This article is aimed at those who fancy a go at spreadbetting, but haven't a clue what to do. The hope is that by the end you'll know enough to get started with a tiny bit of confidence. It goes on a bit, but compare it to books on the subject and you'll realise it's admirably brief.

Trading requires deep pockets, right?

Nope.

I'm pretty sure that out of the 20 odd thousand T2W members not every one of them has £500,000 - £1,000,000 to invest - in fact I'd take a long right now on the probability that thousands and thousands would consider £1000 quite a big lump to invest, especially as so many of us are struggling to learn how to survive, let alone win.

So let's assume you have a few hundred, or a couple of thousand, to invest. You like trading, you want to make some money - what could be simpler than that? The really good bit is this - if you get good at it then simple old compound interest and time will make you rich, regardless of where you start. If you are pants at it (trans: not overly effective) then you will achieve the reverse - a dwindling money supply (save the last 50p or so for a Mars bar, you'll need the energy for running from the spouse).

What can you do with £500 - £1000 then? Well, trading shares the traditional way is right out - a long trade on £1000 of shares means all your money is invested in one trade - that's very risky indeed. After paying the broker to buy the shares, plus the spread (more on that soon) plus a tax called stamp duty in the UK, it all combines to ensure that even after risking everything on one throw of the die* you've as much chance of coming out ahead over anything less than a glacial period as I have of becoming Pope.

(*Dice is the plural of die - with £1000 you can't afford two of them)

Fortunately there is an alternative, and with £1000 you can spreadbet. With a pot this size, if you're a daytrading type, you could run a number of trades per day at £1 per point.

As an example I'll choose five stocks from yesterday (20 January) selected solely on the basis of their margin requirements and imagining we had mastered trading to a perfect level. You could, for example, have traded General Motors, Biogen, Home Depot, Qualcom and Intuit. If, through amazing prescience, we had shorted at the highs and longed at the lows - Home Depot we profited by £74, £55 on GM, BIIB (Biogen) we made £297, INTU we went long and made £155, QCOM we made £110. Okay, my cheapo calculator says that with this perfect timing and £1000 in my SB account I could have made 69% profit in a single day. £1000 may not seem that much to start with, but let me tell you, at 69% a day I could make a hamster a billionaire inside a year. Unfortunately, though, even Luke Skywalker with the force would be unable to achieve this level of trading mastery and while spreadbetting may make it easier to make a few trades on a limited budget, it does not, of course, make trading itself any easier.

How do I get started?

I'm not going to attempt a comprehensive coverage of spreadbetting here but I am planning to highlight a few things that will speed you along the path from "rabbit in headlights" to "frightened but having a clue" - after that it's up to you to decide where to go next - this is for raw beginners.

Okay, first off - what is a spreadbet? Simplified the spreadbetting company is a bookmaker, they list things you can spreadbet, like shares, indices, commodities, forex and so on, some offer bets on sports, mortgage rates, all sorts. I'm going to stick to shares mainly, the mechanics of trading financial items like shares, commodities (all that "buy sugar, sell lean hogs" stuff) and indices (buying/selling bets on the Dow, FTSE and so on) work pretty much the same. Sports etc won't be wildly different, but I don't touch them.

Before you open a cash account, you can trade with pretend money (paper trading) with most of them, so you can practise long before you risk real money. Accounts can be funded online with your switch or credit card, and it all goes through fairly quickly and smoothly these days. A number of companies are mentioned in countless threads and there are also reviews in the T2W reviews section - go read some.

I'm going to use things I see/do in my Capital Spreads account as being "typical" spreadbet company stuff, different companies will vary in how things are done, what is available, etc - but in the main they're all going to have more similarities than differences.

So, you enter your username, tap in your clever password (pa44w0rd - cue furious logging in to change passwords all over the planet) and you see a list of popular bets on offer, plus a bunch of tabs offering you the option to look at different lists.

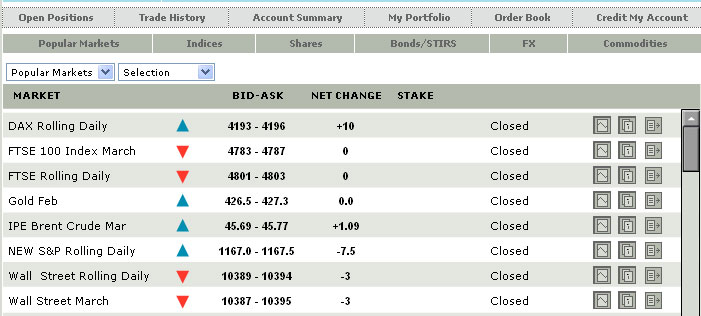

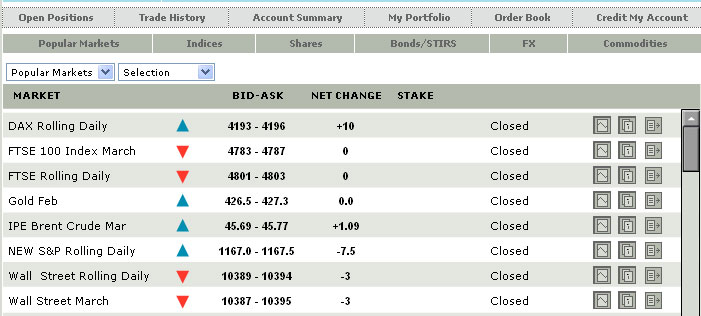

Here's a picture (about time):-

caption: Main Screen once logged in (partial)

This is the sort of thing you'll see once past the login - these screenshots were taken after the US markets closed on Friday 21 Jan 2005, by the way. This is just a mix of bits and pieces, but we can use this to see what info is available to us - obviously the column reading "closed" isn't much use right now, but let's check the rest out. Whichever spreadbet company you go with the info here will be somewhere around the screens your own spreadbet company presents - you'll soon become familiar with other screens.

Okay, tabs at the top, left to right. Open positions lets you see all current bets, you can see what you have in play, and there are simple icons to click on to call up a dealing window to close each one. To open a bet you also just click on an icon, a small popup appears to tell you the current prices on offer, and there are "buy" and "sell" buttons on it, also (of course) a button to quit without trading because you went off the idea. Buttons/icons are there to call up charts, info on the share, transfer to portfolio etc (not shown, as markets are shut, are buttons to initiate your bets).

Why is there more than one price on offer?

Yes, there is a price for buying, and one for selling - they are different, look at the DAX Rolling Daily above (never mind what it IS, just look at the price...). 4193-4196 is the quote, if you want to buy this bet, ie you are betting that the DAX will go up, then you buy at 4196. If you think it will fall you short it (sell) at 4193. If you are watching the Dax on a live feed like esignal or ADVFN then it might be showing 4194.5.... if you are long it has to go up 1.5 points before you break even at 4196, a short trade will break even after it has fallen 1.5 points to 4193. That's the basic idea - the company quotes one price to buyers, a different price to sellers, and the few pennies in the middle is where they make their money day in, day out, taking a few coppers off every trade (that, and people like me losing, of course).

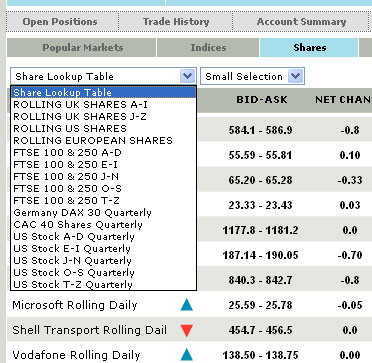

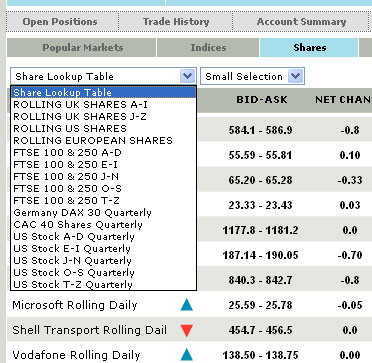

caption: Example of the range of shares you can spreadbet

This is a single dropdown, listing the share collections we can look at to find items to trade. We'll see shortly what "rolling" and "Quarterly" means.... you see that Capital Spreads will let you trade UK, US, European, German (DAX) and French (CAC40) shares.

Okay, let's concentrate on stocks - each spreadbet company will be different, but generally speaking you'll find lots to trade, each company deciding what to offer bets on.

More tabs then (quickly) - the others allow you to check a list of trades you've made, you can see what

stop losses are ready for your open trades, you can call up a window to add money from bank or credit card to your account, you can make a portfolio of shares up by selecting from the lists on the main display. You can see on the lower row of tabs the different categories of instrument you can trade - shares, indices, commodities, forex, and so forth. Click a tab, pick what you want to trade, and you simply tap how many "units" to trade and click the trade icon to call up the dealing popup. "Units" - some brokers will let you trade as low as 1p to a point while learning, a fairly average minimum trade is £1 (or $1) to point... what this means is simply that for every 1c price change on a US share you win or lose £1. (Eeek!)

You DO therefore need to keep an eye on things, a share that gaps down $2 will cost you £200, and stop losses only work if the price passes through them, not past them. Some spreadbet companies offer guaranteed stops - ie you're out at the chosen price, gap or not. These tend to cost more in the form of a bigger gap between the price you enter at and the price you break even at - all spreadbets, on entry, will be at least a pound or two in loss because you'll be "the spread" adrift at entry, the trick is to get to break even and into profit as soon as possible! The spread varies, depending on what you trade, but it'll generally amount to a small bit more than the bid-ask spread you see in your real-time datafeed.... it's shown on the screen, and continually updated when markets are open, so just make a point to check it before trading.... there's no point trading a share that is rangebound in a 10c wide range if the spread is 15c!

Why are some prices different for different months?

We haven't finished with price yet - check this screen out....

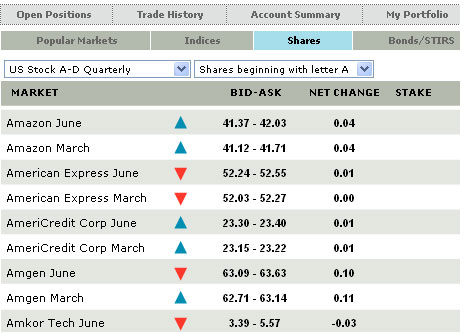

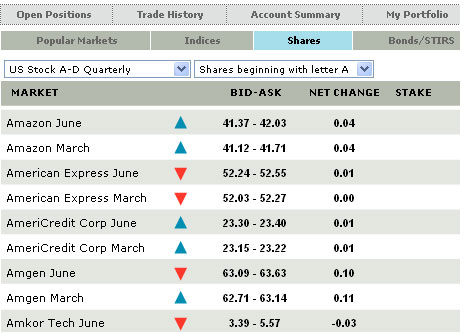

caption: US shares bets, the quarterly bets

and then compare it to this one...

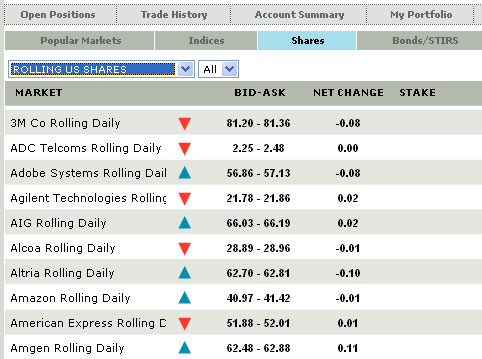

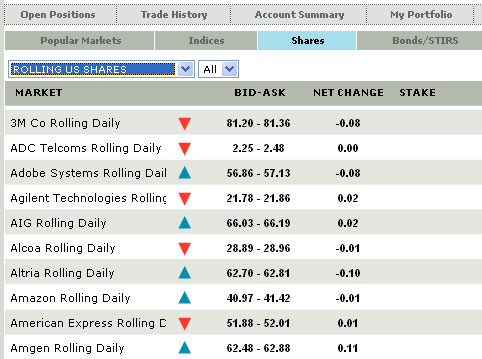

caption: - and the 'Rolling Daily' (intraday priced) versions

- look at American Express

In the upper picture American Express is listed as

American Express June at 52.24 - 52.55

American Express March at 52.03 - 52.27

whilst in the lower picture we see American Express Rolling Daily 51.88 - 52.01

What gives? Well, first off as the market is closed the spreads tend to go a bit odd, the bid and ask (ie the sell and buy prices) get a lot further apart - when the markets are open these spreads are much tighter, but they still show what I want to get across - the prices differ for different bets on the same share (or index, commodity, etc). The "June" price is where you are betting that the price will go outside the quoted spread in your favour before the June bet "times out"... it's a bet on the future value of the share, and bets are made based on them closing on a specific date in March, June, September, and December each year. Consequently Capital Spreads are offering bets on the "next two quarters", so in March the March future bet will stop trading and anyone still holding a bet at that time will either have it closed out and the profit/loss then showing will be applied, or it can be "rolled over" (I'll explain that in a moment).

Now it stands to reason that the price will move over time, so the likely price for a share in March will differ from that in June, and so on. The price will move away from the current share price to reflect where it is expected to go, and there are all sorts of boring things involved like interest payments on the future, and so on... a future is really a contract to deliver something on a specific settlement day, so what you are sort of betting on is:-

"Some people have contracted to deliver some shares in American express on a specific date in March (or June, etc) to some other people. The first group think that they know what those shares will be worth then better than the second lot, and vice versa."

It's not really complicated (ho ho), but it is outside the scope of this little piece, so feel free to read up on futures.... just think of it as "what the share is expected to be worth" and it's chart for American Express. It also explains why the March price and the June price are different to each other - different delivery date, different period to calculate interest over... different futures price. The daily rolling price is, by contrast, a delight - it will match what you see on your real-time screen, give or take the few cents/pennies the spreadbet company are skimming off each trade. Consequently when you look at the daily rolling price and compare it to the live price for the share, hey presto, it matches.

Now I for one find this easier to handle - the spreadbet quote moves (a trifle sluggishly at times perhaps) as I see the price on my real-time charts move, and what I see on the chart is pretty well the same as on my spreadbet positions list - the difference is the bit they skim off, a cent or two mostly, and I know where the price needs to be on the real-time chart for it to equal breakeven on my account.

What was that "rolling" bit, and what is "rolling over"?

Suppose you were long on American Express at 52.01, you entered during the "doldrum" period (from 11.15/11.30 to about 2pm EST... call it 4.15 - 7.15pm UK winter time). The chart is stubborn, it refuses to move as the close approaches and you are positive it's going to climb.... you could close the bet and enter a new one tomorrow, this will cost you a few pounds all told, or you can "roll it over" - a small fee (rolling over a daily bet on a $25 share came to about 20p yesterday when I did it) will ensure the bet stays open and resumes tomorrow. Now personally, at the moment, I don't want to do that - I was trying to close the bet I mentioned and due to a minor hitch the market closed seconds before I got to the icon to do it. I don't like it, because overnight gaps are fairly common, and whilst a gap up of $1 would be a nice £100 bonus at £1 a point I don't want to pay £100 per dollar moved if the gap is in the other direction! However, it is possible to do it, if you want to.

What's IMR?

IMR means the "initial margin requirement", and basically it tells you how many pounds must be free for trading for every point bet on each share, index etc. On Capital Spreads AXP (I got fed up typing American Express, that's the ticker for it), has an IMR of 250. That means you must have £250 in the pot, free - ie not already allocated to a trade - for every £1 you want to bet on AXP. So you bet long on AXP for £1 a point, you need £250 in your account. If your losses get big enough to exceed what you have then you will be given a short period to put extra money into your account. After that 2 minutes is over (okay, maybe a bit longer - I'm just trying to stress that they aren't going to wait very long at all before you've had your chance) they'll close open positions until you are in the black, or they're all shut and you still owe money.

Now if you have only got a few hundred quid, and are limited to a minimum of £1/point, then seeing Google with an IMR of 500 is going to tell you something - you can't afford to trade Google. You look at your account balance, and however many pounds are in it is the total IMR you can afford to bet - so if you have £500 in the pot and trade Disney (IMR=130) and General Motors (IMR 200) that's 330 gone, you can't trade anything with an IMR above 170 without closing one of the open pair because the IMR will add up to more "points" than you have got pounds to cover. Simple.

Choosing shares to trade

What I find useful - okay, I am currently trading small amounts in the daily US shares, I have copied many of the "daily US rolling" shares to my portfolio, and I have the same shares set up in esignal for charting. I've typed the same list into Excel and it lists the IMR and the sector the share is in as well as other things such as volatility.

Right at the very bottom are shares I don't touch - ADCT (ADC Telco) has an IMR of only 10... the share price is tiny, $2.30 or so, and a huge bar is about 3c in size... the spread is very small, but still huge as a fraction of the moves you can trade. There is a trade off - low IMR can be considered low risk from some viewpoints, with smaller price moves generally. Some $20 shares bounce around far more than some $50 ones, but overall the low IMR shares are less inclined to give a heart attack. The downside is that the swings can be so small that you are not really likely to gain a great amount from the winners, and there's little point trading small positions where wins are minimal but spreads produce a steady drain. You need to find a price area you are happy and over time you will probably find you like certain shares and trade them much more often than others.

It is also useful to know the share's volatility - you can get a range of data to describe this, volatility figures for different periods, ATR (Average True Range) and so on, but you can't be sure which is best until you decide how you'll trade. Somebody looking to trade over an extended period might find something like the 20 day volatility useful, but an intraday trader looking to move in and out of short period swings might find it more useful to find a tool capable of reporting the range or average of price swings the share experiences, or simply to eyeball a chart to visually assess that sort of detail.

Automatic stops

If you use Capital Spreads, and for all I know others do this as well, then your trade may have an automatic stop placed under it when you select a long (ie buy) bet - or above it if shorting. On Capital Spreads this is called a Computer Generated Stop Loss (CGSL) and they've got a formula that calculates an automatic stop at around 80% of the entry, which is nice I suppose, but personally my first action after entering a trade tends to be to move the stop much closer to the price - it's just a matter on Capital Spreads of opening the "Order Book" tab, clicking the "amend" button alongside the stop I want to change, and tapping a new price in. Why? If the chart goes the wrong way I want out, I got it wrong - even so a rapid move can catch you out - so having the stop $2 away isn't much use!

Making a bet

What's it like then? Here's an example -

I decide that National Semiconductor (NSM) looks like it's going to go up, it's one of the tickers listed in "my portfolio" which is the tab I have selected most of the time.

On the line alongside each share name in the portfolio (or share listing screens) there's a button labelled "trade" next to a small blank box. I click on the box so that I can type my stake into it, and as I'm small fry I type "1" in to inform them that I want to place a £1 per point bet (ie I win or lose £1 for every cent NSM moves). I click the "trade" button and a small popup appears that tells me the current prices on offer for NSM, one for shorting the price, one for going long on it - I click the "buy" button if I think the price will rise, and the "sell" button if I want to bet on it falling (these boxes and buttons aren't shown when the markets are closed, so they're not showing in my screenshots).

The important bit here is that the company don't know which I want to do until I have seen their prices - they can't wait to see that I'm going long and then raise the price a bit, which is one thing that might worry beginners unaware of how this works.

I now have an open position as soon as the trade goes through, which is usually a few seconds after I hit the buttons. I can go to my "trade history" tab and see this new trade listed there, I can look at my "open positions" and it's there. At the bottom of the screen my current account balance is shown, and for each trade I have active my open positions screen continually updates to show me which are winning/losing, and by how much, what the current prices for it are, what I paid for them, and so forth, so I'm never unaware of how much I have at stake, how much I am in profit or losing.

Drawbacks

If you're one of the talented and lucky few who excel at spreadbetting you may eventually need to consider other means of trading the markets, such as direct access. No matter what the spreadbet companies say I'm sure they're not really as pleased as they make out if a customer takes 10 grand a week off them, and you'll be looking to save the extra cost over and above the spread visible in the market anyhow.

It's risky - you are betting purely on the price move, so if NSM is $25.00 and it goes up to $25.10 at £1 a point, you stand to make £10 profit (ignoring the spread, which will probably mean you made more like £5) and you would have had to have £50 in your account to cover the margin requirement (IMR). Now, to make £10 on NSM through traditional share dealing would require almost $19.00 profit and you'd have had to buy 190 shares at $25 each, which is $4750, or around £2500. That's leverage, using a small amount of money to get the effect of a much bigger amount.

The downside to this is that you are effectively multiplying the price moves - if you have a £500 account then proceed to pick a few bad shares that go down instead of up (shorts, obviously, would be the opposite) it doesn't take long to have a bunch of trades that lose $5 between them - or £500 as far as your account goes! You have got to keep your eye on your trades, have effective stops in place to preserve your capital when you aren't watching the price, and you must realise all the time that this leverage means you can go rich or broke much faster than you would trading the actual shares. If you think Amazon is going up, you bet long or a share trader would buy long - next day it has dropped $1, the share trader grunts, that's a 2.5% loss just about... the share isn't a basket case but it's going the wrong way. The spread betting customer with a £500 pot has lost £100, the account is down 20% in one go - they don't grunt so much as make a thudding sound.

A note about security

I have, occasionally, had the PC play silly B's while I have bets in play, and recovered it all quickly enough not to worry - but commonsense dictates that you keep a note of your account details and the spreadbet company's phone number to hand. You really don't want to be poised to exit a position, have the PC go down, and be unable to contact the spreadbet company to exit. Prices on the more volatile stocks can move quickly, and at even £1 a point a 10 minute loss of contact could be expensive. This is another reason why you should change the computer generated stop to a more sensible, closer position as soon as a bet is underway - bad enough to find you can't exit via PC and phone the day the local telephone exchange is hit by a meteorite, never mind having it happen when your stop is so far from the share entry that it represents a 50% loss! Some spreadbet types keep a mobile phone handy as a third backup system. There's no limit, really, to how secure you might choose to make this.

Finally - the PC itself must be secure. You should have an antivirus program running, with virus definitions bang up to date, and the program set to update itself automatically. You should have it set to scan all incoming and outgoing mail, and not only schedule a regular scan of the whole PC but actually let it do it regularly - scheduling it, getting annoyed when it starts, and hitting the "stop scan" button doesn't count! My favourite is Norton Antivirus, but there are a good few out there - just pick a good one.

You should have a firewall program running - I use Zone Alarm Pro, which costs about $30, there is a free version "Zone Alarm Plus" that is almost as good and will keep you safe.

Microsoft has an AntiSpyware program which is currently free to download - it's at

http://www.microsoft.com/athome/security/spyware/software/default.mspx

this will help ensure that nobody manages to stick a small program on your PC to report interesting things like your username/password back to head office.

The three items above will go a long way towards keeping you safe, and just about invisible to hackers. You cannot afford to have your PC crash due to a virus, you cannot afford to lose your passwords to a spyware program, and you certainly don't want anyone spotting your PC on the internet and hacking into it while you are online. These programs should be on everyone's PC if they go online anyway, and all together they'll cost about £30.

In summary...

You will need to find suitable charting too - you need a good datafeed whatever period you chart. I shouldn't have to say this but don't try intraday trading based on the 15 or 20 minute delayed charts shown on the spreadbet site!

Trading requires deep pockets, right?

Nope.

I'm pretty sure that out of the 20 odd thousand T2W members not every one of them has £500,000 - £1,000,000 to invest - in fact I'd take a long right now on the probability that thousands and thousands would consider £1000 quite a big lump to invest, especially as so many of us are struggling to learn how to survive, let alone win.

So let's assume you have a few hundred, or a couple of thousand, to invest. You like trading, you want to make some money - what could be simpler than that? The really good bit is this - if you get good at it then simple old compound interest and time will make you rich, regardless of where you start. If you are pants at it (trans: not overly effective) then you will achieve the reverse - a dwindling money supply (save the last 50p or so for a Mars bar, you'll need the energy for running from the spouse).

What can you do with £500 - £1000 then? Well, trading shares the traditional way is right out - a long trade on £1000 of shares means all your money is invested in one trade - that's very risky indeed. After paying the broker to buy the shares, plus the spread (more on that soon) plus a tax called stamp duty in the UK, it all combines to ensure that even after risking everything on one throw of the die* you've as much chance of coming out ahead over anything less than a glacial period as I have of becoming Pope.

(*Dice is the plural of die - with £1000 you can't afford two of them)

Fortunately there is an alternative, and with £1000 you can spreadbet. With a pot this size, if you're a daytrading type, you could run a number of trades per day at £1 per point.

As an example I'll choose five stocks from yesterday (20 January) selected solely on the basis of their margin requirements and imagining we had mastered trading to a perfect level. You could, for example, have traded General Motors, Biogen, Home Depot, Qualcom and Intuit. If, through amazing prescience, we had shorted at the highs and longed at the lows - Home Depot we profited by £74, £55 on GM, BIIB (Biogen) we made £297, INTU we went long and made £155, QCOM we made £110. Okay, my cheapo calculator says that with this perfect timing and £1000 in my SB account I could have made 69% profit in a single day. £1000 may not seem that much to start with, but let me tell you, at 69% a day I could make a hamster a billionaire inside a year. Unfortunately, though, even Luke Skywalker with the force would be unable to achieve this level of trading mastery and while spreadbetting may make it easier to make a few trades on a limited budget, it does not, of course, make trading itself any easier.

How do I get started?

I'm not going to attempt a comprehensive coverage of spreadbetting here but I am planning to highlight a few things that will speed you along the path from "rabbit in headlights" to "frightened but having a clue" - after that it's up to you to decide where to go next - this is for raw beginners.

Okay, first off - what is a spreadbet? Simplified the spreadbetting company is a bookmaker, they list things you can spreadbet, like shares, indices, commodities, forex and so on, some offer bets on sports, mortgage rates, all sorts. I'm going to stick to shares mainly, the mechanics of trading financial items like shares, commodities (all that "buy sugar, sell lean hogs" stuff) and indices (buying/selling bets on the Dow, FTSE and so on) work pretty much the same. Sports etc won't be wildly different, but I don't touch them.

Before you open a cash account, you can trade with pretend money (paper trading) with most of them, so you can practise long before you risk real money. Accounts can be funded online with your switch or credit card, and it all goes through fairly quickly and smoothly these days. A number of companies are mentioned in countless threads and there are also reviews in the T2W reviews section - go read some.

I'm going to use things I see/do in my Capital Spreads account as being "typical" spreadbet company stuff, different companies will vary in how things are done, what is available, etc - but in the main they're all going to have more similarities than differences.

So, you enter your username, tap in your clever password (pa44w0rd - cue furious logging in to change passwords all over the planet) and you see a list of popular bets on offer, plus a bunch of tabs offering you the option to look at different lists.

Here's a picture (about time):-

caption: Main Screen once logged in (partial)

This is the sort of thing you'll see once past the login - these screenshots were taken after the US markets closed on Friday 21 Jan 2005, by the way. This is just a mix of bits and pieces, but we can use this to see what info is available to us - obviously the column reading "closed" isn't much use right now, but let's check the rest out. Whichever spreadbet company you go with the info here will be somewhere around the screens your own spreadbet company presents - you'll soon become familiar with other screens.

Okay, tabs at the top, left to right. Open positions lets you see all current bets, you can see what you have in play, and there are simple icons to click on to call up a dealing window to close each one. To open a bet you also just click on an icon, a small popup appears to tell you the current prices on offer, and there are "buy" and "sell" buttons on it, also (of course) a button to quit without trading because you went off the idea. Buttons/icons are there to call up charts, info on the share, transfer to portfolio etc (not shown, as markets are shut, are buttons to initiate your bets).

Why is there more than one price on offer?

Yes, there is a price for buying, and one for selling - they are different, look at the DAX Rolling Daily above (never mind what it IS, just look at the price...). 4193-4196 is the quote, if you want to buy this bet, ie you are betting that the DAX will go up, then you buy at 4196. If you think it will fall you short it (sell) at 4193. If you are watching the Dax on a live feed like esignal or ADVFN then it might be showing 4194.5.... if you are long it has to go up 1.5 points before you break even at 4196, a short trade will break even after it has fallen 1.5 points to 4193. That's the basic idea - the company quotes one price to buyers, a different price to sellers, and the few pennies in the middle is where they make their money day in, day out, taking a few coppers off every trade (that, and people like me losing, of course).

caption: Example of the range of shares you can spreadbet

This is a single dropdown, listing the share collections we can look at to find items to trade. We'll see shortly what "rolling" and "Quarterly" means.... you see that Capital Spreads will let you trade UK, US, European, German (DAX) and French (CAC40) shares.

Okay, let's concentrate on stocks - each spreadbet company will be different, but generally speaking you'll find lots to trade, each company deciding what to offer bets on.

More tabs then (quickly) - the others allow you to check a list of trades you've made, you can see what

stop losses are ready for your open trades, you can call up a window to add money from bank or credit card to your account, you can make a portfolio of shares up by selecting from the lists on the main display. You can see on the lower row of tabs the different categories of instrument you can trade - shares, indices, commodities, forex, and so forth. Click a tab, pick what you want to trade, and you simply tap how many "units" to trade and click the trade icon to call up the dealing popup. "Units" - some brokers will let you trade as low as 1p to a point while learning, a fairly average minimum trade is £1 (or $1) to point... what this means is simply that for every 1c price change on a US share you win or lose £1. (Eeek!)

You DO therefore need to keep an eye on things, a share that gaps down $2 will cost you £200, and stop losses only work if the price passes through them, not past them. Some spreadbet companies offer guaranteed stops - ie you're out at the chosen price, gap or not. These tend to cost more in the form of a bigger gap between the price you enter at and the price you break even at - all spreadbets, on entry, will be at least a pound or two in loss because you'll be "the spread" adrift at entry, the trick is to get to break even and into profit as soon as possible! The spread varies, depending on what you trade, but it'll generally amount to a small bit more than the bid-ask spread you see in your real-time datafeed.... it's shown on the screen, and continually updated when markets are open, so just make a point to check it before trading.... there's no point trading a share that is rangebound in a 10c wide range if the spread is 15c!

Why are some prices different for different months?

We haven't finished with price yet - check this screen out....

caption: US shares bets, the quarterly bets

and then compare it to this one...

caption: - and the 'Rolling Daily' (intraday priced) versions

- look at American Express

In the upper picture American Express is listed as

American Express June at 52.24 - 52.55

American Express March at 52.03 - 52.27

whilst in the lower picture we see American Express Rolling Daily 51.88 - 52.01

What gives? Well, first off as the market is closed the spreads tend to go a bit odd, the bid and ask (ie the sell and buy prices) get a lot further apart - when the markets are open these spreads are much tighter, but they still show what I want to get across - the prices differ for different bets on the same share (or index, commodity, etc). The "June" price is where you are betting that the price will go outside the quoted spread in your favour before the June bet "times out"... it's a bet on the future value of the share, and bets are made based on them closing on a specific date in March, June, September, and December each year. Consequently Capital Spreads are offering bets on the "next two quarters", so in March the March future bet will stop trading and anyone still holding a bet at that time will either have it closed out and the profit/loss then showing will be applied, or it can be "rolled over" (I'll explain that in a moment).

Now it stands to reason that the price will move over time, so the likely price for a share in March will differ from that in June, and so on. The price will move away from the current share price to reflect where it is expected to go, and there are all sorts of boring things involved like interest payments on the future, and so on... a future is really a contract to deliver something on a specific settlement day, so what you are sort of betting on is:-

"Some people have contracted to deliver some shares in American express on a specific date in March (or June, etc) to some other people. The first group think that they know what those shares will be worth then better than the second lot, and vice versa."

It's not really complicated (ho ho), but it is outside the scope of this little piece, so feel free to read up on futures.... just think of it as "what the share is expected to be worth" and it's chart for American Express. It also explains why the March price and the June price are different to each other - different delivery date, different period to calculate interest over... different futures price. The daily rolling price is, by contrast, a delight - it will match what you see on your real-time screen, give or take the few cents/pennies the spreadbet company are skimming off each trade. Consequently when you look at the daily rolling price and compare it to the live price for the share, hey presto, it matches.

Now I for one find this easier to handle - the spreadbet quote moves (a trifle sluggishly at times perhaps) as I see the price on my real-time charts move, and what I see on the chart is pretty well the same as on my spreadbet positions list - the difference is the bit they skim off, a cent or two mostly, and I know where the price needs to be on the real-time chart for it to equal breakeven on my account.

What was that "rolling" bit, and what is "rolling over"?

Suppose you were long on American Express at 52.01, you entered during the "doldrum" period (from 11.15/11.30 to about 2pm EST... call it 4.15 - 7.15pm UK winter time). The chart is stubborn, it refuses to move as the close approaches and you are positive it's going to climb.... you could close the bet and enter a new one tomorrow, this will cost you a few pounds all told, or you can "roll it over" - a small fee (rolling over a daily bet on a $25 share came to about 20p yesterday when I did it) will ensure the bet stays open and resumes tomorrow. Now personally, at the moment, I don't want to do that - I was trying to close the bet I mentioned and due to a minor hitch the market closed seconds before I got to the icon to do it. I don't like it, because overnight gaps are fairly common, and whilst a gap up of $1 would be a nice £100 bonus at £1 a point I don't want to pay £100 per dollar moved if the gap is in the other direction! However, it is possible to do it, if you want to.

What's IMR?

IMR means the "initial margin requirement", and basically it tells you how many pounds must be free for trading for every point bet on each share, index etc. On Capital Spreads AXP (I got fed up typing American Express, that's the ticker for it), has an IMR of 250. That means you must have £250 in the pot, free - ie not already allocated to a trade - for every £1 you want to bet on AXP. So you bet long on AXP for £1 a point, you need £250 in your account. If your losses get big enough to exceed what you have then you will be given a short period to put extra money into your account. After that 2 minutes is over (okay, maybe a bit longer - I'm just trying to stress that they aren't going to wait very long at all before you've had your chance) they'll close open positions until you are in the black, or they're all shut and you still owe money.

Now if you have only got a few hundred quid, and are limited to a minimum of £1/point, then seeing Google with an IMR of 500 is going to tell you something - you can't afford to trade Google. You look at your account balance, and however many pounds are in it is the total IMR you can afford to bet - so if you have £500 in the pot and trade Disney (IMR=130) and General Motors (IMR 200) that's 330 gone, you can't trade anything with an IMR above 170 without closing one of the open pair because the IMR will add up to more "points" than you have got pounds to cover. Simple.

Choosing shares to trade

What I find useful - okay, I am currently trading small amounts in the daily US shares, I have copied many of the "daily US rolling" shares to my portfolio, and I have the same shares set up in esignal for charting. I've typed the same list into Excel and it lists the IMR and the sector the share is in as well as other things such as volatility.

Right at the very bottom are shares I don't touch - ADCT (ADC Telco) has an IMR of only 10... the share price is tiny, $2.30 or so, and a huge bar is about 3c in size... the spread is very small, but still huge as a fraction of the moves you can trade. There is a trade off - low IMR can be considered low risk from some viewpoints, with smaller price moves generally. Some $20 shares bounce around far more than some $50 ones, but overall the low IMR shares are less inclined to give a heart attack. The downside is that the swings can be so small that you are not really likely to gain a great amount from the winners, and there's little point trading small positions where wins are minimal but spreads produce a steady drain. You need to find a price area you are happy and over time you will probably find you like certain shares and trade them much more often than others.

It is also useful to know the share's volatility - you can get a range of data to describe this, volatility figures for different periods, ATR (Average True Range) and so on, but you can't be sure which is best until you decide how you'll trade. Somebody looking to trade over an extended period might find something like the 20 day volatility useful, but an intraday trader looking to move in and out of short period swings might find it more useful to find a tool capable of reporting the range or average of price swings the share experiences, or simply to eyeball a chart to visually assess that sort of detail.

Automatic stops

If you use Capital Spreads, and for all I know others do this as well, then your trade may have an automatic stop placed under it when you select a long (ie buy) bet - or above it if shorting. On Capital Spreads this is called a Computer Generated Stop Loss (CGSL) and they've got a formula that calculates an automatic stop at around 80% of the entry, which is nice I suppose, but personally my first action after entering a trade tends to be to move the stop much closer to the price - it's just a matter on Capital Spreads of opening the "Order Book" tab, clicking the "amend" button alongside the stop I want to change, and tapping a new price in. Why? If the chart goes the wrong way I want out, I got it wrong - even so a rapid move can catch you out - so having the stop $2 away isn't much use!

Making a bet

What's it like then? Here's an example -

I decide that National Semiconductor (NSM) looks like it's going to go up, it's one of the tickers listed in "my portfolio" which is the tab I have selected most of the time.

On the line alongside each share name in the portfolio (or share listing screens) there's a button labelled "trade" next to a small blank box. I click on the box so that I can type my stake into it, and as I'm small fry I type "1" in to inform them that I want to place a £1 per point bet (ie I win or lose £1 for every cent NSM moves). I click the "trade" button and a small popup appears that tells me the current prices on offer for NSM, one for shorting the price, one for going long on it - I click the "buy" button if I think the price will rise, and the "sell" button if I want to bet on it falling (these boxes and buttons aren't shown when the markets are closed, so they're not showing in my screenshots).

The important bit here is that the company don't know which I want to do until I have seen their prices - they can't wait to see that I'm going long and then raise the price a bit, which is one thing that might worry beginners unaware of how this works.

I now have an open position as soon as the trade goes through, which is usually a few seconds after I hit the buttons. I can go to my "trade history" tab and see this new trade listed there, I can look at my "open positions" and it's there. At the bottom of the screen my current account balance is shown, and for each trade I have active my open positions screen continually updates to show me which are winning/losing, and by how much, what the current prices for it are, what I paid for them, and so forth, so I'm never unaware of how much I have at stake, how much I am in profit or losing.

Drawbacks

If you're one of the talented and lucky few who excel at spreadbetting you may eventually need to consider other means of trading the markets, such as direct access. No matter what the spreadbet companies say I'm sure they're not really as pleased as they make out if a customer takes 10 grand a week off them, and you'll be looking to save the extra cost over and above the spread visible in the market anyhow.

It's risky - you are betting purely on the price move, so if NSM is $25.00 and it goes up to $25.10 at £1 a point, you stand to make £10 profit (ignoring the spread, which will probably mean you made more like £5) and you would have had to have £50 in your account to cover the margin requirement (IMR). Now, to make £10 on NSM through traditional share dealing would require almost $19.00 profit and you'd have had to buy 190 shares at $25 each, which is $4750, or around £2500. That's leverage, using a small amount of money to get the effect of a much bigger amount.

The downside to this is that you are effectively multiplying the price moves - if you have a £500 account then proceed to pick a few bad shares that go down instead of up (shorts, obviously, would be the opposite) it doesn't take long to have a bunch of trades that lose $5 between them - or £500 as far as your account goes! You have got to keep your eye on your trades, have effective stops in place to preserve your capital when you aren't watching the price, and you must realise all the time that this leverage means you can go rich or broke much faster than you would trading the actual shares. If you think Amazon is going up, you bet long or a share trader would buy long - next day it has dropped $1, the share trader grunts, that's a 2.5% loss just about... the share isn't a basket case but it's going the wrong way. The spread betting customer with a £500 pot has lost £100, the account is down 20% in one go - they don't grunt so much as make a thudding sound.

A note about security

I have, occasionally, had the PC play silly B's while I have bets in play, and recovered it all quickly enough not to worry - but commonsense dictates that you keep a note of your account details and the spreadbet company's phone number to hand. You really don't want to be poised to exit a position, have the PC go down, and be unable to contact the spreadbet company to exit. Prices on the more volatile stocks can move quickly, and at even £1 a point a 10 minute loss of contact could be expensive. This is another reason why you should change the computer generated stop to a more sensible, closer position as soon as a bet is underway - bad enough to find you can't exit via PC and phone the day the local telephone exchange is hit by a meteorite, never mind having it happen when your stop is so far from the share entry that it represents a 50% loss! Some spreadbet types keep a mobile phone handy as a third backup system. There's no limit, really, to how secure you might choose to make this.

Finally - the PC itself must be secure. You should have an antivirus program running, with virus definitions bang up to date, and the program set to update itself automatically. You should have it set to scan all incoming and outgoing mail, and not only schedule a regular scan of the whole PC but actually let it do it regularly - scheduling it, getting annoyed when it starts, and hitting the "stop scan" button doesn't count! My favourite is Norton Antivirus, but there are a good few out there - just pick a good one.

You should have a firewall program running - I use Zone Alarm Pro, which costs about $30, there is a free version "Zone Alarm Plus" that is almost as good and will keep you safe.

Microsoft has an AntiSpyware program which is currently free to download - it's at

http://www.microsoft.com/athome/security/spyware/software/default.mspx

this will help ensure that nobody manages to stick a small program on your PC to report interesting things like your username/password back to head office.

The three items above will go a long way towards keeping you safe, and just about invisible to hackers. You cannot afford to have your PC crash due to a virus, you cannot afford to lose your passwords to a spyware program, and you certainly don't want anyone spotting your PC on the internet and hacking into it while you are online. These programs should be on everyone's PC if they go online anyway, and all together they'll cost about £30.

In summary...

- decide what to trade -commodities, shares, etc.

- decide the type of trader you are - impatient types might look at intraday swings, those with excess patience might look for long term trends.

- stick all the instruments you intend to pick the trades from into your spreadbet portfolio.

- consider doing what I do - copy the portfolio into Excel or similar, and add columns of useful data (volatility, IMR, current share price perhaps). The idea is that you want the important data readily to hand when trading... you don't want to jump at a share price move only to discover the bet is rejected because your margin limit has been exceeded.

- keep the information readily to hand (and a phone, of course) so you can exit trades if your PC or internet connection go down.

- ensure your PC is secured against virus, intrusion, and spyware.

- open a simulated account with spreadbet companies (try several) to get as familiar as you can with the platform - consider having more than one "live" account when the time comes, some companies are regarded as being better than others for one particular type of bet.

- review your progress critically, not just trading success but are you buying/selling the right stocks etc? Are your trades only just clearing the spread costs because the share price moves aren't big enough - on the other hand are you trading items that are too volatile, risking too big a loss from what is a "noisy" price chart?

You will need to find suitable charting too - you need a good datafeed whatever period you chart. I shouldn't have to say this but don't try intraday trading based on the 15 or 20 minute delayed charts shown on the spreadbet site!

Last edited by a moderator: