Grey1

Senior member

- Messages

- 2,190

- Likes

- 210

Let the trend be your friend, cut losses fast and stuff like that .. Easily said than done..

How ever there are ways to trade the trend which are less riskier than other methodologies..

Method1,

Buy into stocks where the number of Higher highs are greater during the same time period than any other stock... ( lower lows in case you go short ).. By doing that you are limiting the drawdown and don’t allow the stock to oscillate.. just pure trend..

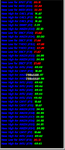

The Chart below gives you the following info

a) what stock is going through higher high ( or Lower Low)

b) The number of times the stocks has met the above criteria

Example INTU has had 85 new higher highs with little pullback and oscillation and YHOO 122 times lower lows

look at the SPOT , it only has had 12 lower lows during the same time frame ..

method 2)

Plot the regression line through the price … When market is in Positive, Go long when price pullbacks 2SD below the regression line..

You need some kind of a scanner to pick these stocks for you and sooner or later you have to get one if you want to trade the equity market for living .

PS:-- As we go along I will explain my detailed views on Momentum trading and why value trading is more profitable than momentum trading .. This post is for momentum traders.

PS:- method 1 is batter than method 2

regards

How ever there are ways to trade the trend which are less riskier than other methodologies..

Method1,

Buy into stocks where the number of Higher highs are greater during the same time period than any other stock... ( lower lows in case you go short ).. By doing that you are limiting the drawdown and don’t allow the stock to oscillate.. just pure trend..

The Chart below gives you the following info

a) what stock is going through higher high ( or Lower Low)

b) The number of times the stocks has met the above criteria

Example INTU has had 85 new higher highs with little pullback and oscillation and YHOO 122 times lower lows

look at the SPOT , it only has had 12 lower lows during the same time frame ..

method 2)

Plot the regression line through the price … When market is in Positive, Go long when price pullbacks 2SD below the regression line..

You need some kind of a scanner to pick these stocks for you and sooner or later you have to get one if you want to trade the equity market for living .

PS:-- As we go along I will explain my detailed views on Momentum trading and why value trading is more profitable than momentum trading .. This post is for momentum traders.

PS:- method 1 is batter than method 2

regards

Attachments

Last edited: