oildaytrader

Senior member

- Messages

- 2,806

- Likes

- 125

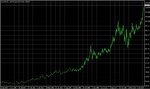

Gold will rise and remain strong because

1) Economies are weak and interest rates are falling, therefore it costs less to hold gold as an asset.

2) Gold is a hedge against inflation. The current monetary policies are building up hyperinflation for the future.

3) Gold is a hedge against the U S dollar. The U S dollar is set for devaluation because they have printed so much paper money. See videos below about money

4) Gold is a hedge against deflation

5) When world economies recover oil will recover to $80 to $200 per barrel. It will lead to a rise in inflation.Gold will benefit.

6)The economic demise will lead to social unrest , political uncertainty and increase in global terrorism and gold will be the safe heaven

7)India and China are increasing their gold consumption for investment purposes.

8)Central banks like China want to hold gold.This will increase demand for gold

9)Comex the gold futures will see a breakdown.Many people have sold gold they do not have or own.Soon they will have to pay with physical gold.

http://www.blanchardonline.com/gold_as_investment/gold_rise.php

http://www.cnbc.com/id/28030936

http://www.hardassetsinvestor.com/f...hiff-gold-will-rise-dollar-will-collapse.html

http://news.goldseek.com/GoldForecaster/1227294000.php

http://seekingalpha.com/article/111852-will-comex-default-on-gold-and-silver

http://economictimes.indiatimes.com...iversify_risks_Report/articleshow/3731109.cms

Great videos on money creation

http://uk.youtube.com/watch?v=vVkFb26u9g8&feature=related

http://uk.youtube.com/watch?v=hfXavRTM4Fg&feature=related

http://uk.youtube.com/watch?v=ewxWjT-Mteg&feature=related

http://uk.youtube.com/watch?v=LvH8Jw_ouR0&feature=related

http://uk.youtube.com/watch?v=7kpSbkaD4tM&feature=related

http://uk.youtube.com/watch?v=J2fjxaRLpQo&feature=related

http://uk.youtube.com/watch?v=iYZM58dulPE&feature=related

http://uk.youtube.com/watch?v=iKFbOiBh_C8&feature=related

http://uk.youtube.com/watch?v=9V5OP-VmXgE&feature=PlayList&p=63A3587A8275A46A&index=8

http://www.telegraph.co.uk/finance/...e-above-2000-next-year-as-world-unravels.html

Gold is poised for a dramatic surge and could blast through $2,000 an ounce by the end of next year as central banks flood the world's monetary system with liquidity, according to an internal client note from the US bank Citigroup.

The bank said the damage caused by the financial excesses of the last quarter century was forcing the world's authorities to take steps that had never been tried before.

This gamble was likely to end in one of two extreme ways: with either a resurgence of inflation; or a downward spiral into depression, civil disorder, and possibly wars. Both outcomes will cause a rush for gold.

"They are throwing the kitchen sink at this," said Tom Fitzpatrick, the bank's chief technical strategist.

"The world is not going back to normal after the magnitude of what they have done. When the dust settles this will either work, and the money they have pushed into the system will feed though into an inflation shock.

"Or it will not work because too much damage has already been done, and we will see continued financial deterioration, causing further economic deterioration, with the risk of a feedback loop. We don't think this is the more likely outcome, but as each week and month passes, there is a growing danger of vicious circle as confidence erodes," he said.

Subject: FW: Gold and Gold Stocks to Soar During 2009

The president of America telling lies to the whole world just before U S A defaulted on gold. The truth we must avoid devaluation and destroy the U S dollar.This was a president who lied and cheated and was about to be impeached

http://uk.youtube.com/watch?v=iRzr1QU6K1o

http://www.watergate.info/impeachment/impeachment-articles.shtml

The end of the Bretton Woods system

By the early 1970s, as the Vietnam War accelerated inflation, the United States was running not just a balance of payments deficit but also a trade deficit (for the first time in the twentieth century). The crucial turning point was 1970, which saw U.S. gold coverage of the paper dollar deteriorate from 55% to 22%. This, in the view of neoclassical economists, represented the point where holders of the dollar had lost faith in the U.S. ability to cut its budget and trade deficits.

In 1971, more and more dollars were printed and then sent overseas, to pay for the nation's military expenditures and private investments. In the first six months of 1971, assets for $22 billion fled the United States.[citation needed]

Because of the excessive printing of paper dollars, and the negative balance of U.S. trade, other nations were increasingly demanding fulfillment of America's "promise to pay". That is, they were demanding gold from the U.S. in exchange for paper dollars. France, in particular, made heavy and repeated demands and acquired large amounts of gold in that manner.

http://en.wikipedia.org/wiki/Nixon_Shock

The second run on the dollar in the wake of the 1971 default started in 2007

Gold is the premier store of wealth that this world has known for the last 3000 plus years. Even the fact that gold is not the official currency in the countries of the world has not changed this fact. I know of no place in the world, now or many years before, where gold is not known and not highly valued.So in summary, gold is money and it derives its usefulness from being money and therefore people dig it out, melt it down and guard it like they would guard money.It is especially during an economic crisis that one needs an effective preserver of wealth or buying power. Let us see whether gold has done its job as a preserver of wealth during this credit/financial crisis so far.

http://www.marketoracle.co.uk/Article7737.html

http://www.marketoracle.co.uk/Article6417.html

Gold Is Money; Therefore A Hedge Against Inflation and Deflation

http://news.goldseek.com/GoldSeek/1229366400.php

U.S. Federal Reserve Sets Stage for Weimar Style Hyper-inflation

The Return of the Gold Standard After 36 Years

http://www.marketoracle.co.uk/Article6465.html

http://www.marketoracle.co.uk/Article7801.html

http://www.marketoracle.co.uk/Article7923.html

GOLD rises & u s dollar set for fall.

The better hedge against the US Dollar depreciation is GOLD. The best next thing is OIL and only then you can choose the EURO for this purpose.

BEIJING (Dow Jones)--China's central bank is considering raising its gold reserve by 4,000 metric tons from 600 tons to diversify risks brought by the country's huge foreign exchange reserves, the Guangzhou Daily reported, citing unnamed industry people in Hong Kong.

Bankrupt Britain Trending Towards Hyper-Inflation?

http://www.marketoracle.co.uk/Article7526.html

1) Economies are weak and interest rates are falling, therefore it costs less to hold gold as an asset.

2) Gold is a hedge against inflation. The current monetary policies are building up hyperinflation for the future.

3) Gold is a hedge against the U S dollar. The U S dollar is set for devaluation because they have printed so much paper money. See videos below about money

4) Gold is a hedge against deflation

5) When world economies recover oil will recover to $80 to $200 per barrel. It will lead to a rise in inflation.Gold will benefit.

6)The economic demise will lead to social unrest , political uncertainty and increase in global terrorism and gold will be the safe heaven

7)India and China are increasing their gold consumption for investment purposes.

8)Central banks like China want to hold gold.This will increase demand for gold

9)Comex the gold futures will see a breakdown.Many people have sold gold they do not have or own.Soon they will have to pay with physical gold.

http://www.blanchardonline.com/gold_as_investment/gold_rise.php

http://www.cnbc.com/id/28030936

http://www.hardassetsinvestor.com/f...hiff-gold-will-rise-dollar-will-collapse.html

http://news.goldseek.com/GoldForecaster/1227294000.php

http://seekingalpha.com/article/111852-will-comex-default-on-gold-and-silver

http://economictimes.indiatimes.com...iversify_risks_Report/articleshow/3731109.cms

Great videos on money creation

http://uk.youtube.com/watch?v=vVkFb26u9g8&feature=related

http://uk.youtube.com/watch?v=hfXavRTM4Fg&feature=related

http://uk.youtube.com/watch?v=ewxWjT-Mteg&feature=related

http://uk.youtube.com/watch?v=LvH8Jw_ouR0&feature=related

http://uk.youtube.com/watch?v=7kpSbkaD4tM&feature=related

http://uk.youtube.com/watch?v=J2fjxaRLpQo&feature=related

http://uk.youtube.com/watch?v=iYZM58dulPE&feature=related

http://uk.youtube.com/watch?v=iKFbOiBh_C8&feature=related

http://uk.youtube.com/watch?v=9V5OP-VmXgE&feature=PlayList&p=63A3587A8275A46A&index=8

http://www.telegraph.co.uk/finance/...e-above-2000-next-year-as-world-unravels.html

Gold is poised for a dramatic surge and could blast through $2,000 an ounce by the end of next year as central banks flood the world's monetary system with liquidity, according to an internal client note from the US bank Citigroup.

The bank said the damage caused by the financial excesses of the last quarter century was forcing the world's authorities to take steps that had never been tried before.

This gamble was likely to end in one of two extreme ways: with either a resurgence of inflation; or a downward spiral into depression, civil disorder, and possibly wars. Both outcomes will cause a rush for gold.

"They are throwing the kitchen sink at this," said Tom Fitzpatrick, the bank's chief technical strategist.

"The world is not going back to normal after the magnitude of what they have done. When the dust settles this will either work, and the money they have pushed into the system will feed though into an inflation shock.

"Or it will not work because too much damage has already been done, and we will see continued financial deterioration, causing further economic deterioration, with the risk of a feedback loop. We don't think this is the more likely outcome, but as each week and month passes, there is a growing danger of vicious circle as confidence erodes," he said.

Subject: FW: Gold and Gold Stocks to Soar During 2009

The president of America telling lies to the whole world just before U S A defaulted on gold. The truth we must avoid devaluation and destroy the U S dollar.This was a president who lied and cheated and was about to be impeached

http://uk.youtube.com/watch?v=iRzr1QU6K1o

http://www.watergate.info/impeachment/impeachment-articles.shtml

The end of the Bretton Woods system

By the early 1970s, as the Vietnam War accelerated inflation, the United States was running not just a balance of payments deficit but also a trade deficit (for the first time in the twentieth century). The crucial turning point was 1970, which saw U.S. gold coverage of the paper dollar deteriorate from 55% to 22%. This, in the view of neoclassical economists, represented the point where holders of the dollar had lost faith in the U.S. ability to cut its budget and trade deficits.

In 1971, more and more dollars were printed and then sent overseas, to pay for the nation's military expenditures and private investments. In the first six months of 1971, assets for $22 billion fled the United States.[citation needed]

Because of the excessive printing of paper dollars, and the negative balance of U.S. trade, other nations were increasingly demanding fulfillment of America's "promise to pay". That is, they were demanding gold from the U.S. in exchange for paper dollars. France, in particular, made heavy and repeated demands and acquired large amounts of gold in that manner.

http://en.wikipedia.org/wiki/Nixon_Shock

The second run on the dollar in the wake of the 1971 default started in 2007

Gold is the premier store of wealth that this world has known for the last 3000 plus years. Even the fact that gold is not the official currency in the countries of the world has not changed this fact. I know of no place in the world, now or many years before, where gold is not known and not highly valued.So in summary, gold is money and it derives its usefulness from being money and therefore people dig it out, melt it down and guard it like they would guard money.It is especially during an economic crisis that one needs an effective preserver of wealth or buying power. Let us see whether gold has done its job as a preserver of wealth during this credit/financial crisis so far.

http://www.marketoracle.co.uk/Article7737.html

http://www.marketoracle.co.uk/Article6417.html

Gold Is Money; Therefore A Hedge Against Inflation and Deflation

http://news.goldseek.com/GoldSeek/1229366400.php

U.S. Federal Reserve Sets Stage for Weimar Style Hyper-inflation

The Return of the Gold Standard After 36 Years

http://www.marketoracle.co.uk/Article6465.html

http://www.marketoracle.co.uk/Article7801.html

http://www.marketoracle.co.uk/Article7923.html

GOLD rises & u s dollar set for fall.

The better hedge against the US Dollar depreciation is GOLD. The best next thing is OIL and only then you can choose the EURO for this purpose.

BEIJING (Dow Jones)--China's central bank is considering raising its gold reserve by 4,000 metric tons from 600 tons to diversify risks brought by the country's huge foreign exchange reserves, the Guangzhou Daily reported, citing unnamed industry people in Hong Kong.

Bankrupt Britain Trending Towards Hyper-Inflation?

http://www.marketoracle.co.uk/Article7526.html