bluebellmk

Member

- Messages

- 51

- Likes

- 5

Hi Guys,

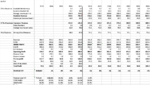

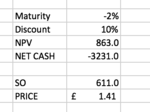

So as discussed in another post I was recently researching AA using a discounted cash flow model. I have decided to trade and build a portfolio only using fundamentals and looking for value investments. My goal is to see how everything goes and to add one stock per month to my portfolio (if an opportunity presents itself) and to do this in as much a risk adverse manner as possible (quite difficult with CFD's😕).

I am just your average joe working and paying bills and not an experienced trader or investor just someone with a passion for numbers and a passion for the financial markets.

I have busted many trading accounts on the past always trying to use fundamental analysis so have concluded that it does not work for me.

I was introduced to discounting cash flows from a friend who works for a large IB who told me that is how all the analysts value equities there.

So my goal is to add a company to my portfolio every month, add approximately £250 - £500 per month out of my wages to my trading account.

I will post the research I have made and then post the positions I have taken.

I am still learning the process of DCF so for any experienced traders feel free to offer me some constructive criticism on where I could improve.

My first position is in AA PLC please see research and position, I hope the screenshots have appeared as an attachment ?

So as discussed in another post I was recently researching AA using a discounted cash flow model. I have decided to trade and build a portfolio only using fundamentals and looking for value investments. My goal is to see how everything goes and to add one stock per month to my portfolio (if an opportunity presents itself) and to do this in as much a risk adverse manner as possible (quite difficult with CFD's😕).

I am just your average joe working and paying bills and not an experienced trader or investor just someone with a passion for numbers and a passion for the financial markets.

I have busted many trading accounts on the past always trying to use fundamental analysis so have concluded that it does not work for me.

I was introduced to discounting cash flows from a friend who works for a large IB who told me that is how all the analysts value equities there.

So my goal is to add a company to my portfolio every month, add approximately £250 - £500 per month out of my wages to my trading account.

I will post the research I have made and then post the positions I have taken.

I am still learning the process of DCF so for any experienced traders feel free to offer me some constructive criticism on where I could improve.

My first position is in AA PLC please see research and position, I hope the screenshots have appeared as an attachment ?