Open interest is without a doubt the least used bit of market data by chart watchers. Conventional wisdom; prices up on increasing O.I. being bullish, is just as often found to be bearish.

What I want to show here is the relationship of O.I. and the buying patterns of the Commercials for the Commitment of Traders (COT) report.

I'll begin by showing a chart of gold with an indicator I'm sure you have never seen before, a 13 week stochastics of just Open Interest. Yes, this index is simply an oscillator of O.I. What we see is that, generally speaking, low levels in this index are found at market bottoms.

Thinking about it makes sense as what it is telling us is there is little interest, open or not, in the market we are studying. I have marked off every time the index fell below 10% on the chart, admittedly this was "chosen" on a best fit basis.

We also see there are times the O.I. measure is low and the price of Gold does not rally, it is at a top and declines. Can this be rectified?

Yes and here's how. The next chart is of the same time period, only this time I have placed a 26 week stochastics of the net Commercial position. For a moment let's focus on just this index.

High readings tell us the Commercials, producers and users or hedgers, have been doing more buying than selling. Typically prices rally following such readings, but not always; this business is just not that easy.

We can, though, think of a bullish condition by imagining a time when the Commercials have been doing a great deal of buying---that usually means a low, while at the same time Open Interest has dropped---which also usually means a low.

This is a somewhat rare condition, but one to be on the lookout for. The essences of the numbers are saying something like this;

What a double dose of bullishness this should be, and in fact the charts prove the point.

Here we see the results; note how on the middle of 2002 O.I., the blue line, was at a very low reading while at the same time the red line, Commercial buying, was high telling us that the only "player" in the game were the big guys and their action was on the long side.

Again in the middle of 2003 O.I. dropped to next to nothing, while the Commercials became heavy buyers and Gold began to glitter.

At the end of 2004 the opposite condition set up, low O.I. and a large short position by the commercials, shortly thereafter Gold broke down. And on it goes, study the chart and you will see we have a nice "set up" for rally when "no one wants to buy" except the commercials.

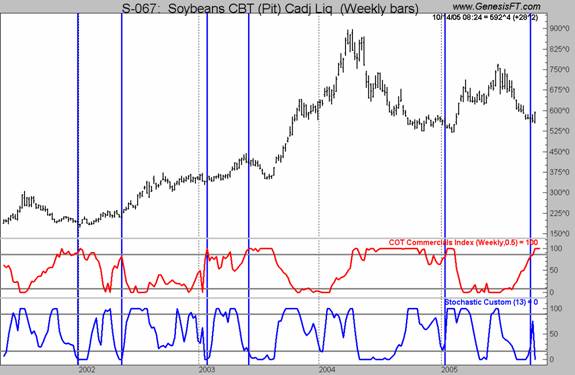

SOYBEANS---The first chart here shows just the O.I. indicator where again we see low readings as most likely found at the start of important upside moves. This is perhaps the ultimate contrary opinion indicator, an and indicator we have not put to full use

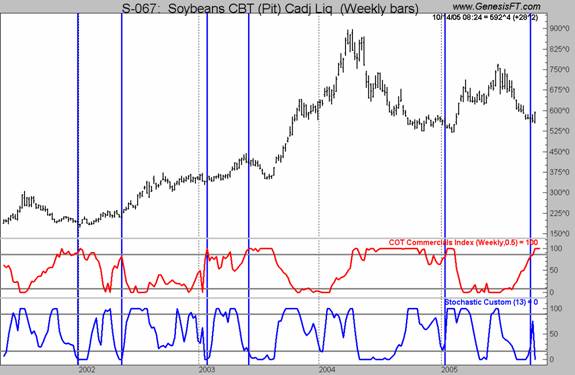

Now lets look at times we have the double whammy effect of Commercials buying and Open Interest low.

Now we can see the set ups I have spoken of and as you see the presented a trader with numerous major moves. Do not think this is a timing tool or technique, at least that's not the way I use it. To me this is all about getting a market set up - or ready - to move to the upside.

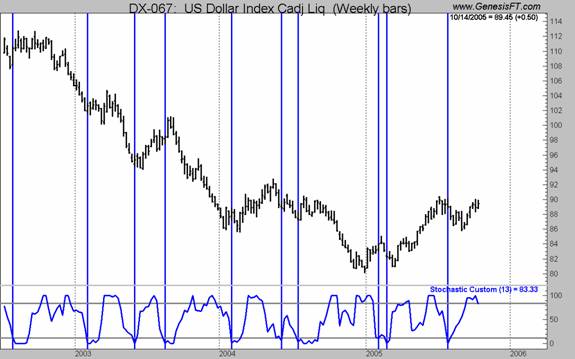

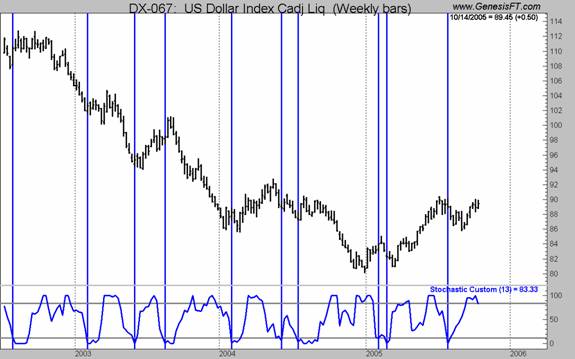

THE DOLLAR INDEX

Again we see the familiar pattern of low O.I. being bullish, but not always. We saw high O.I. readings just before prices declined in early 2005 and then again later in the year. This tells us to be careful, we cannot bank, or trade on this pattern alone, that we cam do better by seeing who the buyers are at these time of little attention.

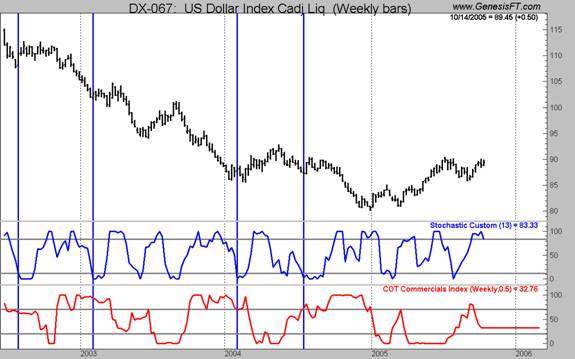

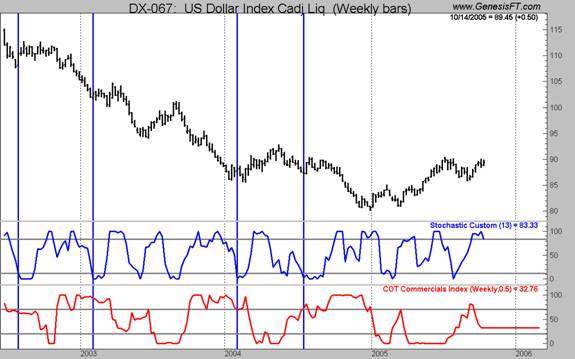

The next chart shows the addition of the Commercial index as a guide to confirm the possible bullish set ups suggested by O.I.

SELLING SHORT----

Finally we can look at the exact opposite - high readings in Open Interest and low or bearish readings from the Commercials. We saw how effective that was in soybeans and the same pattern is seen here.

It makes sense - after all we have an insight into what real people are doing with real money, not some mystic number or invisible line reaching through space. What we have here is a time of great attention to the market - hence the high Open Interest reading. But the attention or buying is not being done by the smart, commercial money. Instead the rally or buying has been from trend followers and the public, hence a market top usually unfolds and usually more quickly than expected.

What I want to show here is the relationship of O.I. and the buying patterns of the Commercials for the Commitment of Traders (COT) report.

I'll begin by showing a chart of gold with an indicator I'm sure you have never seen before, a 13 week stochastics of just Open Interest. Yes, this index is simply an oscillator of O.I. What we see is that, generally speaking, low levels in this index are found at market bottoms.

Thinking about it makes sense as what it is telling us is there is little interest, open or not, in the market we are studying. I have marked off every time the index fell below 10% on the chart, admittedly this was "chosen" on a best fit basis.

We also see there are times the O.I. measure is low and the price of Gold does not rally, it is at a top and declines. Can this be rectified?

Yes and here's how. The next chart is of the same time period, only this time I have placed a 26 week stochastics of the net Commercial position. For a moment let's focus on just this index.

High readings tell us the Commercials, producers and users or hedgers, have been doing more buying than selling. Typically prices rally following such readings, but not always; this business is just not that easy.

We can, though, think of a bullish condition by imagining a time when the Commercials have been doing a great deal of buying---that usually means a low, while at the same time Open Interest has dropped---which also usually means a low.

This is a somewhat rare condition, but one to be on the lookout for. The essences of the numbers are saying something like this;

No one is interested in this market (low O.I.)

No one but the smart guys (high Commercial readings)

No one but the smart guys (high Commercial readings)

What a double dose of bullishness this should be, and in fact the charts prove the point.

Here we see the results; note how on the middle of 2002 O.I., the blue line, was at a very low reading while at the same time the red line, Commercial buying, was high telling us that the only "player" in the game were the big guys and their action was on the long side.

Again in the middle of 2003 O.I. dropped to next to nothing, while the Commercials became heavy buyers and Gold began to glitter.

At the end of 2004 the opposite condition set up, low O.I. and a large short position by the commercials, shortly thereafter Gold broke down. And on it goes, study the chart and you will see we have a nice "set up" for rally when "no one wants to buy" except the commercials.

SOYBEANS---The first chart here shows just the O.I. indicator where again we see low readings as most likely found at the start of important upside moves. This is perhaps the ultimate contrary opinion indicator, an and indicator we have not put to full use

Now lets look at times we have the double whammy effect of Commercials buying and Open Interest low.

Now we can see the set ups I have spoken of and as you see the presented a trader with numerous major moves. Do not think this is a timing tool or technique, at least that's not the way I use it. To me this is all about getting a market set up - or ready - to move to the upside.

THE DOLLAR INDEX

Again we see the familiar pattern of low O.I. being bullish, but not always. We saw high O.I. readings just before prices declined in early 2005 and then again later in the year. This tells us to be careful, we cannot bank, or trade on this pattern alone, that we cam do better by seeing who the buyers are at these time of little attention.

The next chart shows the addition of the Commercial index as a guide to confirm the possible bullish set ups suggested by O.I.

SELLING SHORT----

Finally we can look at the exact opposite - high readings in Open Interest and low or bearish readings from the Commercials. We saw how effective that was in soybeans and the same pattern is seen here.

It makes sense - after all we have an insight into what real people are doing with real money, not some mystic number or invisible line reaching through space. What we have here is a time of great attention to the market - hence the high Open Interest reading. But the attention or buying is not being done by the smart, commercial money. Instead the rally or buying has been from trend followers and the public, hence a market top usually unfolds and usually more quickly than expected.

Last edited by a moderator: