Ahhhh, okay, so there is no way to really have a pinpoint as to what it's going to do after the double-top happens? What are the chances that it'd continue in an uptrend?

Also, is there any relationship to the space of time a double-top would appear in? For example, and I'm just guessing here, would a short period of time indicate a rally and a then a longer period of time, it would fall?

Thanks for all the responses thus far, guys.

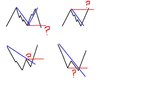

there is no way to tell exactly what is going to happen at a double top. you could consider the following questions about the double top:

1. Did it occur at previous support/resistance/price pivot zone on a higher t/f to the t/f that the double top set up on.

2. If considering a trade is there any order flow (i.e. news) that is scheduled in the near future.

3. If the double top turns out to be a reversal on that t/f what does this mean on the higher t/f's, are you re-entering a long term trend.

4. what 'space' do you have if considering a trade. i.e. what is the distance to the next level of previous price consolidiation/chop.

5. depending on what price representation you are using (line, bar, candles) what is this showing you immediately at and after the double top.

6. what is the overall price action that the double top appears. Are you in a strong trend extending to higher t/f s, are you in a range, beware of going against a strong trend that extends to high t/f s.

I hope from this you can see that a double top on its own means nothing (imo). I learnt much of my methods from BBmac (member on here) who is very helpful and just an all round good guy imo. search him you will find his posts.

I am sure D.Toast is going to jump on me now and say Technical trading is basically witchcraft. I believe he trades purely off tape, i.e. time and sales. I know traders who make money using technical methods without time/sales/order flow, I also know traders who make money purely using time/sales/order flow. There are plenty of ways to skin a cat imo.