SOLIDECN

Senior member

- Messages

- 3,041

- Likes

- 0

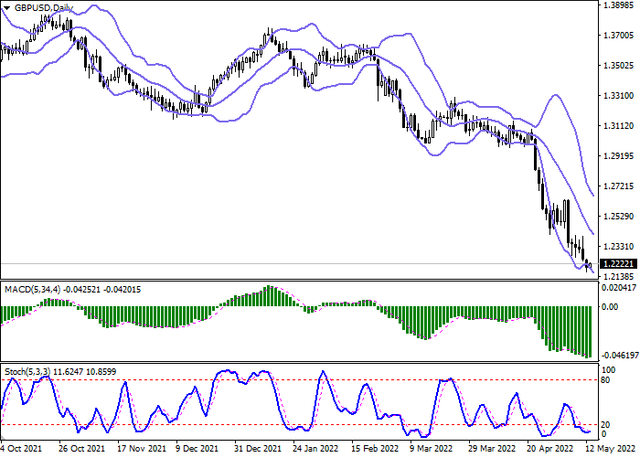

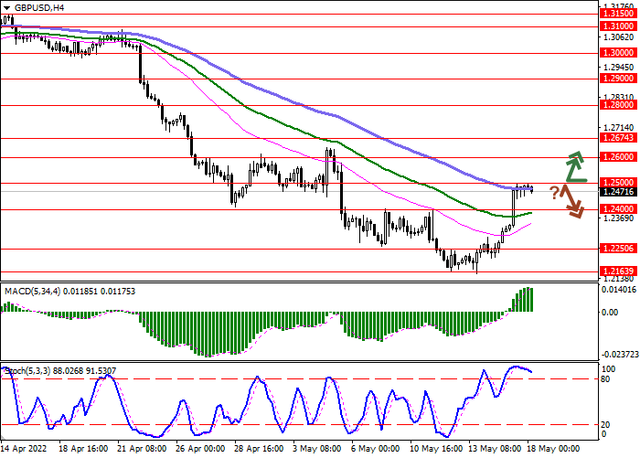

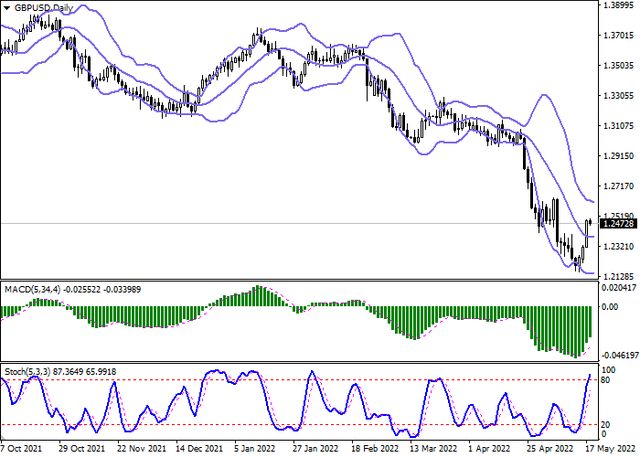

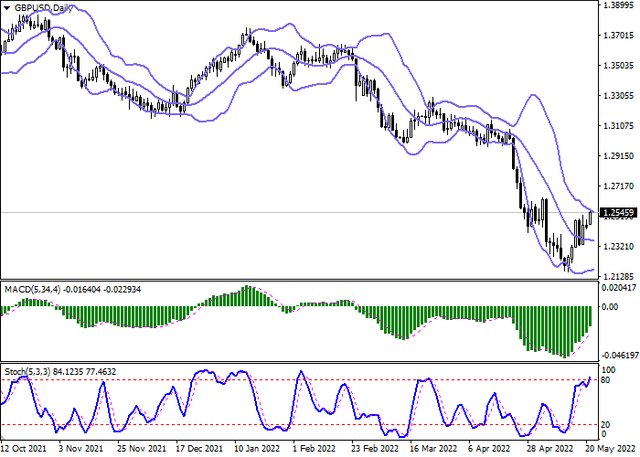

The British pound is trading up against the US currency, trying to recover from four sessions of decline, which led to new record lows since June 2020. The instrument remains under pressure from extremely low demand for risky assets, which, in turn, pushes the US currency to update record highs.

Despite an attempt by the Bank of England to stabilize the situation, experts fear that a sharp rise in interest rates could have an extremely negative impact on the recovery of the British economy, up to the onset of a recession. Meanwhile, the situation with energy resources remains tense, given that the EU and the UK continue to increase sanctions pressure against the Russian economy in response to a special military operation in Ukraine. Last Sunday, the leaders of the G7 countries held talks via videoconference, during which they supported the decision to phase out energy resources, as well as a ban on oil imports from Russia.

The data published the day before put additional pressure on the British currency. Thus, BRC Like-For-Like Retail Sales in April showed a decrease of 1.7% after falling by 0.4% a month earlier, while analysts expected an acceleration of negative dynamics, but expected a slightly more modest decrease of –1.6%. Tomorrow, investors will follow the publication of updated data on the dynamics of UK GDP for Q1 2022.

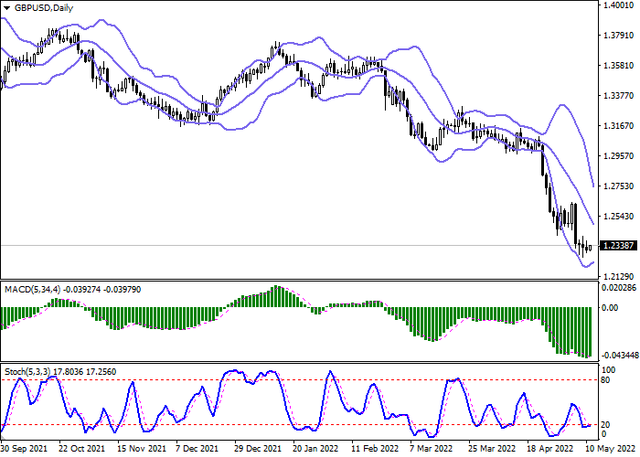

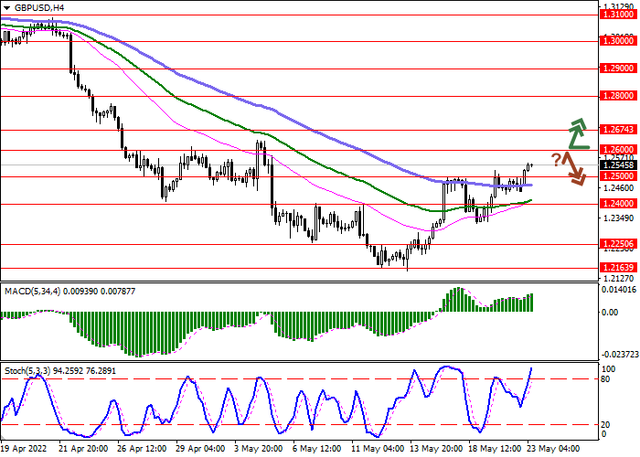

Bollinger Bands on the daily chart show a steady decline. The price range is narrowing, reflecting the emergence of multidirectional trading dynamics in the short term. MACD indicator reverses to growth while forming a new buy signal (the histogram is about to consolidate above the zero level). Stochastic shows similar dynamics, recovering from its lows, indicating the risks of oversold pound in the ultra-short term.

Resistance levels: 1.24, 1.25, 1.26, 1.2674 | Support levels: 1.225, 1.22, 1.215, 1.21