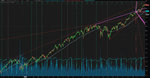

Forecast ES 16 Nov 2017

For buy

- 1 Day impulse

- NO down repositioning 2566 price level

- Weekly POC transferred to 2564

- purchasing Wed overnight volumes

Complicates buy

- 2592-2578 - Volumes to hold 1 day impulse

- low volume statistic of weekly POC

- 60 min sellers responsive activity was built

- low purchasing volatility from 2566

Conclusion: buyer holds sellers volatility from the middle of 60 min balance ( 2566). No reinforcing sellers Volumes ( V). But still low purchasing statistic to easy volatility to 2584.

Main point for Thursday is to position 2566 as a support to 2584 + hold as a support of the day 2566

Long 2566/2568 Take profit 2578/2584 reverse priority 2564

"Positive scenario:

directional positioning of purchases till 2584 without any contr volatility"

Negative scenario: rotations between 2578-2566 to fix 2566 as a support

Cancel purchase: selling high volumes undrer 52578 will fix the price as a resistant level and shorts lower than 2558 ( till the week end)

For buy

- 1 Day impulse

- NO down repositioning 2566 price level

- Weekly POC transferred to 2564

- purchasing Wed overnight volumes

Complicates buy

- 2592-2578 - Volumes to hold 1 day impulse

- low volume statistic of weekly POC

- 60 min sellers responsive activity was built

- low purchasing volatility from 2566

Conclusion: buyer holds sellers volatility from the middle of 60 min balance ( 2566). No reinforcing sellers Volumes ( V). But still low purchasing statistic to easy volatility to 2584.

Main point for Thursday is to position 2566 as a support to 2584 + hold as a support of the day 2566

Long 2566/2568 Take profit 2578/2584 reverse priority 2564

"Positive scenario:

directional positioning of purchases till 2584 without any contr volatility"

Negative scenario: rotations between 2578-2566 to fix 2566 as a support

Cancel purchase: selling high volumes undrer 52578 will fix the price as a resistant level and shorts lower than 2558 ( till the week end)