Autonomy (au.) the once darling of the stock market still having tough times...with bearish comments appearing from analysts and chart break out failures...

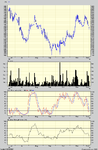

After 2 bottoming in sept and oct at 160ish level, au. tried very hard to reach and break through august high of 428...it did reach once in Nov, but failed to break through and retraced to 340-50 only to retry in early Dec not only to fail again, but also making 3 tops at the same level and starting falling fast ever since...

Interestingly bearish comments followed, looks like the market has exagerated the demand for its products and the common believe that it's got no competition is not true and now facing potent rivals...

Going back to the chart, the last 2 top look seriously nasty with the trough in between being more than 70 points deep...suggesting a possible pull back to trough-70 referring 270ish levels...

Again interestingly 270 is a major support level for au.

Both stochastics now below 20 line with K flat D still falling...looking at the history fo au. stochastics one can see they can spend a long time below 20 line, so that doesnt necessarily refer to a buy due to over sold...

RSI still falling sharply, havent reached the 30 line where historically it finds supports on some cases...

Last fall has been sharp, 80 points in about 10 days...unless this starts a reaction bounce, I dont see any reason why au. shouldnt retest 270 its low of early November...

Just put it on my shorting list to watch as of Monday...

Riz

After 2 bottoming in sept and oct at 160ish level, au. tried very hard to reach and break through august high of 428...it did reach once in Nov, but failed to break through and retraced to 340-50 only to retry in early Dec not only to fail again, but also making 3 tops at the same level and starting falling fast ever since...

Interestingly bearish comments followed, looks like the market has exagerated the demand for its products and the common believe that it's got no competition is not true and now facing potent rivals...

Going back to the chart, the last 2 top look seriously nasty with the trough in between being more than 70 points deep...suggesting a possible pull back to trough-70 referring 270ish levels...

Again interestingly 270 is a major support level for au.

Both stochastics now below 20 line with K flat D still falling...looking at the history fo au. stochastics one can see they can spend a long time below 20 line, so that doesnt necessarily refer to a buy due to over sold...

RSI still falling sharply, havent reached the 30 line where historically it finds supports on some cases...

Last fall has been sharp, 80 points in about 10 days...unless this starts a reaction bounce, I dont see any reason why au. shouldnt retest 270 its low of early November...

Just put it on my shorting list to watch as of Monday...

Riz

Attachments

Last edited: