inakocibelli

Junior member

- Messages

- 16

- Likes

- 0

🙂

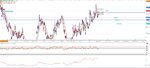

NZD/USD has created a beautiful head and shoulders on the 4hr chart. However there will be high volatility and uncertainty in the market today, due to many important economic releases including FED’s interest rate decisions.

Considering the price action of these last days we believe that it is time for NZDUSD to retrace most of March’s rally as bears seem to have control for the moment with the SMA 20 having crossed SMA50 on the H4 and H1 chart. While Moving Averages are lagging indicators, we are using them as an indication of the overall trend.

A break of the neckline (0.6830 level) would open more space on the downside, however with the SMA 200 right below that level, NZDUSD might jump back as it is an important support. What we would like to see now is a recovery around 0.6920 levels and that would be the perfect level to short as the stop loss will be around 25 pips above that level.

The first target for this short is 0.6810. In the event that SMA 200 is breached and one H4 candlestick is closed below that, it would be a good sign for the short setup and we might ride NZDUSD down to 0.6750, and later on 0.6670 right above SMA 200 in the Daily chart.

In the event that NZDUSD does not jump back and reach our entry point but the neckline is breached immediately and at least one H1 candlestick is closed below 0.68250, we will enter short in market prices.

Stop Loss = 0.6950 TP1 = 0.6810*

TP2 = 0.6750 TP3 = 0.6670

NZD/USD has created a beautiful head and shoulders on the 4hr chart. However there will be high volatility and uncertainty in the market today, due to many important economic releases including FED’s interest rate decisions.

Considering the price action of these last days we believe that it is time for NZDUSD to retrace most of March’s rally as bears seem to have control for the moment with the SMA 20 having crossed SMA50 on the H4 and H1 chart. While Moving Averages are lagging indicators, we are using them as an indication of the overall trend.

A break of the neckline (0.6830 level) would open more space on the downside, however with the SMA 200 right below that level, NZDUSD might jump back as it is an important support. What we would like to see now is a recovery around 0.6920 levels and that would be the perfect level to short as the stop loss will be around 25 pips above that level.

The first target for this short is 0.6810. In the event that SMA 200 is breached and one H4 candlestick is closed below that, it would be a good sign for the short setup and we might ride NZDUSD down to 0.6750, and later on 0.6670 right above SMA 200 in the Daily chart.

In the event that NZDUSD does not jump back and reach our entry point but the neckline is breached immediately and at least one H1 candlestick is closed below 0.68250, we will enter short in market prices.

Stop Loss = 0.6950 TP1 = 0.6810*

TP2 = 0.6750 TP3 = 0.6670