MahiFX

Active member

- Messages

- 123

- Likes

- 0

The Eurozone is looking increasingly Japanese with consistently low GDP growth rates and plummeting inflation levels, which implies the EUR faces upward pressures like JPY once did.

Eurozone inflation is running around 0.8% and the region is barely expected to grow 1% a year. In the short-term the main culprit for low growth is austerity and the brutal process of wage and cost adjustments within the peripheral Eurozone countries. They became chronically uncompetitive in the run up to 2007.

But longer term there are some worrying parallels with Japan. Europe is getting older and quite quickly. According to Eurostat those aged 65 years and over will account for 29.5 % of the EU-27’s population by 2060, compared 17.5 % in 2011. Meanwhile, the working population is likely to decrease steadily sapping Europe's growth potential while increasing medical and retirement costs.

Japan is way ahead. Nearly a quarter of its population is 65 and over and that will rise to 38% by 2055. Not only that, but the country's population is actually shrinking. The previous governor of the Bank of Japan Masaaki Shirakawa blamed the ageing population for low growth and warned that the West was on a similar path.

But a steadily less dynamic Japan, endowed with high living standards and deflation saw JPY getting steadily stronger until Abenomics was introduced to very deliberately put an end to that trend.

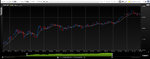

The grey currencies – EUR/JPY

ECB can't do QE

The Eurozone is very close to drifting towards deflation and unlike Japan, US and UK has a deeply constrained central bank. Though the European Central Bank has done some clever manoeuvres to provide liquidity it cannot do outright quantitative easing. It's simply not allowed to do it.

If Japan, US and other major economies all manage to generate some inflation and keep interest rates very low – there will be growing pressure over the long-term for EUR to appreciate and this could pose a problem for the ECB and the recovering Eurozone members in terms of exports.

And the real reason why deflation matters is not so much about delayed consumption – older people are more into needs-based consumption – it is about debt. Japan has a debt to GDP ratio of 230% and at some point it will cripple the country unless it is paid down or inflated away. With a shrinking population the former is not possible. As Europe gets older it will face the same dilemma.

However, unlike Japan, the Eurozone is a union of sovereign countries pursuing independent fiscal policies. So as economic pressure points shift within the zone it is likely to trigger intermittent bouts of concern and even crises, which will undermine the EUR when they occur.

By Justin Pugsley, Markets Analyst MahiFX

Eurozone inflation is running around 0.8% and the region is barely expected to grow 1% a year. In the short-term the main culprit for low growth is austerity and the brutal process of wage and cost adjustments within the peripheral Eurozone countries. They became chronically uncompetitive in the run up to 2007.

But longer term there are some worrying parallels with Japan. Europe is getting older and quite quickly. According to Eurostat those aged 65 years and over will account for 29.5 % of the EU-27’s population by 2060, compared 17.5 % in 2011. Meanwhile, the working population is likely to decrease steadily sapping Europe's growth potential while increasing medical and retirement costs.

Japan is way ahead. Nearly a quarter of its population is 65 and over and that will rise to 38% by 2055. Not only that, but the country's population is actually shrinking. The previous governor of the Bank of Japan Masaaki Shirakawa blamed the ageing population for low growth and warned that the West was on a similar path.

But a steadily less dynamic Japan, endowed with high living standards and deflation saw JPY getting steadily stronger until Abenomics was introduced to very deliberately put an end to that trend.

The grey currencies – EUR/JPY

ECB can't do QE

The Eurozone is very close to drifting towards deflation and unlike Japan, US and UK has a deeply constrained central bank. Though the European Central Bank has done some clever manoeuvres to provide liquidity it cannot do outright quantitative easing. It's simply not allowed to do it.

If Japan, US and other major economies all manage to generate some inflation and keep interest rates very low – there will be growing pressure over the long-term for EUR to appreciate and this could pose a problem for the ECB and the recovering Eurozone members in terms of exports.

And the real reason why deflation matters is not so much about delayed consumption – older people are more into needs-based consumption – it is about debt. Japan has a debt to GDP ratio of 230% and at some point it will cripple the country unless it is paid down or inflated away. With a shrinking population the former is not possible. As Europe gets older it will face the same dilemma.

However, unlike Japan, the Eurozone is a union of sovereign countries pursuing independent fiscal policies. So as economic pressure points shift within the zone it is likely to trigger intermittent bouts of concern and even crises, which will undermine the EUR when they occur.

By Justin Pugsley, Markets Analyst MahiFX