After Tuesday’s slaughtering session, the U.S indices bounced back during yesterday’s trading day, led by the financial sector. Even though the increase wasn’t nearly as high as Tuesday’s drop, the major indices managed to hold above recent support levels, showing further consolidation patterns.

Bullish sentiment was sparked across the board as the senate announced that it had reached an agreement, compromising with the House of Representatives on a $789 billion package, to help the economy. The Dow Jones added gains of 0.6%, while the Nasdaq increased by a mere 0.4%

As stated above the major movers were the financials, retracing a fair part of their prior losses. After dropping by 19% on Tuesday, Bank of America bounced back by over 10%, while Citigroup increased by approximately 7%.

Despite the positive sentiment in the U.S, the Stimulus agreement didn’t have a bullish impact on all the markets as economic data published earlier during the session continued to weigh on investors. Europe’s unemployment rate increased to a whopping 6.3%, while Germany’s inflation continued to show a negative figure. In addition The Federal Budget Balance showed a phenomenal figure of -83.80B. To date, analysts are expecting the deficit to reach an enormous figure of -1.6 trillion, towards the end of September this year.

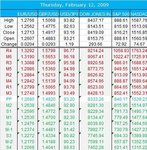

On the Forex Market the Dollar continued to consolidate against an array of currency pairs. The Dollar index yet again traded within recent range patterns, bouncing off upper resistance throughout the session. As shown on dodjit’s “chart analysis” page, most of the pairs are now stuck between support & resistance. Ranging strategies should be used in today’s current market, until the pairs receive a clear break.

On the commodity market Crude oil gapped up during yesterday’s session, closing the day at $42.47 per barrel. Even though inventories in the U.S showed an increase, coming out at 4.70M, investors snapped up the black Gold on speculation that the price might have reached a market bottom. Gold continued higher due to the current economic uncertainty, breaking resistance of $931, closing the session at approximately $938 per ounce.

Looking forward, the U.S is scheduled to release its retail sales result later today, a result that should show a slight improvement compared to last month’s -2.70% figure. In addition eyes will focus on unemployment claims, scheduled at 12:30 GMT. During the U.S session ECB president Trichet will be releasing his notes, regarding the ECB’s future activity. Forex traders normally observe officials comments trying to receive clues regarding future monetary policy.

Bullish sentiment was sparked across the board as the senate announced that it had reached an agreement, compromising with the House of Representatives on a $789 billion package, to help the economy. The Dow Jones added gains of 0.6%, while the Nasdaq increased by a mere 0.4%

As stated above the major movers were the financials, retracing a fair part of their prior losses. After dropping by 19% on Tuesday, Bank of America bounced back by over 10%, while Citigroup increased by approximately 7%.

Despite the positive sentiment in the U.S, the Stimulus agreement didn’t have a bullish impact on all the markets as economic data published earlier during the session continued to weigh on investors. Europe’s unemployment rate increased to a whopping 6.3%, while Germany’s inflation continued to show a negative figure. In addition The Federal Budget Balance showed a phenomenal figure of -83.80B. To date, analysts are expecting the deficit to reach an enormous figure of -1.6 trillion, towards the end of September this year.

On the Forex Market the Dollar continued to consolidate against an array of currency pairs. The Dollar index yet again traded within recent range patterns, bouncing off upper resistance throughout the session. As shown on dodjit’s “chart analysis” page, most of the pairs are now stuck between support & resistance. Ranging strategies should be used in today’s current market, until the pairs receive a clear break.

On the commodity market Crude oil gapped up during yesterday’s session, closing the day at $42.47 per barrel. Even though inventories in the U.S showed an increase, coming out at 4.70M, investors snapped up the black Gold on speculation that the price might have reached a market bottom. Gold continued higher due to the current economic uncertainty, breaking resistance of $931, closing the session at approximately $938 per ounce.

Looking forward, the U.S is scheduled to release its retail sales result later today, a result that should show a slight improvement compared to last month’s -2.70% figure. In addition eyes will focus on unemployment claims, scheduled at 12:30 GMT. During the U.S session ECB president Trichet will be releasing his notes, regarding the ECB’s future activity. Forex traders normally observe officials comments trying to receive clues regarding future monetary policy.

Attachments

Last edited by a moderator: