Grey1

Senior member

- Messages

- 2,190

- Likes

- 210

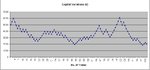

Money managment

Lets say Joe, had £5000 and decided to trade the market to buy a private jet..

Also lets say he had a trading strategy with 50% success rate ( coin flipping strategy ) and he never had to pay any commission not even a penny ... Joe is a simple man and likes to keep things simple so he risks 10% of his capital in every trade and takes profit after 10% gain .. ( Reward / Risk =1 )

After 200 trades what is going to happen to Joe

1) He buys his jet

2) He can not afford to buy his jet but he makes profit

3) He goes bankrupt and gets a job in his local Pub

What you think is going to happen to Joe ?

Iraj

Lets say Joe, had £5000 and decided to trade the market to buy a private jet..

Also lets say he had a trading strategy with 50% success rate ( coin flipping strategy ) and he never had to pay any commission not even a penny ... Joe is a simple man and likes to keep things simple so he risks 10% of his capital in every trade and takes profit after 10% gain .. ( Reward / Risk =1 )

After 200 trades what is going to happen to Joe

1) He buys his jet

2) He can not afford to buy his jet but he makes profit

3) He goes bankrupt and gets a job in his local Pub

What you think is going to happen to Joe ?

Iraj