A look a the current market correction - the 'canary correction' and what may have caused it.

When the Morgan Stanley Emerging Markets Index Exchange Traded Fund (EEM) hit an all-time high of $111.10 on May 9, 2006, it marked a meteoric rise from its humble launch price of $33.37 a little more than three years before. Volume had also grown exponentially from a mere 36,300 shares on April 11, 2003, to an average daily exchange of more than 3.5 million shares by early May 2006.

caption: Figure 1 - The Morgan Stanley MSCI Emerging Market ETF (EEM) dropped sharply between May 9 and June 13, 2006. May registered the biggest monthly decline in the history of the index, and the drop was only half over.

Chart provided by www.Genesisft.com.

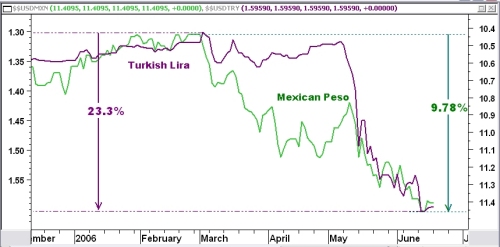

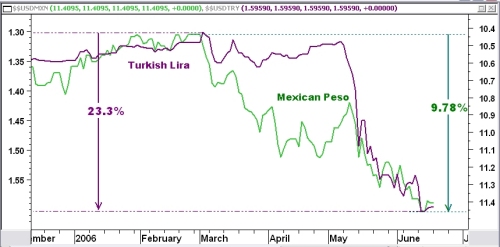

caption: Figure 2 - This daily chart illustrates the fall in the Mexican peso and Turkish lira between early March and mid-June. With the lira suffering the majority of its losses since May, the drop became even more destabilizing. Chart provided by Metastock.com.

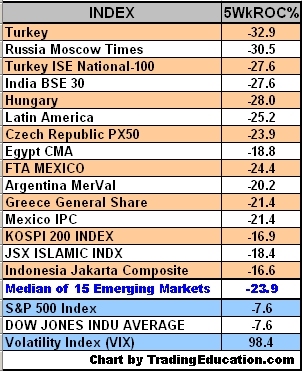

But then the unexpected happened. By May 31, the EEM had lost nearly 12 percent, the largest monthly fall in its history, and the worst was still to come. By June 13 after just 24 trading days, the value of the ETF was down more than 26 percent. The damage was not restricted to emerging markets. In total between early May and mid-June 2006, global stock markets lost $6.3 trillion in value, according to Birinyi Associates, or approximately one-half the annual gross domestic product (GDP) of the United States.

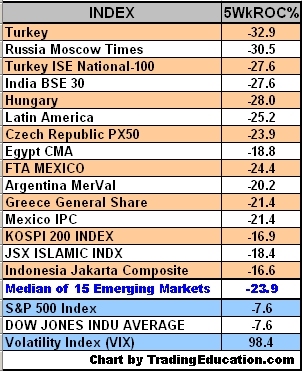

caption: Table 1 - This summary of percentage drops in emerging markets shows huge declines around the world between May 9 and June 13, 2006. In the process, the CBOE market volatility index (VIX) surged to highs not seen since April 2003 following the start of the rally that ended the last recession.

Table by www.TradingEducation.com Data by www.Metastock.com.

Stocks weren't the only asset class to suffer a serious correction. Gold dropped 22% during the stock market drop in May-June, and a number of other leading metals suffered similar fates. Copper, a leading indicator of global industrial activity, dropped more than 24%.

Small economy and emerging market currencies have also been hammered, not the least of which were the Icelandic krona and New Zealand dollar. The Mexican peso fell 10% and the Turkish lira plummeted more than 23% between the beginning of March and June 13 (see Figure 2) while the Hungarian forint lost nearly 8% against the dollar between May 31 and June 13. Rising inflation and falling currencies means that those economies will be tested as their central banks attempt to cool the blaze without putting out the fire - a tough job and one that often proves mission impossible.

In fact, none of the five major asset classes (equities, commodities, currencies, bonds and real estate) were immune. In this two-part article, we will examine the emerging financial troubles, look back for times when similar challenges threatened global markets and explore what this development and financial indicators may be trying to tell us about the future.

Of Canaries and the Carry Trade

One of the greatest attributes of all successful traders is their ability to step back and take a long hard look when things go wrong. Repeating mistakes in this business is a good way to go broke in a hurry. With the "canary correction" in May and June, traders around the world were forced to re-evaluate as losses mounted. What caused the meltdown and could it have been anticipated? More important, what does it mean for markets going forward?

To begin to plumb that question, we need to step back in time. As global economies came out of the 2001 recession, money managers resumed their search for new investment opportunities. One that attracted attention was to become known as the carry trade, and it relied on the international interest rate differences. Borrowing funds from banks in nations where rates were low, such as Japan, and lending in other economies where high rates existed, such as Iceland and New Zealand, global bond traders could pocket a handsome profit. In Japan the bonds became known as uridashi or "bargain sale."

The only real downside was currency risk. As long as the Japanese yen didn't soar or currencies in the recipient nations didn't plummet, profits accumulated. As more investors piled into the game, target countries experienced unprecedented influxes of cash, heating up economies and propelling stocks, real estate and wages higher. In two short months, Iceland's inflation rate rose from 4.5 percent in March to 7.6 percent in May 2006, and the nation's current account deficit hit an incredible 16% of GDP. Inflows of foreign capital had made the economy unstable. An economic canary had started to sing.

Back in late February, however, the carry trade game had already begun to unravel. Realizing the risk of an "unsustainable" 16% current account deficit, Fitch Ratings downgraded Iceland's debt. Traders dropped the krona like a hot potato, causing the currency to fall 10% in less than two days.

On June 6, the situation took a turn for the worse. First came of the resignation of Iceland's Prime Minister. Then on the same day a credit downgrade was announced by another credit rating agency - this time it was Standard and Poor's - from stable to negative, dropping the Icelandic krona a further 3% the following day. An analyst for S&P commented that the current situation increases the chances for a hard landing as the boom that started two years ago and resulting economic imbalances begin to unwind. Not the kind of situation carry trade bondholders wanted to see.

In New Zealand, inflation had also become a problem and the overnight interest rate had risen to 7.25 percent, driving mortgage rates up to more than 9 percent. In spite of this, the New Zealand dollar had dropped more than 15% in a year. This put carry trade bondholders invested down under seriously underwater. To make matters worse, the New Zealand government announced that GDP growth had turned negative for Q4-2005. Like piling concrete bricks into a sinking boat, poor economic performance is the last thing a struggling currency needs. This left no room for increasing interest rates, the standard central bank remedy for rising inflation and a falling currency. Now the canary was singing in Auckland.

As an example of how popular the carry trade became, Japanese investors purchased 6.63 trillion yen ($64.2 billion) in foreign bonds during the first two months of 2005. But little more than a year later by May and June 2006, this had dropped by two-thirds to 2.60 trillion yen ($20 billion). The carry trade was rapidly unwinding and with it investment flows into high-yield economies, many of which were emerging markets.

And such excesses were not limited to bond markets. According to the Economist, foreigners invested $61.4 billion in emerging-market equities plus an additional $237.5 billion in direct investments in 2005. By the end of the year the market capitalization of all exchanges in emerging economies was $4.4 trillion, up from $1.7 trillion in 2002. Asian markets had tripled in size.

Such flows of capital have a tendency to destabilize smaller markets and economies. With such rapid growth in funds pouring into small economies and emerging markets, it was only a matter of time before a serious stock market correction came.

Iceland and New Zealand were major recipients of the carry trade, but they were just two of a number of economic canaries singing an alarm that something was amiss. Together with a major correction in emerging stock markets worldwide, Turkey, Hungary and Mexico were also having problems.

But there is another ticking time bomb that, if it were to blow, would be far more devastating than a melt of bond and stock markets combined - the derivatives market.

Derivatives - Success in Excess

A derivative is an agreement to shift risk. Their worth is determined by the value of an underlying asset such as a commodity, an interest rate, corporate stock, an index or a currency. Stock and futures options are common examples.

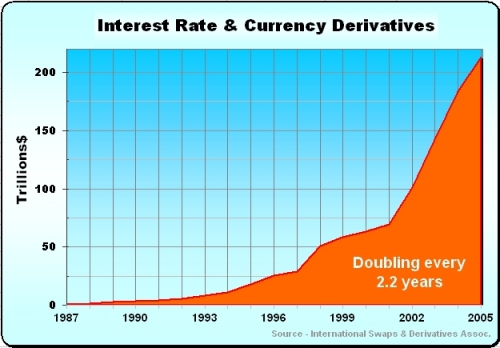

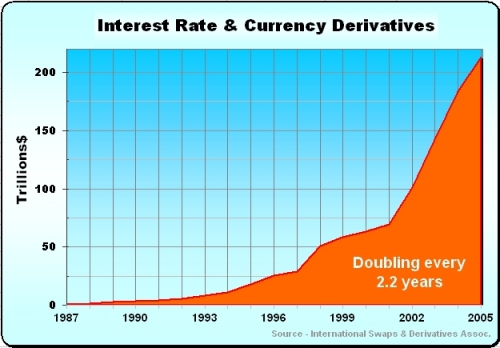

As Figure 3 shows, the value of interest rate (IR) and currency derivatives in 1987 totalled $865.6 billion. Since then the market has doubled in size every 2.2 years on average. This compares to an average doubling rate of 3.5 years for the Nasdaq market between 1990 and 2004. The Nasdaq rivalled the IR/currency derivative growth rate briefly during the bubble years from 1998 through 2000 when it was doubling every 2.07 years but, as we all know, this wasn't sustainable. By the end of 2005, the value of these derivatives had grown to nearly 20 times the size of the total annual GDP output of the United States.

caption: Figure 3 - An interest rate swap is an agreement between parties to exchange interest rate flows at intervals over the life of the contract. Currency options and futures contracts are examples of a currency derivative. Their use has increased dramatically in the last two decades

Chart provided by www.TradingEducation.com.

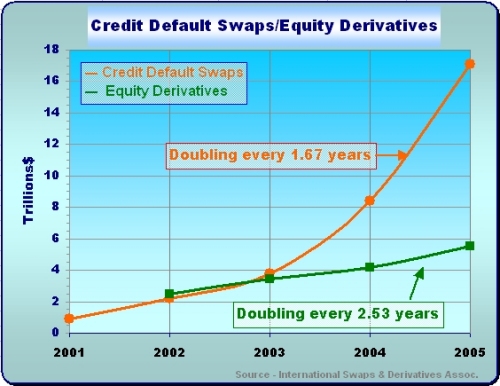

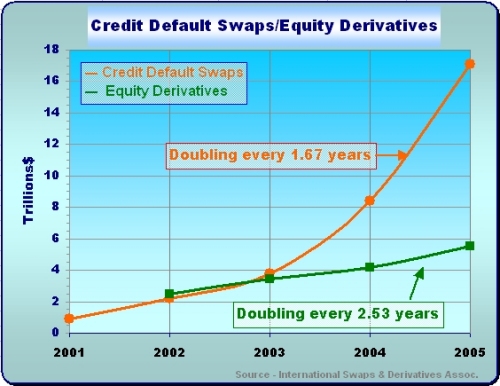

Credit default swaps, which protect the buyer against default of a bond, have grown even faster, doubling in size every 1.67 years since 2001. Even the slowest growing of the group, equity derivatives, have doubled every 2.53 years since their inception, nearly as fast as the Nasdaq during the Internet bubble. As Figure 4 illustrates, equity derivatives have been dwarfed by the popularity of credit default swaps.

Never before in history had so much money flowed into a market so rapidly. Was it sustainable? And what happens to the markets into which this money has been pouring when the flow inevitably slows?

Another concern was the unusual spike in volatility as global markets came unglued. When the Chicago Board Options Exchange (CBOE) Market Volatility Index (VIX) hit a 38-month high on June 13, stock watchers saw that as a sign of a possible bottom, but those institutional and professional fund and money managers on the wrong side of the trade got hit hard. Only in time will the world know the total size and impact of the losses.

caption: Figure 4 - Credit default swaps are in effect insurance policies against default by an individual, corporation, institution or nation. One party (buyer) pays a fee to another party (seller) in return for compensation in the event of default of a bond, for example, or other instrument by a reference entity.

Chart provided by www.TradingEducation.com.

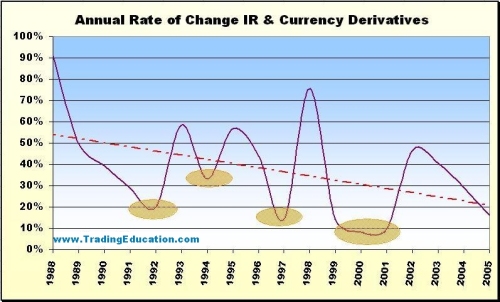

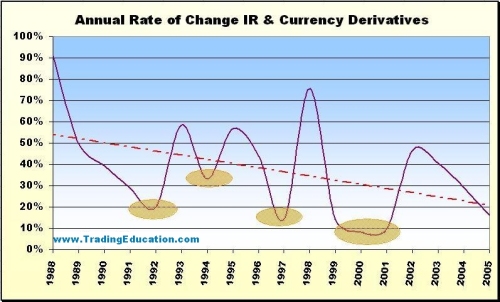

Although it is too early to gauge the damage this recent multi-market meltdown has inflicted on the global financial fabric and whether the incredible growth in derivatives is sustainable, let's look at the rate funds have flowed into them. The most recent data for the annual rate of change of interest rate and currency derivative show the fund flows continue to decline and have been doing so since 2002 (see Figure 5).

Each time fund flows have hit relatively low levels, a bear market or emerging market crisis followed. In 1994 it was the Tequila Crisis in which the Mexican peso lost more than 30%, decimating the Mexican economy with shockwaves felt around the world. In 1997 is was the meltdown in the Thai baht that spread to global markets in the "Asian flu." In 2000, it was a bear market in which the Nasdaq Composite was to drop more than 80% with fallout spreading to nearly all asset classes.

caption: Figure 5 - The annual percent change in the flow of funds into interest rate swaps and currency derivatives is trending down (red line). A significant drop in the flow of funds preceded the bear market of 2000 and subsequent recession in 2001-02. Ditto for the Thai baht melt and Asian flu (1997), Mexican peso crisis (1994) and 1993 bear market. Take? Whenever funds flowing into these derivatives hit a relative low, it means smart investors are getting cautious.

Chart provided by www.TradingEducation.com.

In Part 2

Part 2 will explain how this slowdown corresponds with periods of narrow yield premiums between a basket of emerging market bond yields and U.S. Treasury bond yields indicating periods of investor complacency. Here are some other major points we will cover in part 2.

When the Morgan Stanley Emerging Markets Index Exchange Traded Fund (EEM) hit an all-time high of $111.10 on May 9, 2006, it marked a meteoric rise from its humble launch price of $33.37 a little more than three years before. Volume had also grown exponentially from a mere 36,300 shares on April 11, 2003, to an average daily exchange of more than 3.5 million shares by early May 2006.

caption: Figure 1 - The Morgan Stanley MSCI Emerging Market ETF (EEM) dropped sharply between May 9 and June 13, 2006. May registered the biggest monthly decline in the history of the index, and the drop was only half over.

Chart provided by www.Genesisft.com.

caption: Figure 2 - This daily chart illustrates the fall in the Mexican peso and Turkish lira between early March and mid-June. With the lira suffering the majority of its losses since May, the drop became even more destabilizing. Chart provided by Metastock.com.

But then the unexpected happened. By May 31, the EEM had lost nearly 12 percent, the largest monthly fall in its history, and the worst was still to come. By June 13 after just 24 trading days, the value of the ETF was down more than 26 percent. The damage was not restricted to emerging markets. In total between early May and mid-June 2006, global stock markets lost $6.3 trillion in value, according to Birinyi Associates, or approximately one-half the annual gross domestic product (GDP) of the United States.

caption: Table 1 - This summary of percentage drops in emerging markets shows huge declines around the world between May 9 and June 13, 2006. In the process, the CBOE market volatility index (VIX) surged to highs not seen since April 2003 following the start of the rally that ended the last recession.

Table by www.TradingEducation.com Data by www.Metastock.com.

Stocks weren't the only asset class to suffer a serious correction. Gold dropped 22% during the stock market drop in May-June, and a number of other leading metals suffered similar fates. Copper, a leading indicator of global industrial activity, dropped more than 24%.

Small economy and emerging market currencies have also been hammered, not the least of which were the Icelandic krona and New Zealand dollar. The Mexican peso fell 10% and the Turkish lira plummeted more than 23% between the beginning of March and June 13 (see Figure 2) while the Hungarian forint lost nearly 8% against the dollar between May 31 and June 13. Rising inflation and falling currencies means that those economies will be tested as their central banks attempt to cool the blaze without putting out the fire - a tough job and one that often proves mission impossible.

In fact, none of the five major asset classes (equities, commodities, currencies, bonds and real estate) were immune. In this two-part article, we will examine the emerging financial troubles, look back for times when similar challenges threatened global markets and explore what this development and financial indicators may be trying to tell us about the future.

Of Canaries and the Carry Trade

One of the greatest attributes of all successful traders is their ability to step back and take a long hard look when things go wrong. Repeating mistakes in this business is a good way to go broke in a hurry. With the "canary correction" in May and June, traders around the world were forced to re-evaluate as losses mounted. What caused the meltdown and could it have been anticipated? More important, what does it mean for markets going forward?

To begin to plumb that question, we need to step back in time. As global economies came out of the 2001 recession, money managers resumed their search for new investment opportunities. One that attracted attention was to become known as the carry trade, and it relied on the international interest rate differences. Borrowing funds from banks in nations where rates were low, such as Japan, and lending in other economies where high rates existed, such as Iceland and New Zealand, global bond traders could pocket a handsome profit. In Japan the bonds became known as uridashi or "bargain sale."

The only real downside was currency risk. As long as the Japanese yen didn't soar or currencies in the recipient nations didn't plummet, profits accumulated. As more investors piled into the game, target countries experienced unprecedented influxes of cash, heating up economies and propelling stocks, real estate and wages higher. In two short months, Iceland's inflation rate rose from 4.5 percent in March to 7.6 percent in May 2006, and the nation's current account deficit hit an incredible 16% of GDP. Inflows of foreign capital had made the economy unstable. An economic canary had started to sing.

Back in late February, however, the carry trade game had already begun to unravel. Realizing the risk of an "unsustainable" 16% current account deficit, Fitch Ratings downgraded Iceland's debt. Traders dropped the krona like a hot potato, causing the currency to fall 10% in less than two days.

On June 6, the situation took a turn for the worse. First came of the resignation of Iceland's Prime Minister. Then on the same day a credit downgrade was announced by another credit rating agency - this time it was Standard and Poor's - from stable to negative, dropping the Icelandic krona a further 3% the following day. An analyst for S&P commented that the current situation increases the chances for a hard landing as the boom that started two years ago and resulting economic imbalances begin to unwind. Not the kind of situation carry trade bondholders wanted to see.

In New Zealand, inflation had also become a problem and the overnight interest rate had risen to 7.25 percent, driving mortgage rates up to more than 9 percent. In spite of this, the New Zealand dollar had dropped more than 15% in a year. This put carry trade bondholders invested down under seriously underwater. To make matters worse, the New Zealand government announced that GDP growth had turned negative for Q4-2005. Like piling concrete bricks into a sinking boat, poor economic performance is the last thing a struggling currency needs. This left no room for increasing interest rates, the standard central bank remedy for rising inflation and a falling currency. Now the canary was singing in Auckland.

As an example of how popular the carry trade became, Japanese investors purchased 6.63 trillion yen ($64.2 billion) in foreign bonds during the first two months of 2005. But little more than a year later by May and June 2006, this had dropped by two-thirds to 2.60 trillion yen ($20 billion). The carry trade was rapidly unwinding and with it investment flows into high-yield economies, many of which were emerging markets.

And such excesses were not limited to bond markets. According to the Economist, foreigners invested $61.4 billion in emerging-market equities plus an additional $237.5 billion in direct investments in 2005. By the end of the year the market capitalization of all exchanges in emerging economies was $4.4 trillion, up from $1.7 trillion in 2002. Asian markets had tripled in size.

Such flows of capital have a tendency to destabilize smaller markets and economies. With such rapid growth in funds pouring into small economies and emerging markets, it was only a matter of time before a serious stock market correction came.

Iceland and New Zealand were major recipients of the carry trade, but they were just two of a number of economic canaries singing an alarm that something was amiss. Together with a major correction in emerging stock markets worldwide, Turkey, Hungary and Mexico were also having problems.

But there is another ticking time bomb that, if it were to blow, would be far more devastating than a melt of bond and stock markets combined - the derivatives market.

Derivatives - Success in Excess

A derivative is an agreement to shift risk. Their worth is determined by the value of an underlying asset such as a commodity, an interest rate, corporate stock, an index or a currency. Stock and futures options are common examples.

As Figure 3 shows, the value of interest rate (IR) and currency derivatives in 1987 totalled $865.6 billion. Since then the market has doubled in size every 2.2 years on average. This compares to an average doubling rate of 3.5 years for the Nasdaq market between 1990 and 2004. The Nasdaq rivalled the IR/currency derivative growth rate briefly during the bubble years from 1998 through 2000 when it was doubling every 2.07 years but, as we all know, this wasn't sustainable. By the end of 2005, the value of these derivatives had grown to nearly 20 times the size of the total annual GDP output of the United States.

caption: Figure 3 - An interest rate swap is an agreement between parties to exchange interest rate flows at intervals over the life of the contract. Currency options and futures contracts are examples of a currency derivative. Their use has increased dramatically in the last two decades

Chart provided by www.TradingEducation.com.

Credit default swaps, which protect the buyer against default of a bond, have grown even faster, doubling in size every 1.67 years since 2001. Even the slowest growing of the group, equity derivatives, have doubled every 2.53 years since their inception, nearly as fast as the Nasdaq during the Internet bubble. As Figure 4 illustrates, equity derivatives have been dwarfed by the popularity of credit default swaps.

Never before in history had so much money flowed into a market so rapidly. Was it sustainable? And what happens to the markets into which this money has been pouring when the flow inevitably slows?

Another concern was the unusual spike in volatility as global markets came unglued. When the Chicago Board Options Exchange (CBOE) Market Volatility Index (VIX) hit a 38-month high on June 13, stock watchers saw that as a sign of a possible bottom, but those institutional and professional fund and money managers on the wrong side of the trade got hit hard. Only in time will the world know the total size and impact of the losses.

caption: Figure 4 - Credit default swaps are in effect insurance policies against default by an individual, corporation, institution or nation. One party (buyer) pays a fee to another party (seller) in return for compensation in the event of default of a bond, for example, or other instrument by a reference entity.

Chart provided by www.TradingEducation.com.

Although it is too early to gauge the damage this recent multi-market meltdown has inflicted on the global financial fabric and whether the incredible growth in derivatives is sustainable, let's look at the rate funds have flowed into them. The most recent data for the annual rate of change of interest rate and currency derivative show the fund flows continue to decline and have been doing so since 2002 (see Figure 5).

Each time fund flows have hit relatively low levels, a bear market or emerging market crisis followed. In 1994 it was the Tequila Crisis in which the Mexican peso lost more than 30%, decimating the Mexican economy with shockwaves felt around the world. In 1997 is was the meltdown in the Thai baht that spread to global markets in the "Asian flu." In 2000, it was a bear market in which the Nasdaq Composite was to drop more than 80% with fallout spreading to nearly all asset classes.

caption: Figure 5 - The annual percent change in the flow of funds into interest rate swaps and currency derivatives is trending down (red line). A significant drop in the flow of funds preceded the bear market of 2000 and subsequent recession in 2001-02. Ditto for the Thai baht melt and Asian flu (1997), Mexican peso crisis (1994) and 1993 bear market. Take? Whenever funds flowing into these derivatives hit a relative low, it means smart investors are getting cautious.

Chart provided by www.TradingEducation.com.

In Part 2

Part 2 will explain how this slowdown corresponds with periods of narrow yield premiums between a basket of emerging market bond yields and U.S. Treasury bond yields indicating periods of investor complacency. Here are some other major points we will cover in part 2.

- We will examine an index that has been uncannily accurate in providing advance warning of emerging market trouble and what it is saying now.

- What does the yield curve inversion in the United States for the third time in the last six months mean, and how accurate has it been in the past in prognosticating bear markets.

- Global property market trouble spots. Based on the importance that real estate and related construction activities have taken on in global economies, what does a real estate correction mean for the economy?

- As the traditional driver of consumer spending, real wage growth is essential to long-term economic strength. We will take a look at the trend in wage growth after inflation and what it means.

- All markets and economies are cyclical. What are the most important cycles currently at play, and what do they mean for markets going forward?

- Finally, we will tie these factors together to provide an overall snapshot from 30,000 feet and what it means for markets in the coming months and years.

Last edited by a moderator: