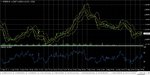

The single currency recorded slight increase against the dollar on Monday, breaking a two-day negative series. The pair moved within a narrow range with extreme values reached at 1.1341 and 1.1301, and finally the euro rose 11 pips to a closing price of 1.1319. Index relative strength develops in negative territory as the price remains limited by the resistance at 1.1350 and moving averages upwards.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The single currency rose against the dollar on Monday to 1.1322 or with a growth of only 0.09%. The pair is in a narrow range in anticipation of inflation data in the US today, which could present a clearer picture of the future of the US economy.

On Monday the euro/dollar was in a correctional phase during the day. The euro rebounded against the US dollar to a mark of 1.1342 after declining manufacturing activity in New York to minus 9.02 vs. the forecasts of 6.50 plus. By the close of the trading day the couple returned to the level of 1.1315.

Yesterday EURUSD initially rose but found enough selling pressure at the 50-day moving average to give back some of its gains but closed in the green, although near the low of the day, but managed to close within the Fridays range, suggesting being slightly on the bearish side of neutral.

The pair is trading below the 10 and the 50-day moving averages that are acting as dynamic resistances although still trading above the 200-day moving average that is acting as a dynamic support.

The key levels to watch are: Daily resistance at 1.1459, the 10-day moving average at 1.1367 (resistance), the 50-day moving average at 1.1333 (resistance), a daily support at 1.1237, a swing low at 1.1141 (support) and a daily support at 1.1097.

The pair is trading below the 10 and the 50-day moving averages that are acting as dynamic resistances although still trading above the 200-day moving average that is acting as a dynamic support.

The key levels to watch are: Daily resistance at 1.1459, the 10-day moving average at 1.1367 (resistance), the 50-day moving average at 1.1333 (resistance), a daily support at 1.1237, a swing low at 1.1141 (support) and a daily support at 1.1097.

Today the attention of traders will be focused on data on inflation in the UK and the US. Later, three representatives of the US Federal Reserve will make their statements. The day will be difficult for the single currency, as in Asia the pound and the Australian dollar strengthened considerably to all currencies.

On Tuesday, the dollar is stable against other major currencies, as investors remained cautious ahead of a string of US economic reports, which will be released later today. Investors are preparing for release later in the session US data on the housing sector, consumer prices and industrial production in the search for further instructions on the strength of the US economy. The EUR/USD is stable at 1.1324.

arigoldman

Established member

- Messages

- 626

- Likes

- 10

Awaiting the FOMC Minutes tomorrow.

victoriajensen

Established member

- Messages

- 648

- Likes

- 10

EUR/USD found some support at 1.1280 and formed a spinning top candlestick above that level on the daily time-frame, so we might see a move to the upside, but I doubt anything major will happen before the fundamentals tomorrow.

EUR/USD didn’t move significantly on Tuesday and continued trading at familiar levels for the second consecutive day. The euro depreciated softly to 1.1311 and reached extremes at 1.1348 and 1.1301. Fed minutes failed to support the US dollar. Bears remain in the leading position, which will be reinforced by break of 1.1280.

Yesterday EURUSD initially rose but found enough selling pressure again at the 50-day moving average to give back all of its gains and closed in the red, near the low of the day, but managed to close within the previous day range, suggesting being slightly on the bearish side of neutral.

The pair is trading below the 10 and the 50-day moving averages that are acting as dynamic resistances although still trading above the 200-day moving average that is acting as a dynamic support.

The key levels to watch are: Daily resistance at 1.1459, the 10-day moving average at 1.1358(resistance), the 50-day moving average at 1.1333 (resistance), a daily support at 1.1237, a swing low at 1.1141 (support) and a daily support at 1.1097.

The pair is trading below the 10 and the 50-day moving averages that are acting as dynamic resistances although still trading above the 200-day moving average that is acting as a dynamic support.

The key levels to watch are: Daily resistance at 1.1459, the 10-day moving average at 1.1358(resistance), the 50-day moving average at 1.1333 (resistance), a daily support at 1.1237, a swing low at 1.1141 (support) and a daily support at 1.1097.

victoriajensen

Established member

- Messages

- 648

- Likes

- 10

EUR/USD broke below 1.1280 but right now everyone are waiting for the FOMC meeting minutes announcement. The news will likely push the pair to 1.1200 again.

On Wednesday session the euro recorded its worst performance against the dollar since mid-April after Fed minutes hinted for a rate hike next month. The single currency plummeted and closed at levels of daily low at 1.1215. Negative mood is still actual, but the relative strength index hints overselling. Eventual correction could bring bears back.

Yesterday EURUSD fell sharply with a wide range after the FOMC minutes and closed near the low of the day, in addition managed to close below the previous day low, suggesting a strong bearish momentum.

The pair is trading below the 10 and the 50-day moving averages that are acting as dynamic resistances although still trading above the 200-day moving average that is acting as a dynamic support.

The key levels to watch are: The 50-day moving average at 1.1333 (resistance), the 10-day moving average at 1.1339 (resistance), a daily resistance at 1.1237, a swing low at 1.1141 (support) and a daily support at 1.1097.

The pair is trading below the 10 and the 50-day moving averages that are acting as dynamic resistances although still trading above the 200-day moving average that is acting as a dynamic support.

The key levels to watch are: The 50-day moving average at 1.1333 (resistance), the 10-day moving average at 1.1339 (resistance), a daily resistance at 1.1237, a swing low at 1.1141 (support) and a daily support at 1.1097.

victoriajensen

Established member

- Messages

- 648

- Likes

- 10

After the fundamentals yesterday EUR/USD broke below 1.1200 today although it's currently retracing. That said, the move to the downside will likely continue.

Last edited:

On Thursday, the dollar raised against other major currencies, despite the publication of disappointing US data, as renewed expectations of Fed rate in June continued to support the national currency. The EUR/USD fell 0.17% to 1.1195, the lowest level since March 29.