The law of ledges, congestion, and trading ranges.

The purpose of this thread is to look closer at sideways movement as defined by Joe Ross.

You can get the law of charts here.

http://www.trading-naked.com/Articles_and_Reprints.htm

As the usual second half of the day of trading is most often setup with this sort of price movement, there seems to be little discussion about potential breakouts from sideways movement.

Anyway, the 1-2-3 thread is good, so perhaps an extension of that will be of benefit.

http://www.trade2win.com/boards/showthread.php?t=13451&page=1&pp=40

The topic begins on page 6 of the law of charts, through page 12. Page 12 is very interesting as is page 18. and more of the topic from page 39 through page 50.

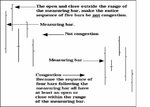

Ledge is 4 to 10 bars

Congestion is 11 to 20 bars

Trading range is 21 or more bars.

From JR's web site.

TRADING IN CONGESTION

Sideways price movement may be broken into three distinct and definable areas:

1. Ledges - consisting of no more than 10 price bars

2. Congestions - 11-20 price bars inclusive

3. Trading Ranges - 21 bars or more with a breakout usually occurring on price bars 21-29 inclusive.

Trading Ranges consisting of more than 29 price bars tend to weaken beyond 29 price bars and breakouts beyond 29 price bars will be:

• Relatively strong if the Trading Range has been growing narrower from top to bottom (coiling).

• Relatively weak if the Trading Range has been growing wider from top to bottom (megaphone).

We have written considerable material about breakouts from Ledges, primarily that since by definition, Ledges must occur in trending markets, the breakout is best traded in the direction of the prior trend, once two matching highs and two matching lows have taken place.

The next discussion deals primarily with Congestions and Trading Ranges:

Under the topic of the Law of Charts, we have defined the first correction following the breakout of a Trading Range or Ledge as being a Ross Hook.

The purpose of this thread is to look closer at sideways movement as defined by Joe Ross.

You can get the law of charts here.

http://www.trading-naked.com/Articles_and_Reprints.htm

As the usual second half of the day of trading is most often setup with this sort of price movement, there seems to be little discussion about potential breakouts from sideways movement.

Anyway, the 1-2-3 thread is good, so perhaps an extension of that will be of benefit.

http://www.trade2win.com/boards/showthread.php?t=13451&page=1&pp=40

The topic begins on page 6 of the law of charts, through page 12. Page 12 is very interesting as is page 18. and more of the topic from page 39 through page 50.

Ledge is 4 to 10 bars

Congestion is 11 to 20 bars

Trading range is 21 or more bars.

From JR's web site.

TRADING IN CONGESTION

Sideways price movement may be broken into three distinct and definable areas:

1. Ledges - consisting of no more than 10 price bars

2. Congestions - 11-20 price bars inclusive

3. Trading Ranges - 21 bars or more with a breakout usually occurring on price bars 21-29 inclusive.

Trading Ranges consisting of more than 29 price bars tend to weaken beyond 29 price bars and breakouts beyond 29 price bars will be:

• Relatively strong if the Trading Range has been growing narrower from top to bottom (coiling).

• Relatively weak if the Trading Range has been growing wider from top to bottom (megaphone).

We have written considerable material about breakouts from Ledges, primarily that since by definition, Ledges must occur in trending markets, the breakout is best traded in the direction of the prior trend, once two matching highs and two matching lows have taken place.

The next discussion deals primarily with Congestions and Trading Ranges:

Under the topic of the Law of Charts, we have defined the first correction following the breakout of a Trading Range or Ledge as being a Ross Hook.