KillPhil08

Experienced member

- Messages

- 1,860

- Likes

- 381

Welcome to my Trading Journal: ER-ER

Ever since starting trading demos and live accounts I have become a 5 minute specialist. I have tried vast amount of markets but my main ones I trade are:

- GBP/USD, EUR/USD, EUR/GBP, FTSE

- USD/CAD, AUD/USD, OIL, DAX

- Any other market which has a high R:R trade which is at it's extremes [hot markets]

However, what makes a good trader is scalping and long term swing positions combined. So in this journal I'm going to delve into the depths of 1h and daily time frames, combined with my 5minute entries to try and get the maximum r:r ratio possible. Imagine making 1400pips with a stoploss of 5?!

My goals are:

- To maximize my R:R ratio

- To become proficient in swing trading and scalping

- To maximize the amount of pips I get and hit rate

- To become effiencient at using 1 hour and daily charts

- To build a portfolio of stocks once I feel the bottom of the equity markets has been reached

- To maximize and specialise in more markets

- To conquer my psychology, become disciplined and fearless.

Note this is going in this forum for now until I post up some of my techniques I use.

Useful Links:

News:

RanSquawk

Economic Calendar

Good Threads to keep up with:

Potential Setups - Ignore the less than 1h calls and crap in between.

I'm Shorting Euros - Good group of lads here who swing trade.

FTSE Trading - Great calls here.

I have 5 accounts. My main ODL one, VDMGM freebie, victorchandlers freebie, iii freebie and igindex for emergencies. (Going to open a natwest one too, love that platform!).

The ODL one will be scalped on, while VDMGM will be used for FTSE and VC for EUR / CABLE trades.

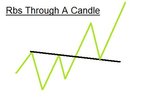

I hope to show you some of the techniques I use (most of them are fairly common) and some of the rules I have. I will probably make some videos later on if you are interested in watching.

At the end of each week I'll write my summary and PnL (in pips/ticks) to and analyse what were the high probably set-ups and what went wrong.

Wish me luck.:clover:

Edit: Another useful link = Chatzy Chatroom

Last edited: