autosignalfx

Junior member

- Messages

- 37

- Likes

- 2

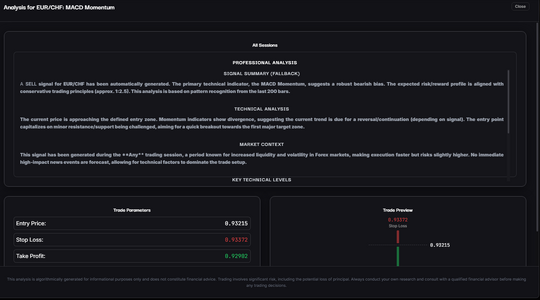

EUR/CHF – MACD Momentum Analysis (Sell Bias) Take Profit:0.92902

Quantum Pulse Professional Market Outlook

The EUR/CHF pair has generated a strong SELL signal under the MACD Momentum framework. Current price action shows clear signs of weakening bullish pressure, with momentum gradually tilting in favor of sellers. The structure remains highly technical, with no major fundamental catalysts interfering, making this setup clean and actionable.

📌 Signal Summary

- Bias: SELL

- Model: MACD Momentum

- Volatility: Moderate

- Risk/Reward: ~1:2.5

- Session: Any (broad liquidity)

This signal is supported by momentum divergence across the last 200 bars, indicating exhaustion of the bullish leg and potential continuation of the broader bearish structure.

Technical Outlook

1. Momentum & Structure

- MACD shows bearish momentum acceleration, with histogram contracting upward and signal lines positioned for downward expansion.

- Price is trading firmly below a micro-resistance cluster and struggling to break higher — a classic sign of trend exhaustion.

- Candle bodies are shrinking near resistance, indicating buy-side weakness.

2. Market Conditions

- Liquidity remains stable across overlapping sessions.

- No high-impact CHF or EUR announcements within the next few hours, keeping the pair technically driven.

- EUR remains soft across the board, increasing correlation pressure on EUR/CHF.

📌 Key Technical Levels

| Level Type | Price |

|---|---|

| Immediate Resistance | 0.93245 |

| Immediate Support | 0.93185 |

| Major Resistance | 0.93275 |

| Major Support | 0.93155 |

🎯 Trade Parameters

- Entry: 0.93215

- Stop Loss: 0.93372

- Take Profit: 0.92902

🧠 Trade Rationale

- Bearish divergence aligning with MACD momentum shift.

- Price pressing against resistance with no bullish follow-through.

- Market sentiment favors CHF strength in low-volatility periods.

- Clean downside liquidity pool visible toward 0.92900 zone.

📉 Risk Management Guidance

- Risk only 1–2% of account capital.

- Consider enabling a trailing stop once price breaks below 0.93155.

- Monitor volatility spikes around EUR macro sessions.

- If price closes above 0.93372, bearish bias becomes invalid.