will usually try to explain to investors what happened in a conference call or a press release. Following this, Wall Street analysts work to compose a report and distribute it to their brokers. This process can often take a great deal of time – sometimes hours or days – which feels like an eternity in Wall Street chronology.

Astute traders will often aim to short a stock somewhere between the actual release and the time it takes the analyst to generate the report. Keep in mind that when the brokers receive these reports, they are likely to be moving their clients out of the stock, or at the very least reducing their positions.

Tax Loss Selling On the Horizon

In the fourth quarter, you will note that companies trading in the lower end of their 52-week trading range will trade even lower. Why is this? It is because individuals and mutual funds want to book some of their losses before year-end to reap the tax benefits. Therefore, these types of stocks may make good candidates for traders seeking to profit from a move lower.

Insider Selling

There are plenty of reasons why an insider might sell his or her stock. This may include buying a home, or simply a desire to book some profits. However, if a number of insiders are selling the stock in large quantities, it may be a wise move to view this as a harbinger of things to come. Keep in mind that execs have extraordinary insight into their companies. Use this information to your advantage and time your short sales accordingly.

Fundamentals Deteriorating

You don't need to find a company that is on the verge of bankruptcy to successfully short its stock. On the contrary, you need to see only a mild deterioration in a company's overall fundamentals for big holders of the stock, such as mutual funds, to get fed up and dump the shares.

Look for companies that have declining gross margins, have recently lowered future earnings guidance, have lost major customers, are getting an inordinate amount of bad press, have seen their cash balances dwindle or have had accounting problems. Put another way, investors need to be aware at all times of the "cockroach theory." That is, where there is one (problem), there is probably a whole bunch more.

Swelling Inventories & Accounts Receivables

This fits in under the topic of deteriorating fundamentals, but it stands to be emphasized because these are two of the most obvious (increasing inventories and accounts receivable) signs that a company is going downhill.

What do these figures tell you?

Increasing inventory figures might not be a bad thing if a company has recently launched a new product and is building up a backlog of that product in anticipation of selling it. However, if a company shows a sizable inventory jump for no reason, it is a sign that it has goods on its books that are stale and might not be saleable. These, in turn, will need to be written off and will have an adverse impact on earnings down the line.

Increasing receivables is a bad sign because it indicates that a company isn't being paid by its customers on a timely basis. This will also throw off earnings going forward. If some of these debts ultimately prove to be uncollectible, they will also have to be written off at some point.

Declining Sector Trends

While a company will occasionally buck a larger trend, most companies within a given sector or industry trade in relative parity. That means that supply and demand issues facing one company are likely to impact others at some point down the road. Use this information to your advantage. Make phone calls to a company's suppliers and/or customers. They can confirm whether the company is witnessing the same problems (or opportunities) as other players in the same industry or sector.

In Summary

Investors need to be aware not only that short selling presents an opportunity to generate tangible gains, but also that signals can alert an investor when a stock is about to take a fall. This knowledge will make you an immeasurably better investor.

Glenn Curtis is a freelance financial writer and analyst contributing to the likes of Investor's Business Daily, The Washington Times, Forbes and CNN

Last edited by a moderator: