tradingdde

Junior member

- Messages

- 13

- Likes

- 1

Please give a look to this strategy based on a mix among Larry Williams, Toby Crabel and Linda Bradford studies.

_______________________

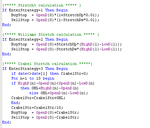

Basic rules for futures 5 min charts:

Enter rules

- Wait for a daily compression (ex NR1, IdNR4)

- Wait for an Opening Range Breakout (intraday price goes over(under) the Day Open+(-) a percentage)

- Enter on the retracement on a 9 period moving average

Exit on daily close

Protective Stop %

Trailing Stop based on 100 Mov Avg

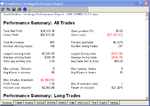

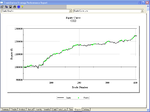

Attached you find TradeStation backtest on the Italian future in the last 9 years 5min data.

Is anyone studying similar strategies on other futures; Does anyone want to share experiences on these subjects?

_______________________

Basic rules for futures 5 min charts:

Enter rules

- Wait for a daily compression (ex NR1, IdNR4)

- Wait for an Opening Range Breakout (intraday price goes over(under) the Day Open+(-) a percentage)

- Enter on the retracement on a 9 period moving average

Exit on daily close

Protective Stop %

Trailing Stop based on 100 Mov Avg

Attached you find TradeStation backtest on the Italian future in the last 9 years 5min data.

Is anyone studying similar strategies on other futures; Does anyone want to share experiences on these subjects?