You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

It’s an ambition of mine to obtain a Prop Trader position by 2013 end. I’ve spoken to some firms and have been informed that as a Prop Trader I would need to double my account every year, which I average to 10% every four weeks (allowing for holidays, slow periods etc). So this is the standard I am targeting in order to obtain and hold a Prop Trader account.

This blog will detail the trials, tribulations and hopefully triumphs, of my Prop Trader endeavour.

I’ll be trading only Forex, using 3 strategies, which I will refer to as: renko, 5M, and PA.

Renko uses a brick size of 5 on AUDUSD and EURUSD.

5M uses levels that I have developed and PA at those levels, on EURUSD only.

PA uses S/R and PA on the 240M TF, on 30 or so different pairs.

Each strategy is in development. And it may turn out that a strategy or 2 prove to be unprofitable. Plus I’m learning as I go, so there will be errors. But hopefully at the end I’ll have developed a strategy with an edge, and just as importantly, an edge that I am capable of wielding.

I’ll post trades I’m in as close to real time as humanely possible. And tally results each week or perhaps month.

So this is The Prop Trader Challenge, wish me luck. 🙂

IF you can keep this thread on track. It may be the best thread yet. Good luck.

jungles

Guest

- Messages

- 614

- Likes

- 67

D70, thanks for your support

IF you can keep this thread on track. It may be the best thread yet. Good luck.

jungles

Guest

- Messages

- 614

- Likes

- 67

It’s not the best time of year to start a journal. There’s perhaps one more good week of trading this year, followed by the holiday break.

Things wont get going again until around the 8th January, 2013.

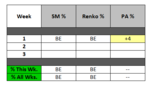

The table below summarises week 1.

As the data sample grows I’ll probably collate results on a monthly basis. I’ve found monthly averages are a better indication than weekly averages.

I took 2 PA trades on Tuesday and Wednesday, but as I only started this journal on Thursday, I wont include the % in the journals “total” results, but it’s nice to record them for the fans…….wink

……..and my own sanity!

……..and my own sanity!

.

Things wont get going again until around the 8th January, 2013.

The table below summarises week 1.

As the data sample grows I’ll probably collate results on a monthly basis. I’ve found monthly averages are a better indication than weekly averages.

I took 2 PA trades on Tuesday and Wednesday, but as I only started this journal on Thursday, I wont include the % in the journals “total” results, but it’s nice to record them for the fans…….wink

.

Attachments

jungles

Guest

- Messages

- 614

- Likes

- 67

some weekend music........i'm enjoying this one a lot at the moment

until next week 😎

Ben Howard - Esmerelda - YouTube

until next week 😎

Ben Howard - Esmerelda - YouTube

avtardhillon

Junior member

- Messages

- 36

- Likes

- 0

good luck hope you get your job

jungles

Guest

- Messages

- 614

- Likes

- 67

Similar threads

- Replies

- 4

- Views

- 3K