Tomorrow, the 18th April 2008, is the 3rd Friday of the month, commonly referred to as expiration Friday. Coincidentally, this year it almost coincides with the first day of the Jewish holiday of Passover. I therefore find it appropriate to ask "Why is this day different than other days?" (If you don't get the joke, and care to, send me an email.)

The truth is that technically the expiration is on the Saturday following the third Friday, but you can't trade the options after the close on Friday. Also, if you want to exercise an option that is in-the-money (ITM) by less than a nickel, or not exercise an option that is ITM by a nickel or more, you must notify your broker by 5:30 pm (EST) on Friday. Some brokers require this notification before that time, some as early as 3:30, so be careful. Another example of why it is important to know the rules of your particular broker.

Also, be sure to remember that as I pointed out in my article of February 21, 2008, "Another Pricing Method" starting with the June 2008 expiration, options that are ITM by only 1 cent will automatically be exercised. So if you don't want to wake up Monday morning with a stock position, you need to let your broker know. Note that if you are short options going into expiration, and the stock price is within a few cents of the strike, the only way to be absolutely sure of what your Monday morning stock position will be is to buy back the options before expiration. The small amount that it will cost is often worth the peace of mind.

At expiration long options will either be exercised or expire worthless at a loss, and short options will either be assigned or expire worthless at a gain. The open interest in the April options will drop down to zero. But as one door closes, another opens! And so, with the passing of the April options, new options will become available for trading on Monday. Note, that unlike stock, options are a derivative product, and as such, contracts are constantly being created and cancelled.

For example, let's say that the new option expiration month that will be available for trading on Monday is June. The open interest on the XYZ June 50 Calls start out at zero. The Market Makers are showing a quote of 2.50 x 2.60 500 x 500. I decide to buy 75 contracts at the market, so 75 trade at 2.60. There is now an open interest of 75 contracts that I have created, feel that power!

A question that arises at expiration is what new expiration months will become available to trade? I'm going to tell you the general rules, but keep in mind that as options become more and more popular, the rules will continue to evolve. Of course, if you keep reading my articles, I won't let you miss anything that's significant.

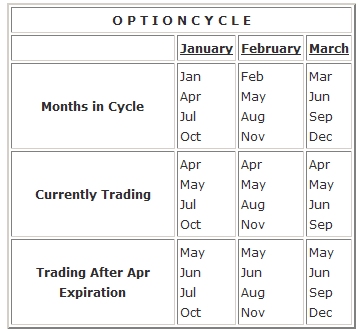

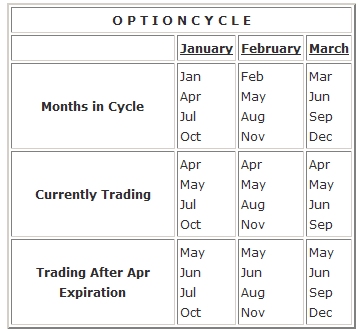

When options on a stock originally start trading, the primary exchange where the options will be traded randomly assigns that stock an option expiration cycle. Once assigned, that cycle generally will never be changed. There are 3 different expiration cycles; January, February and March. Within each cycle the standard expiration months are:

Let's see which options are trading today. The general rule is that there will always be 4 expiration months that are trading. Regardless of the cycle, the 2 front months, i.e., the current month and the next following month will always be trading. In addition, the 2 next months within the cycle will also be trading. As of today, Apr is the front month and May is the following month. If you look at the above currently trading months, you'll get the idea.

Tomorrow will be the last day to trade Apr options. So on Monday, the Jun options will start trading in the January and February cycles because we always need to have the front 2 months. Since Jun options are already trading for stocks on the March cycle, the next month to start trading will be Dec. The above table should make it clear. Examples of stocks trading on the different cycles are: Microsoft (MSFT) is on the January cycle, Agilent Technologies (A) is on the February cycle, and Citigroup (C) is on the March cycle.

In addition to the regular series of options, longer term options referred to as LEAPS (Long-term Equity AnticiPation Securities) also trade on some stocks. For all intents and purposes, they trade seamlessly with and like other options. LEAPS generally expire in January and can go out up to 2 years and 8 months. For stocks that currently have LEAPS trading, the expiration months are January 2009 and 2010. The January 2011 contracts will start trading after the May, June and July expirations for stocks on the January, February and March cycles, respectively. A quirk you should be aware of is that instead of becoming available on the Monday following expiration, they become available on the Monday following that.

You may ask why it is important to know this information. There are 2 main reasons. First, for putting on certain types of spreads, you'll want to anticipate which months will be available to trade and when. Second, when you're considering rolling a position forward or taking it off, the available expiration months may play a part in making that decision.

The truth is that technically the expiration is on the Saturday following the third Friday, but you can't trade the options after the close on Friday. Also, if you want to exercise an option that is in-the-money (ITM) by less than a nickel, or not exercise an option that is ITM by a nickel or more, you must notify your broker by 5:30 pm (EST) on Friday. Some brokers require this notification before that time, some as early as 3:30, so be careful. Another example of why it is important to know the rules of your particular broker.

Also, be sure to remember that as I pointed out in my article of February 21, 2008, "Another Pricing Method" starting with the June 2008 expiration, options that are ITM by only 1 cent will automatically be exercised. So if you don't want to wake up Monday morning with a stock position, you need to let your broker know. Note that if you are short options going into expiration, and the stock price is within a few cents of the strike, the only way to be absolutely sure of what your Monday morning stock position will be is to buy back the options before expiration. The small amount that it will cost is often worth the peace of mind.

At expiration long options will either be exercised or expire worthless at a loss, and short options will either be assigned or expire worthless at a gain. The open interest in the April options will drop down to zero. But as one door closes, another opens! And so, with the passing of the April options, new options will become available for trading on Monday. Note, that unlike stock, options are a derivative product, and as such, contracts are constantly being created and cancelled.

For example, let's say that the new option expiration month that will be available for trading on Monday is June. The open interest on the XYZ June 50 Calls start out at zero. The Market Makers are showing a quote of 2.50 x 2.60 500 x 500. I decide to buy 75 contracts at the market, so 75 trade at 2.60. There is now an open interest of 75 contracts that I have created, feel that power!

A question that arises at expiration is what new expiration months will become available to trade? I'm going to tell you the general rules, but keep in mind that as options become more and more popular, the rules will continue to evolve. Of course, if you keep reading my articles, I won't let you miss anything that's significant.

When options on a stock originally start trading, the primary exchange where the options will be traded randomly assigns that stock an option expiration cycle. Once assigned, that cycle generally will never be changed. There are 3 different expiration cycles; January, February and March. Within each cycle the standard expiration months are:

Let's see which options are trading today. The general rule is that there will always be 4 expiration months that are trading. Regardless of the cycle, the 2 front months, i.e., the current month and the next following month will always be trading. In addition, the 2 next months within the cycle will also be trading. As of today, Apr is the front month and May is the following month. If you look at the above currently trading months, you'll get the idea.

Tomorrow will be the last day to trade Apr options. So on Monday, the Jun options will start trading in the January and February cycles because we always need to have the front 2 months. Since Jun options are already trading for stocks on the March cycle, the next month to start trading will be Dec. The above table should make it clear. Examples of stocks trading on the different cycles are: Microsoft (MSFT) is on the January cycle, Agilent Technologies (A) is on the February cycle, and Citigroup (C) is on the March cycle.

In addition to the regular series of options, longer term options referred to as LEAPS (Long-term Equity AnticiPation Securities) also trade on some stocks. For all intents and purposes, they trade seamlessly with and like other options. LEAPS generally expire in January and can go out up to 2 years and 8 months. For stocks that currently have LEAPS trading, the expiration months are January 2009 and 2010. The January 2011 contracts will start trading after the May, June and July expirations for stocks on the January, February and March cycles, respectively. A quirk you should be aware of is that instead of becoming available on the Monday following expiration, they become available on the Monday following that.

You may ask why it is important to know this information. There are 2 main reasons. First, for putting on certain types of spreads, you'll want to anticipate which months will be available to trade and when. Second, when you're considering rolling a position forward or taking it off, the available expiration months may play a part in making that decision.

Last edited by a moderator: