BLS

Established member

- Messages

- 642

- Likes

- 229

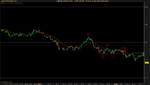

E2: The bears tried twice to crack the 00 level but failed, forming a mini double bottom. Price jump to the upper barrier of the block where there is some pre-breakout tension, with the bears trying to fight back ad the bulls try to push on. This break is something between a false break (because prices came from the bottom of the barrier) and a tease break (because there is some buildup). This setup was unfavorable because of clustering price action around the 20 level that acts as visible chart resistance. That overhead resistance is blocking my 10.8 pip target. I should not have taken this trade.

E3: Same problem with that overhead resistance as in E2. I was ignoring that clustering block for a second time because I held a bullish bias at the time. I saw the mini double bottom (1,2) and a bounce off the 00 (3), thinking that the bulls were going to reverse the downward trend. I did not give much thought to anything that might stand in the bulls' way. Scalpers should hold a neutral view and let price action do that talking instead of trying to trade in the direction of a bullish/bearish bias.

With three consecutive losses and problems with my internet connection, I decided to call it a day with a 14.7 pip loss. I did not trade well today and these bad trades could have been avoided.

E3: Same problem with that overhead resistance as in E2. I was ignoring that clustering block for a second time because I held a bullish bias at the time. I saw the mini double bottom (1,2) and a bounce off the 00 (3), thinking that the bulls were going to reverse the downward trend. I did not give much thought to anything that might stand in the bulls' way. Scalpers should hold a neutral view and let price action do that talking instead of trying to trade in the direction of a bullish/bearish bias.

With three consecutive losses and problems with my internet connection, I decided to call it a day with a 14.7 pip loss. I did not trade well today and these bad trades could have been avoided.