So the SNB debacle took place, and FXCM share price collapsed. A hot flush rushed through my body, as I thought the inevitable might happen, and reading the unfortunate demise of Alpari compounded this feeling with bucket loads of interest, all the wise words of others about not keeping all your money with one broker filled my head with "I told you so", yet my naiveté, and greed in profit accumulation kept me using FXCM mainly.

I decided to pull my money out, but there seemed to be no change in my account size, Hmm, something's not right here. Then I decided to call, and there was no response. Oh dear, it seemed the wreath was already made, and FXCM was about to join the likes of MF Global, and the latterly deceased Alpari.

Luckily for me, and others FXCM got a bail out, and monies were withdrawn.

I have now decided to keep monies under the FCA compensation guarantee, and every time I reach the limit, to keep withdrawing.

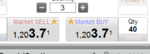

I have always had amounts in other brokers which I keep open to see the price differences with FXCM, and it is safe to say they are nigh on the same. Yet after the SNB debacle, I am now seeing vast differences in prices, spikes that were never seen before seem to be appearing, spreads seem to be astronomically wider around news events, which were previously not there, trend lines which are drawn on 1 min bar high/lows, seem to be shifting slightly as the day progresses, and I have changed timeframes, then back to the original time frame.

WTF is going on with FXCM. Is this a case of FXCM not giving a rat's derriere about it's customers anymore, and just raping their accounts to make sure the ensuing loan they have gets paid off quickly. Could it be a case of FXCM thinking "we tried to have a little integrity, that didn't work, lets revert back to the bucket shop methods of our past. After all our customers are addicted gamblers, who will keep up with their addiction".

I appreciate the main consensus would be to switch brokers, but the FXCM platform is fantastic to use with everything so simple, even a layman like me can use it. Easy to calculate what your percentage risk is in pounds, and pips, thus easy to calculate profit target, which has to be worked out, for the way I trade. I wish not to risk 1%, yet end up losing 1.35% if the trade goes wrong, as my calculations were guesstimates, and in an environment where getting in quickly(for me) is of utmost importance.

What are your views on this, and more importantly, what broker would people recommend.

Best

John

I decided to pull my money out, but there seemed to be no change in my account size, Hmm, something's not right here. Then I decided to call, and there was no response. Oh dear, it seemed the wreath was already made, and FXCM was about to join the likes of MF Global, and the latterly deceased Alpari.

Luckily for me, and others FXCM got a bail out, and monies were withdrawn.

I have now decided to keep monies under the FCA compensation guarantee, and every time I reach the limit, to keep withdrawing.

I have always had amounts in other brokers which I keep open to see the price differences with FXCM, and it is safe to say they are nigh on the same. Yet after the SNB debacle, I am now seeing vast differences in prices, spikes that were never seen before seem to be appearing, spreads seem to be astronomically wider around news events, which were previously not there, trend lines which are drawn on 1 min bar high/lows, seem to be shifting slightly as the day progresses, and I have changed timeframes, then back to the original time frame.

WTF is going on with FXCM. Is this a case of FXCM not giving a rat's derriere about it's customers anymore, and just raping their accounts to make sure the ensuing loan they have gets paid off quickly. Could it be a case of FXCM thinking "we tried to have a little integrity, that didn't work, lets revert back to the bucket shop methods of our past. After all our customers are addicted gamblers, who will keep up with their addiction".

I appreciate the main consensus would be to switch brokers, but the FXCM platform is fantastic to use with everything so simple, even a layman like me can use it. Easy to calculate what your percentage risk is in pounds, and pips, thus easy to calculate profit target, which has to be worked out, for the way I trade. I wish not to risk 1%, yet end up losing 1.35% if the trade goes wrong, as my calculations were guesstimates, and in an environment where getting in quickly(for me) is of utmost importance.

What are your views on this, and more importantly, what broker would people recommend.

Best

John