Carytrader

Newbie

- Messages

- 5

- Likes

- 0

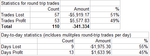

I have started day-trading stocks (in US) for about 45 days now and I have made more than 250 trades during this period. I have been making profits some weeks and losing some. Overall, I am close to zero profit/ loss after 45 days. I want to spell out my strategy and would request your comments and feedback.

TRADING PLATFORM

I use Scottrade Elite platform for day-trading and they charge me $6 per trade - I haven't read anybody else using Scottrade on this forum. I like Scottrade Elite because it provides all the tools (charts, Level II access, etc.) and the trade executions are very fast as well (1-2 seconds). Is there a better trading platform for day trading and can you suggest why? One of the concerns I have heard is that smaller brokers/ trading platforms may not be good for short-selling stocks. My understanding is that for short-selling stocks, the broker (Scottrade, in may case), needs to be able to borrow those stocks from someone else (typically, their other customers) and larger brokers are able to do that better than smaller one. I was considering moving to just2trade.com (for $2.5 per trade commission) or optionshouse.com (for $4 per trade commission), but I am concerned if I won't be able to short-sell and hence not take advantage of the downward stock trend, during day-trading. Comments/ advise?

STRATEGY

I invest typically $10k to $20k per trade and my target is to scalp 0.5 to 1.0 % return on every round-trip trade. I also put a stop loss at 0.5 to 1.0%, typically. In a day, I make 2-6 trades and I trade 2-4 times a week. I have been trading stocks like FB, GMCR, NFLX and ZYNGA.

My strategy is to jump on the trend by analyzing candle charts, volume changes, MCAD chart and RSI charts.

I am learning, and learning fast. My objective is to first demonstrate to myself that I can achieve certain consistency in making money (however small) over a period of 3 months and then scale up from there.

Since I am relatively new to trading, I just wanted to lay open my cards and I would greatly appreciate expert advice from experienced and successful day-traders. If you need more information to better advice me, please let me know and I answer your questions accordingly.

TRADING PLATFORM

I use Scottrade Elite platform for day-trading and they charge me $6 per trade - I haven't read anybody else using Scottrade on this forum. I like Scottrade Elite because it provides all the tools (charts, Level II access, etc.) and the trade executions are very fast as well (1-2 seconds). Is there a better trading platform for day trading and can you suggest why? One of the concerns I have heard is that smaller brokers/ trading platforms may not be good for short-selling stocks. My understanding is that for short-selling stocks, the broker (Scottrade, in may case), needs to be able to borrow those stocks from someone else (typically, their other customers) and larger brokers are able to do that better than smaller one. I was considering moving to just2trade.com (for $2.5 per trade commission) or optionshouse.com (for $4 per trade commission), but I am concerned if I won't be able to short-sell and hence not take advantage of the downward stock trend, during day-trading. Comments/ advise?

STRATEGY

I invest typically $10k to $20k per trade and my target is to scalp 0.5 to 1.0 % return on every round-trip trade. I also put a stop loss at 0.5 to 1.0%, typically. In a day, I make 2-6 trades and I trade 2-4 times a week. I have been trading stocks like FB, GMCR, NFLX and ZYNGA.

My strategy is to jump on the trend by analyzing candle charts, volume changes, MCAD chart and RSI charts.

I am learning, and learning fast. My objective is to first demonstrate to myself that I can achieve certain consistency in making money (however small) over a period of 3 months and then scale up from there.

Since I am relatively new to trading, I just wanted to lay open my cards and I would greatly appreciate expert advice from experienced and successful day-traders. If you need more information to better advice me, please let me know and I answer your questions accordingly.

Last edited: