magyarkuki

Newbie

- Messages

- 1

- Likes

- 0

Hi,

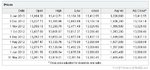

Can anyone advise what happened to the DJI volumes after 25/06/2012?

The reported data shows it going from volume in the "billions", to a day later and hence forth, only "millions"

Here is a table of the data fyi: TR4DER - Dow Jones Industrial Average [^DJI] Historical Prices from 2012-03-01 to 2013-01-01 - Page 1

Makes a bit of difference in the charts.

Cheers

Magyarkuki

Can anyone advise what happened to the DJI volumes after 25/06/2012?

The reported data shows it going from volume in the "billions", to a day later and hence forth, only "millions"

Here is a table of the data fyi: TR4DER - Dow Jones Industrial Average [^DJI] Historical Prices from 2012-03-01 to 2013-01-01 - Page 1

Makes a bit of difference in the charts.

Cheers

Magyarkuki