Hello, I requested free tickets for the New York Trader Expo and I received an email promotion for a $25 dollar account with FXCM. I had planned on opening an account with a $1000 or so with Oanda in the next month or so. Now, I guess I'll play around with this. I am already starting to feel a level of excitement and anxiety I have never felt paper trading for the last year.

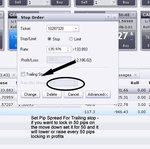

From what I understand, I can only trade in microlots which are 1000 units a piece. So thats .10cents a pip. This is obviously a problem for a 25 dollar account as I can't money mange as well as id like to. I am all ears if anyone would like to give me any advice about money management in this situation. Should i even try to trade a longer TF?

Anyway right now i'm looking at eur/usd. seeing what happens at resistance at 3036 area. im overall bullish on this pair. I think it may break thru resistance.

From what I understand, I can only trade in microlots which are 1000 units a piece. So thats .10cents a pip. This is obviously a problem for a 25 dollar account as I can't money mange as well as id like to. I am all ears if anyone would like to give me any advice about money management in this situation. Should i even try to trade a longer TF?

Anyway right now i'm looking at eur/usd. seeing what happens at resistance at 3036 area. im overall bullish on this pair. I think it may break thru resistance.