Time and time again, I have said that all humans were never designed to become consistently profitable traders. There are many reasons why the majority of individuals fail to make regular profits from Forex trading, but in the end, it all stems from the simple fact that most people are completely unaware of the difference between perception and reality.

Ever since people began to speculate in the money markets, there has been this common belief that only the top guys in Wall Street have the experience and knowledge to do it successfully. The average Joe has always been advised to stay well away from making their own trading and investing decisions and instead hand over their hard-earned cash to the experts in the institutions to make these life-changing choices for them. This simple idea alone is a clear example of why understanding the clear difference between perception and reality is so vital. Who says that Wall Street knows best? Who says that stock brokers are the only ones who know where the next big opportunity is? Generally, it is a herd mentality and fear which leads us to make these assumptions and if you truly want to take charge of your financial future and not leave it in the hands of somebody else, then I highly suggest that it's time to shift your thought process. In discussing the various areas of Forex trading where the perception and reality imbalance is so grossly out of sync; so much so that it can easily punish any novice trader in the early stages of their career, in this article I would like to explore the difference between price and value.

Many people mistakenly believe that there is some kind of mystic art to becoming a successful trader. Sure, it does take the right education at the start and a high level of commitment and discipline to make it work, but anyone can do it if they put in the right amount of effort. In all honesty, the simpler one keeps their trading, the better. It's not about pouring yourself over every inch of fundamental analysis, or applying complicated strategies with numerous technical indicators. Instead, it is the ongoing application of objective price action analysis and detailed risk management skills which prove to be the trump cards time and time again. Note in that last sentence I said "price." Don't forget it because price is the only honest thing any trader is ever given to work with in the markets. If you strive to focus on understanding what governs the movement of price in any given direction, then you already have an advantage over the rest. Those two magic words, Supply and Demand, can be your very best friend in this business only if you know how to read them. In my ongoing Extended Learning Track (XLT) sessions, my students work with me to fully recognize the true imbalances in the market which create the biggest Forex market movements. The analysis we do each day is both unemotional and objective. This is the only way to make trading work because the minute anyone allows even an inch of personal opinion into the decision making process, they are unlikely to succeed.

So what is the root of personal opinion? There are many different aspects we could talk about but through my own experiences of teaching and trading, I have found that too many novice speculators decide to make their trading choices based on what they perceive as value. They see a stock or a currency pair going up so they decide to buy it as what they believe is that its value is rising and if they don't buy it soon, they will then miss out on the chance to sell it at a later time for a profit. What they are failing to analyze is the actual price, or whether the asset itself is currently cheap or expensive. Profitable businesses make money consistently by buying low and selling high and trading should be no different. Let's say I walk into an antiques store looking to purchase a decorative vase. Now assuming I know very little about antique vases (which I don't!), the store manager could easily show me the most expensive item in the store and convince me that this is the one I should be buying due to the fact that it is rare and very collectible. Not only will it look good in my home, but it is likely to hold its value or even rise in price in time. But what is the guarantee of this? I will only make money selling it in the future if there is willing demand for my vase. I would be making my decision to purchase the vase purely on its perceived value and maybe because of a good salesman! If I knew nothing about the vase beforehand, I could easily run the risk of paying way too much cash for it and end up investing in a loser over time. However, if I knew my stuff ahead of time and had researched the price history of vases of this type, I would be at the advantage of knowing, well in advance, if I was getting a good deal or not. Trading Forex in many ways is very similar. There is a huge difference between price and value, and many of the technical tools available to us worldwide have a nasty habit of being completely unable to differentiate between the two.

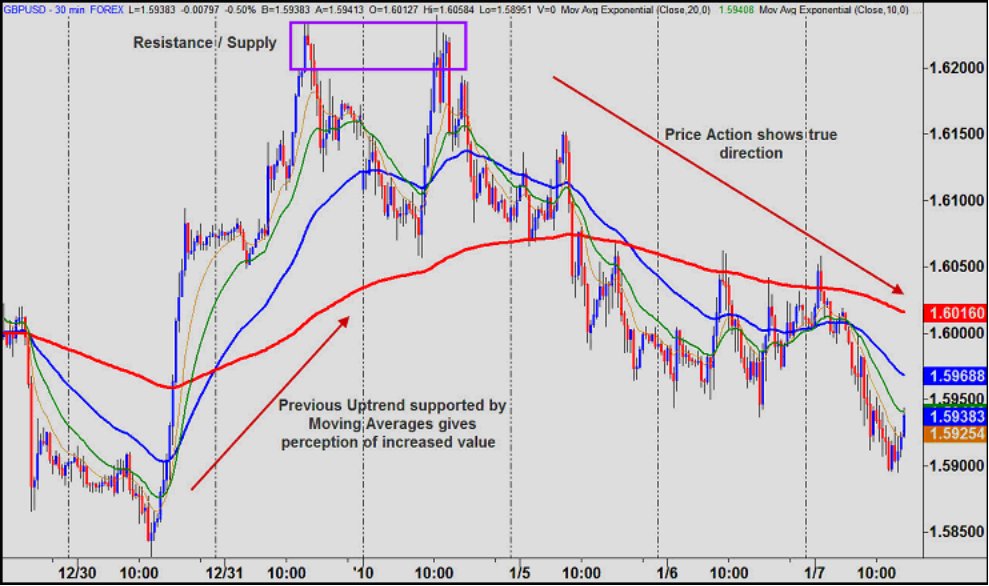

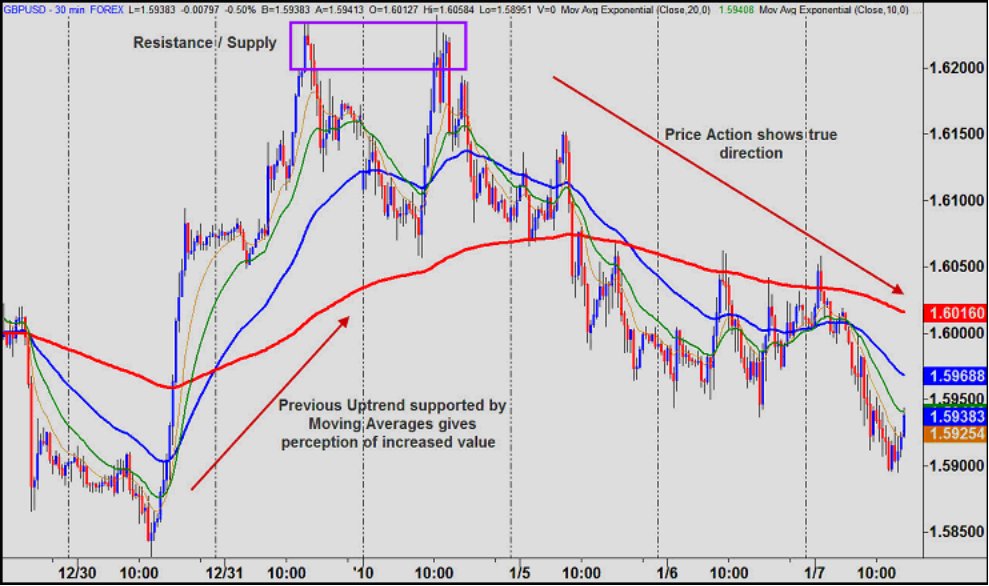

Let's take a brief look at some recent price activity of GBPUSD on a 30 min time frame:

After testing December lows of 1.5830, GBPUSD went on to rally to beyond 1.6200. Now looking at this uptrend, it can be easy for any novice to be enticed to buy into the currency pair and why not? It's in an uptrend and if we apply our Moving Average indicators to the picture, we can clearly see that they are all sloping up and showing that average price is increasing at a steady rate. The objective trader would take a completely different approach to this, though, and note that while GBPUSD was increasing in value, it failed to trade above the 1.6200 with any real conviction, hinting that we were at a price level where supply was objectively greater than demand. Upon the second test of the resistance area marked above, the currency pair failed miserably in its effort to further its gains and sold-off heavily to revisit the 1.5900 price level at the time of writing this article. So much for those moving averages, eh? While the increasing value of GBPUSD lured the newbie into buying the pair, the actual price action of the currency showed the professional trader that we were objectively at a high price offering a low risk, high probability opportunity to short the Pound once more.

Professional traders make it their sole aim to analyze price; nothing more, nothing less. What one person perceives as valuable may seem ridiculous to another. If we are honest with ourselves, value itself is a highly subjective concept. Price on the other hand is what it is: High or Low. Only by adopting this understanding into our everyday trading plan can we ever truly hope to be consistently profitable in the money markets

Sam Evans can be contacted by email Here

Ever since people began to speculate in the money markets, there has been this common belief that only the top guys in Wall Street have the experience and knowledge to do it successfully. The average Joe has always been advised to stay well away from making their own trading and investing decisions and instead hand over their hard-earned cash to the experts in the institutions to make these life-changing choices for them. This simple idea alone is a clear example of why understanding the clear difference between perception and reality is so vital. Who says that Wall Street knows best? Who says that stock brokers are the only ones who know where the next big opportunity is? Generally, it is a herd mentality and fear which leads us to make these assumptions and if you truly want to take charge of your financial future and not leave it in the hands of somebody else, then I highly suggest that it's time to shift your thought process. In discussing the various areas of Forex trading where the perception and reality imbalance is so grossly out of sync; so much so that it can easily punish any novice trader in the early stages of their career, in this article I would like to explore the difference between price and value.

Many people mistakenly believe that there is some kind of mystic art to becoming a successful trader. Sure, it does take the right education at the start and a high level of commitment and discipline to make it work, but anyone can do it if they put in the right amount of effort. In all honesty, the simpler one keeps their trading, the better. It's not about pouring yourself over every inch of fundamental analysis, or applying complicated strategies with numerous technical indicators. Instead, it is the ongoing application of objective price action analysis and detailed risk management skills which prove to be the trump cards time and time again. Note in that last sentence I said "price." Don't forget it because price is the only honest thing any trader is ever given to work with in the markets. If you strive to focus on understanding what governs the movement of price in any given direction, then you already have an advantage over the rest. Those two magic words, Supply and Demand, can be your very best friend in this business only if you know how to read them. In my ongoing Extended Learning Track (XLT) sessions, my students work with me to fully recognize the true imbalances in the market which create the biggest Forex market movements. The analysis we do each day is both unemotional and objective. This is the only way to make trading work because the minute anyone allows even an inch of personal opinion into the decision making process, they are unlikely to succeed.

So what is the root of personal opinion? There are many different aspects we could talk about but through my own experiences of teaching and trading, I have found that too many novice speculators decide to make their trading choices based on what they perceive as value. They see a stock or a currency pair going up so they decide to buy it as what they believe is that its value is rising and if they don't buy it soon, they will then miss out on the chance to sell it at a later time for a profit. What they are failing to analyze is the actual price, or whether the asset itself is currently cheap or expensive. Profitable businesses make money consistently by buying low and selling high and trading should be no different. Let's say I walk into an antiques store looking to purchase a decorative vase. Now assuming I know very little about antique vases (which I don't!), the store manager could easily show me the most expensive item in the store and convince me that this is the one I should be buying due to the fact that it is rare and very collectible. Not only will it look good in my home, but it is likely to hold its value or even rise in price in time. But what is the guarantee of this? I will only make money selling it in the future if there is willing demand for my vase. I would be making my decision to purchase the vase purely on its perceived value and maybe because of a good salesman! If I knew nothing about the vase beforehand, I could easily run the risk of paying way too much cash for it and end up investing in a loser over time. However, if I knew my stuff ahead of time and had researched the price history of vases of this type, I would be at the advantage of knowing, well in advance, if I was getting a good deal or not. Trading Forex in many ways is very similar. There is a huge difference between price and value, and many of the technical tools available to us worldwide have a nasty habit of being completely unable to differentiate between the two.

Let's take a brief look at some recent price activity of GBPUSD on a 30 min time frame:

After testing December lows of 1.5830, GBPUSD went on to rally to beyond 1.6200. Now looking at this uptrend, it can be easy for any novice to be enticed to buy into the currency pair and why not? It's in an uptrend and if we apply our Moving Average indicators to the picture, we can clearly see that they are all sloping up and showing that average price is increasing at a steady rate. The objective trader would take a completely different approach to this, though, and note that while GBPUSD was increasing in value, it failed to trade above the 1.6200 with any real conviction, hinting that we were at a price level where supply was objectively greater than demand. Upon the second test of the resistance area marked above, the currency pair failed miserably in its effort to further its gains and sold-off heavily to revisit the 1.5900 price level at the time of writing this article. So much for those moving averages, eh? While the increasing value of GBPUSD lured the newbie into buying the pair, the actual price action of the currency showed the professional trader that we were objectively at a high price offering a low risk, high probability opportunity to short the Pound once more.

Professional traders make it their sole aim to analyze price; nothing more, nothing less. What one person perceives as valuable may seem ridiculous to another. If we are honest with ourselves, value itself is a highly subjective concept. Price on the other hand is what it is: High or Low. Only by adopting this understanding into our everyday trading plan can we ever truly hope to be consistently profitable in the money markets

Sam Evans can be contacted by email Here

Last edited by a moderator: