Hi

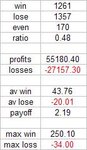

I've posted an incredibly easy FTSE system, the return since 01.01.96 is around 28,000 FTSE points.

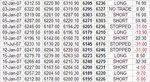

The basis of the system is that it sets two levels for the day, one to buy at (above the market) and one to sell at (below the market). You enter the first to be hit with the other acting as a stop, you hold any position till the end of the day and settle it against the closing price.

An advantages of this system is that is take away a lot of decision making and takes stress from the operator.

That said watching large paper profits dissapear at the close can be hard to stomach.

This system can and has worked, order entry can be tough but there are few days I haven't been able to get entered at the price I want.

My theory is that like any system it is the ability to blindly follow it that will let it down and the trader behind it not the system.

This year alone it's run up to +155 points and back to+55 points, quite hard to take but over the long term no reason to think you won't see a return.

I've got a more advanced system that incorporates a 2% risk budget set to be lost if the position is stopped, growing the account this way is quite staggering if you can stick to it.

I'm interesting in feedback from those who think it can't or won't work and those who can think of problems with it (data is yahoo and in my experience pretty good on FTSE 100).

I'm also interested in how many people think easy systems that can work eventually will be ruined by the operator.

What would really interest me is someone with enough capitalisation to set this system up for a full twelve months to follow blindly, and the same system run by someone who can chose when to exit, ie not have to wait till close but not allowed to cancel the stop order of the day. So they can take a profit or take a smaller loss than the stop but can only enter initially at the system signal.

Any ideas which would come on top?

My feeling is the trader would take profits too quickly perhaps smooth the equity curve but overall miss some of the blow off 100 point moves that pay for all the stops along the way.

Thanks

Stephen McCreedy

I've posted an incredibly easy FTSE system, the return since 01.01.96 is around 28,000 FTSE points.

The basis of the system is that it sets two levels for the day, one to buy at (above the market) and one to sell at (below the market). You enter the first to be hit with the other acting as a stop, you hold any position till the end of the day and settle it against the closing price.

An advantages of this system is that is take away a lot of decision making and takes stress from the operator.

That said watching large paper profits dissapear at the close can be hard to stomach.

This system can and has worked, order entry can be tough but there are few days I haven't been able to get entered at the price I want.

My theory is that like any system it is the ability to blindly follow it that will let it down and the trader behind it not the system.

This year alone it's run up to +155 points and back to+55 points, quite hard to take but over the long term no reason to think you won't see a return.

I've got a more advanced system that incorporates a 2% risk budget set to be lost if the position is stopped, growing the account this way is quite staggering if you can stick to it.

I'm interesting in feedback from those who think it can't or won't work and those who can think of problems with it (data is yahoo and in my experience pretty good on FTSE 100).

I'm also interested in how many people think easy systems that can work eventually will be ruined by the operator.

What would really interest me is someone with enough capitalisation to set this system up for a full twelve months to follow blindly, and the same system run by someone who can chose when to exit, ie not have to wait till close but not allowed to cancel the stop order of the day. So they can take a profit or take a smaller loss than the stop but can only enter initially at the system signal.

Any ideas which would come on top?

My feeling is the trader would take profits too quickly perhaps smooth the equity curve but overall miss some of the blow off 100 point moves that pay for all the stops along the way.

Thanks

Stephen McCreedy