TraderPerkins

Newbie

- Messages

- 6

- Likes

- 0

Thought it would be a fun way to share my trading set-ups and analysis. This journal is only my opinion, right or wrong on the outcome, I'm just putting it out there.

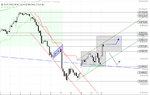

Mostly trade DAX XETRA these days with the use of a CFD account and financial spread betting account. Partial to some SMI trades and the occasional S&P trades as I find these 3 markets the easiest to chart and follow.

I do not trade markets such as FTSE or Dow Jones or FX, even commodities I tend not to get involved with as I find them harder to chart successfully over the longer term. I prefer to trade markets that work with my style of TA rather than be a 'Jack Of All Trades'... excuse the pun.

Main interpretation of charts is with the use of trend-lines, channels, support/resistance, candlesticks, multi time frames and some indicators, just your normal everyday run of the mill TA stuff that always gets rubbished 🙂

One final note, I have set this journal to only allow people to post on it that are on my contact list. So if you want to take-part, then request acceptance. Helps keep the journal tidy.

Thanking you.

Mostly trade DAX XETRA these days with the use of a CFD account and financial spread betting account. Partial to some SMI trades and the occasional S&P trades as I find these 3 markets the easiest to chart and follow.

I do not trade markets such as FTSE or Dow Jones or FX, even commodities I tend not to get involved with as I find them harder to chart successfully over the longer term. I prefer to trade markets that work with my style of TA rather than be a 'Jack Of All Trades'... excuse the pun.

Main interpretation of charts is with the use of trend-lines, channels, support/resistance, candlesticks, multi time frames and some indicators, just your normal everyday run of the mill TA stuff that always gets rubbished 🙂

One final note, I have set this journal to only allow people to post on it that are on my contact list. So if you want to take-part, then request acceptance. Helps keep the journal tidy.

Thanking you.